Growth Decisions of FMCG Industry amid Inflation in India

India’s story with food inflation has always been dramatically volatile and uncertain creating lasting impacts on consumer demand cycle. One of the primary reasons behind this challenge lies in the unreliable climatic conditions that shape India’s agricultural production.

Consumer Price Index (CPI) which is measure used in India to calculate inflation, assigns a larger amount of weights to food expenditure. Hence showing the larger influence they have over the average Indian’s spending habits.

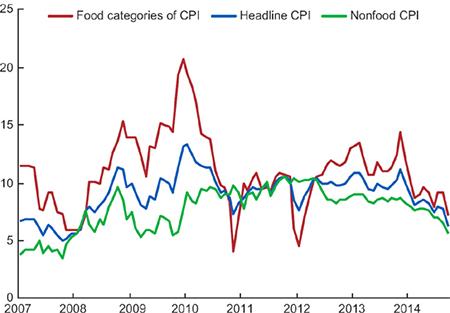

A 2016 publication by Rahul Anand in the IMF Library, named ‘Taming Indian Inflation’ notes the extent to which food inflation has historically impacted the overall CPI in the last two decades. The graph shows the historically volatile patterns that Indian food inflation follows.

The interesting story that underlies this, is how our Fast-Moving Consumer Goods (FMCG) and the Food Processing industry have grown in the last decade owing to volatile food prices as these affected the larger retail CPI figures in the country.

Fast-moving consumer goods (FMCGs) are non-durable consumer goods that sell like hotcakes as they usually come with a low price and high usability. Their examples include toothpaste, ready-to-make food, soap, cookie, notebook, chocolate, etc. According to the India Brand Equity Foundation, in j last 6 years, from 2016 to 2020, the FMCG industry in India has grown from USD 49 Billion to USD 110 Billion.

Similarly, the food processing sector has grown at an annual rate of 8.3% in the last 5 years as the domestic market is projected to grow at 47% between 2021 and 2027, with a forecasted size of USD 1047 Billion in FY 2027.

Although the prime question to ask is what aids this growth? Apart from a boisterous demand for the products due to rising per capita GDP and even faster rising disposable incomes, contribute to the growth. According to MoSPI data, India’s personal disposable income increased from INR 238 Trillion in 2022 to INR 272 Trillion in 2023 alone.

India’s FMCG industry grew 12.2% in value in the April-June quarter of 2023 driven by higher consumption growth, according to data from NIQ India. This comes after the FMCG industry saw high inflation translating into price-led growth for over two years.

However, the analytics firm Nielsen IQ’s (NIQ) studies on the FMCG industry in India have distinguished between two types of growth that the industry has faced in the last 3 years of the country’s battle with high inflation post the Covid era. The NIQ articles refer to a transition that the industry has undergone, from price-led growth to volume-led growth. Both meaning, as the terminology specifies, a transition from growth due to higher retail inflationary prices, to growth due to increasing sales volumes.

The NIQ piece gives us an overview of the rising industry opportunities with a change in tide in the market, this article intends to focus on the individual firms that are more or less representative of the FMCG and Food Processing industries in the country. These are large scale, well established companies with a solid unshaken consumer base, Nestlé India, Britannia Ltd., Dabur India Ltd. and the industry giant ITC Ltd.

The article analyzes their metrics of sales and profits before tax, in concordance with the average food inflation figures corresponding to each particular financial quarter. This firm wise study also aims to study how the transition from price led growth to volume led growth has translated to individual companies with fluctuations in inflation figures.

All corporate financial figures are drawn from the respective company’s quarterly financial reports and inflation figures from the Ministry of Statistics and Programme Implementation (MoSPI) data. The inflation figures are taken at their quarterly averages. The period under consideration will be October 2021 to June 2023.

Food Inflation: The Last 2 Years

For contextual insights into the country’s food inflation trajectory in the last 2 years, the data shows a clear graph where inflation was highest from April 2022 to September 2022, reaching its highest in April 2022 at 8.38% and still higher in September 2022 at 8.6%.

This is also the time when RBI began increasing its Repo Rate for credit control. Between May, 2022 and December 2022, the Monetary Policy Committee increased its Repo Rate by 225 basis points. Following this, as the inflation rates eased post November 2022 falling within the RBI targets of 6% consecutively for the next 8 months.

As overall inflation stabilized to 6.83% for Q3 of 2023 however, food inflation has since rapidly reached a 15 month high of 11.51%, mainly owing to supply side climatic factors such as El Nino.

For the purposes of this article, we shall take a quarter average of these figures as referenced below.

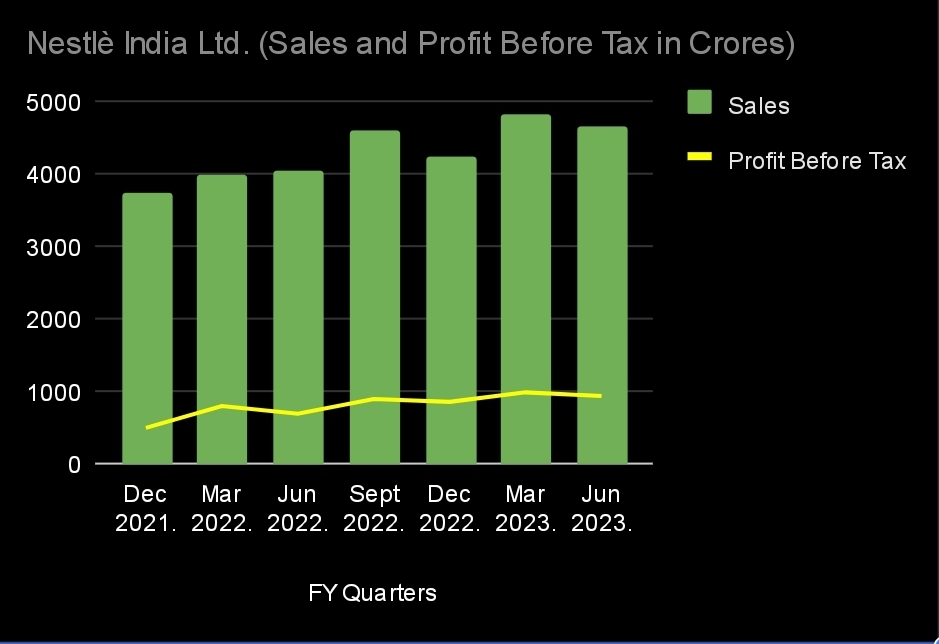

Nestlè India Ltd.

The first company under consideration is Nestlé India Ltd., a giant with brands spread across all food categories, confectionaries, milk and dairy products, prepared and packaged dishes and powdered and liquid beverages. The milk and dairy products of these has led their revenue share at 42.8% of their total revenue since the last 3 financial years.

According to Suresh Narayanan, Chairman and Managing Director of food & beverages major Nestle India, the menace of food inflation remains a concern even after two years of high inflationary cycle. According to him, with a 30 per cent deficit in rainfall this season Kharif crops might get impacted, even if the sowing was good. Apart from agri-commodities, prices of milk have spiked in recent quarters that have impacted both retail consumers and bulk buyers like Nestle.

The graph given below states the company’s performance within the period of our study.

Following NIQ’s thesis of price led growth during periods of high inflation in the industry, Nestlè can be a prime example where it showed a growth rate of 6.53% between the December 2021 to March 2022 quarter, and of 13.74% between the June 2022 and September 2022 quarter, which was the period of peak inflation in our charts.

In fact, the Quarterly Press Release of Nestlè India on their March 2022 Quarter explicitly states that their ‘Nutrition’ and ‘Prepared Dishes and Cooking Aids’ categories both fared well due to ‘pricing actions’.

This robust growth led by rising prices leading to high sales was strong throughout the period of December 2021 to September 2022. The slight slowness in growth in the June 2022 quarter when sales increased only 1.32% and a record decrease in Profit Before Tax of 4.32% can perhaps be attributed to the rising expenses of the company due to high Wholesale Price Index figures. The March to June Quarter of FY 2022 marked the highest average WPI figures of 16.08%, within our time period of consideration.

The company’s quarterly reports also mention that the September 2022 quarter saw early signs of price stability particularly in packaging materials and edible oils. As we clearly see the reducing inflation trend between the December 2022 to June 2023 period, Nestlè’s sales growth in this time has continued, growing 9.44% during this time, signifying strong volume led growth.

In fact, the March 2023 quarter was the highest growth rate Nestlè recorded in the last 10 years of operations, backed by a mix of price action and volume as mentioned in their quarterly reports.

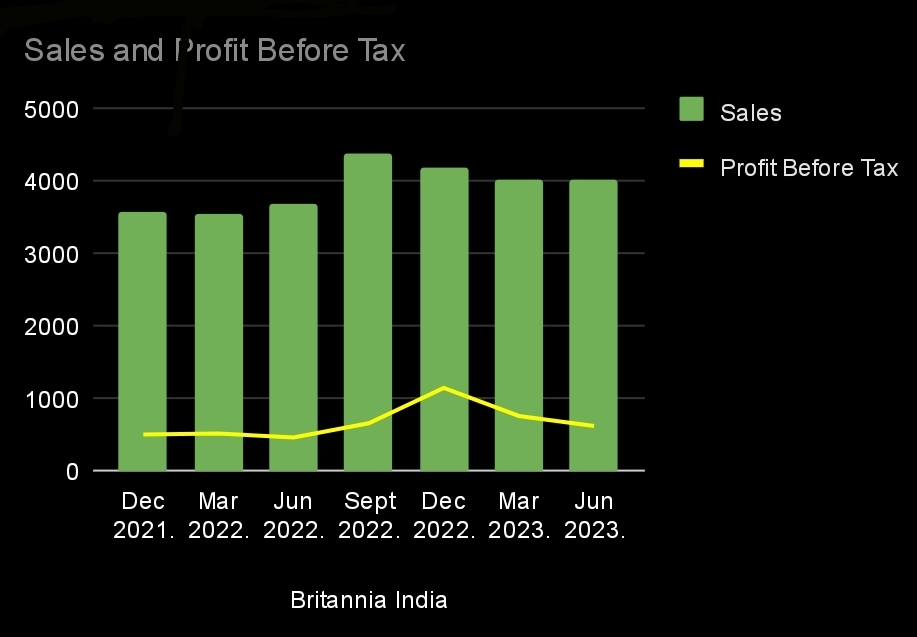

Britannia Ltd.

The largest biscuits and snacks manufacturer in the country with famous brands like Bourbon, Marie, Little Hearts, JimJam, 50/50 and Nutri-Choice. Britannia’s product segments are also spread across rusk, caked and bread, dairy, cheese, beverages and yogurt.

Although it has a substantial spread across snacking segments, a tremendous 77% of Britannia’s revenue is attributable to its Biscuits division, cakes make 10% and Bread and Rusks make 8%.

In the same time period as Nestlè, however, Britannia shows a very different growth trajectory.

Its steady sales growth that started from the quarter of March 2022 shows a 4.25% sales growth between March to June 2022 and an 18.34% sales growth rate from June to September 2022 backed by strong headwinds in price action.

What’s interesting is Britannia’s performance in the December 2022 quarter, where although its sales have reduced and show negative growth of 4.17%, which can be directly traced back to its cost effectiveness programs, (the company’s expenses during the quarter went down from INR 3668 crore to INR 3379 Crore) but it also recorded an additional exceptional profit of 376 Crore that contributes to the inflated profit before tax figure of INR 1149 Crore.

This exceptional gain is owing to a Joint Venture Agreement with Bel SA in their cheese segment, where Britannia sold 49% of its equity stake to them in the subsidiary Britannia Dairy to them. Decreasing quarter on quarter profits can be attributable to expenses in technology investments that were utilized to upgrade their factories in Tamil Nadu and Uttar Pradesh that are set to enhance productivity.

Especially in the case of Britannia, volume growth has been of particular concern reducing their QoQ figures.

ITC India Ltd.

A historic benchmark and market leader in the FMCG space, ITC has long surpassed its image of a tobacco company into one that has substantial market share into all FMCG products from stationery items to personal care products.

The reason why it is incorporated in this study, is because close to 79% of its revenue comes from its food segments, ranging from brands like Yippee Noodles, Aashirvaad Atta, Sunfeast, Nice Biscuits, Momma’s Magic, Bingo Chips, Confectionary segments like Dark Fantasy, Candyman and beverages ‘BNatural’.

However, ITC being a steady and well established product line spread across multiple domains of non-food goods as well, its receptiveness to only a food inflation scale remains limited.

A point to be observed here despite the boisterous growth from the March to June 2022 Quarter of 11.67% in its sales, similar to the other firms analyzed in this study.

ITC has provided a detailed view of their FMCG segment growth in its quarterly reports, where they mention having adopted a premiumisation marketing strategy to improve brand recall value and several supply chain cost cutting to pull through this high inflationary headwinds.

Sanjiv Puri, CMD of diversified conglomerate ITC Ltd had also expressed his concerns, “While the potential is almost limitless, we are not immune to the adverse impact of several global crises including climate emergency, persisting inflation, supply chain disruptions, muted demand conditions in some major economies and the impact of geopolitical dynamics. The climate crisis represents an existential threat and in the short term, the impact of El Nino remains a key monitorable. Further, despite moderating inflation, key commodity prices remain elevated and volatile, adding to the magnitude of external risks”.

The September 2022 to March 2023 Quarter marked a stable 3.08% QoQ growth rate as volume increases picked up.

Tata Consumer Products Ltd.

Although a recently growing and newly branded player in the market, Tata Consumer Products has had its brands across Salt being sold since 1983 and Tea and Coffee being sold in the market since 1978. Tata Salt currently leads the market as the largest salt brand in the country, Tata Tea is the 2nd largest tea brand, and Tetley is internationally the 2nd largest tea brand in the UK and the largest one in Canada.

In the last decade these have been consolidated under the Consumer Products banner as it has also expanded into retail with their association with Starbucks.

Although not as closely linked to inflation trends as Nestlè nor showing a negative trend as Britannia, Tata Consumer Products has been rather consistent in its QoQ growth trajectory unlike its FMCG competitors.

It recorded a 4.79% QoQ growth between March to June 2022 and a 4.44% growth between June to December 2022 across two quarters. These steady figures represent consistent patterns indicating a growing market share against their competitors in Taj Mahal Tea, Lipton and Society Tea. Figures by market research firm Tofler indicate a 30% market share of Tata Tea in 2021.

Their financial results dossiers reveal an enviable position that Tata Consumer Products holds in the tea market in the country. Where the June 2022 quarter recorded a 1% volume growth, inflationary prices action drove revenue growth during this period. Whereas in the December 2022 quarter, the beverages segment contracted in volume growth by 5%, and the food segment with Tata Salt, Tata Soulful and Sampann brands led the way with 4.3% volume increments.

Towards the beginning of 2023, Tata has ridden the volume wave and delivered 3% and 8% volume growth across their beverages and food segments, with the total sales growth of 9.75% between the two quarters of September 2022 to March 2023.

Concluding Remarks

As material inflation reduced from high single digits to low single digits, there has been an uptick in volumes in both urban and rural markets, indicating promising signs of recovery in demand.

The big FMCGs find that given the challenge of food inflation, the real competition lies in the small or local players who have re-joined the market after easing of inflation. Hence, HUL, ITC, Godrej Consumer, Dabur, Marico and Tata Consumer are increasing spends on advertising and promotions while working upon price corrections to remain competitive & continue to drive topline while maintaining profitability.

With the exception of Britannia, Indian brand giants in the Food Processing space have adapted fantastically well to inflationary tendencies in the larger economy, coursing through price rises and volume growth almost equivalently.

This is to a huge extent, also owing to the rising personal disposable incomes in the domestic Indian market. A longitudinal study by (Gokarn, 2011) on Indian food prices since the 1960s, concluded that the only way to curb these inflationary pressures is to increase supply rapidly to revive economic consumption.

The Indian retail sector is poised to bolster forward through the coming tough times of inflation, if FMCG players manage to match and expand supply along with growing tides of demand of coming festive seasons.