Identifying Potential of India’s Labour Intensive Industries

Across the world, presently the hopes riding on the Indian economy are immense. Besides being seen as a replacement manufacturing destination to China, India is also being viewed as the most favourable country by its geopolitical ally. India is playing almost a fine balanced effort in creating an image distinct from other major political blocs.

Dr. Nouriel Roubini, an economist renowned for his market predictions, in a recent interview, stressed on the necessity for India to proliferate their labour intensive industries to maximize manufacturing potential.

Despite these exigencies, India’s job market barring the service sector has been concerning dormant. Employment in India has been on a visibly declining trend even prior to the COVID-19 setback. According to the Centre for Monitoring Indian Economy, manufacturing workforce fell from 53 million to 27.3 million between 2017 and 2021. India’s programme of Make in India initiative also largely failed to deliver in the job market as good as it did in inviting FDI.

With these caveats in mind, the purpose of this article will be to study the highest performing labour intensive industries in India, namely the Ready-made Good (RMG) Textiles, leather and related products and tea; in terms of their trends exports, total output investments and employment. Although an industry specific year on year employment data was unavailable, the article assumes that increases in output, exports and investments will also be suggestive of positive trends in employment.

- Textiles

Beginning with the first industry, textiles have served to become the second largest employment generator in India’s economy. According to 2022 data, it employs 45 million people directly and 60 million indirectly through allied activities. With an apparently increasing output, it recorded a Compounded Annual Growth Rate of 10% in FY 2019-20. India is one of the largest producers of cotton and jute in the world, also the 2nd largest producer of silk in the world and 95% producer of the world’s entire hand-woven fabric.

The textile industry, by nature is a labour intensive one. That is, besides the initial furnishing of raw material into fabric which relies heavily on machinery, the final design and development into retail goods is almost entirely done by labour. Consequently, the skill requirements are relatively high and intricate. It is also due to this reason that the retail textiles manufacturing is one of the largest sectors of providing female employment in the country.

It is notable that cost of production being low. According to the Ministry of Commerce, textiles accounted for 11.4% of India’s total exports in 2020-21.

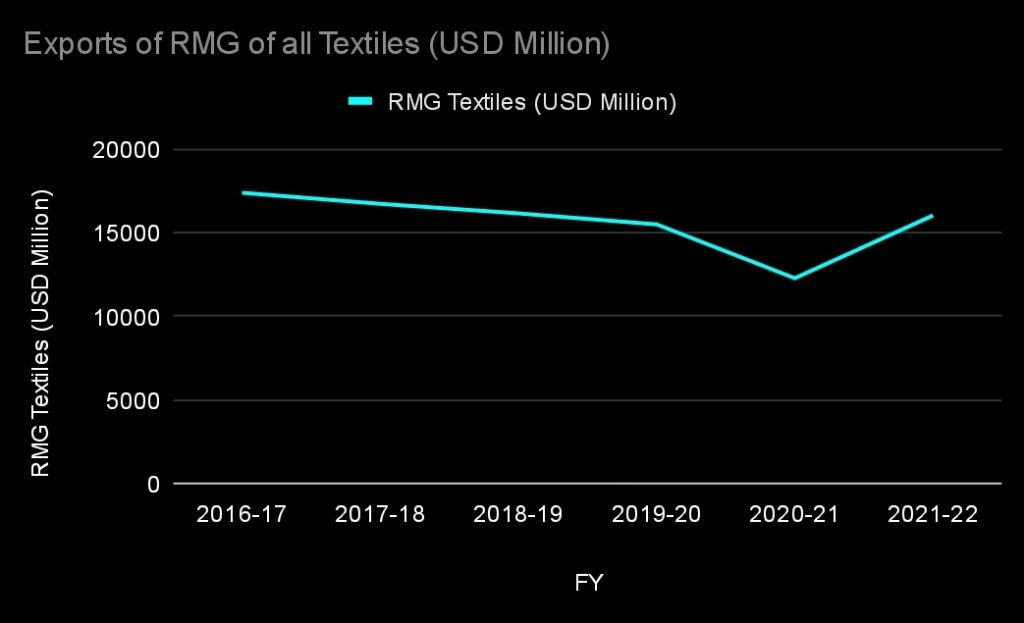

The graph evidently indicates that textile exports have been stagnant between 15.48 Billion USD and 17.36 Billion USD, the former being the lowest in the 6 year time frame, discounting the 2020-21 COVID-19 figures. It is a telling illustration, contrary to other popular narratives of increases in apparel exports.

The noteworthy point here, is that while total textile exports including cotton and other natural yarns and man-made yarns, technical textiles for medical goods and such were at an all time high of USD 44 Billion in 2021-22, the refinement and production of these fabrics is still largely capital intensive according to Invest India, associated with the Ministry of Commerce.

This is one of the largest bottlenecks in the industry, where capital intensive means of production chokes the creation of further jobs, and production and exports in labour intensive segments (like apparels and garments) has remained stagnant over the years.

The above image represents the total domestic textile industry in India. Although the last three months of 2022 showed positive growth in the industry, averaging at 3.5% the key point, employment, has remained stagnant despite recovery after COVID-19. Keeping aside the forecasts for FY26, FY22 recorded USD 172 Billion in value, a respectable growth.

The government has taken several initiatives in recent years in cognizance of the growing importance of this industry. The two foremost ones among them are the central stature given to the textile businesses in the recently announced Production Linked Incentive Scheme which announced an outlay of INR 10,683 crores or USD 1.44 Billion for the growth of technical textiles and man-made fires. Besides this, since 2014 the government has established 59 Textile Parks under the ‘Scheme for Integrated Textile Parks’ (SITP). These will be equipped with modern infrastructure and facilities to bolster textile manufacturing in the country. The total outlay of this being INR 4445 crore. The aim behind this is to reduce logistics costs while forecasting the creation of 20 lakh jobs.

The noteworthy point amidst all of this total output has been increasing domestically, the sign of decreasing export trends tells us a story of necessary policy directed towards the same that incentivises exports further. Moreover, the government investments through the PLI scheme as well as other FDIs have been towards segments of the production line which are more capital intensive in nature, defeating the overall purpose of propelling textiles as a labour intensive market.

- Leather and Related Products

India is the second largest exporter of leather garments, third largest of saddler and harnesses and fourth largest exporter of leather related products in the world, holding a robust 13% share of total leather hides and skins production globally. Doubtlessly, its allied sectors contribute to a large chunk of the labour employment in India, providing jobs to 3.09 Million people in 2018, which has risen to 4.42 million in 2022 according to India Brand Equity Foundation. A healthy 30% of these numbers are women.

Major footwear and leather products producing states in India are Tamil Nadu, West Bengal, Uttar Pradesh, Maharashtra, Punjab, Karnataka, Madhya Pradesh, Haryana, Kerala, Rajasthan and Jammu & Kashmir. Among them, Tamil Nadu accounts for nearly 40% of the total leather production in the country, while 79.5% of leather produced in West Bengal is exported.

The graph follows a pattern similar to that of textile exports, in which the figures seem to be continually declining. Although FY22 records a 32% growth from its previous year, this is merely a rise back to pre-COVID numbers which were themselves waning. RBI data records exports of USD 5289.1 Million in FY 2017-18 which also reduced to USD 4685.5 Million in FY 2019-20.

According to the Council for Leather Exports, FY23 also reported exports of about USD 5260 Million, which indicates a rising trend following the post COVID era, but the sustainability of these trend over the long term remains to be seen as the figures are yet to cross the FY18 numbers. These figures expose the sincere need in policymaking dedicated to export promotion.

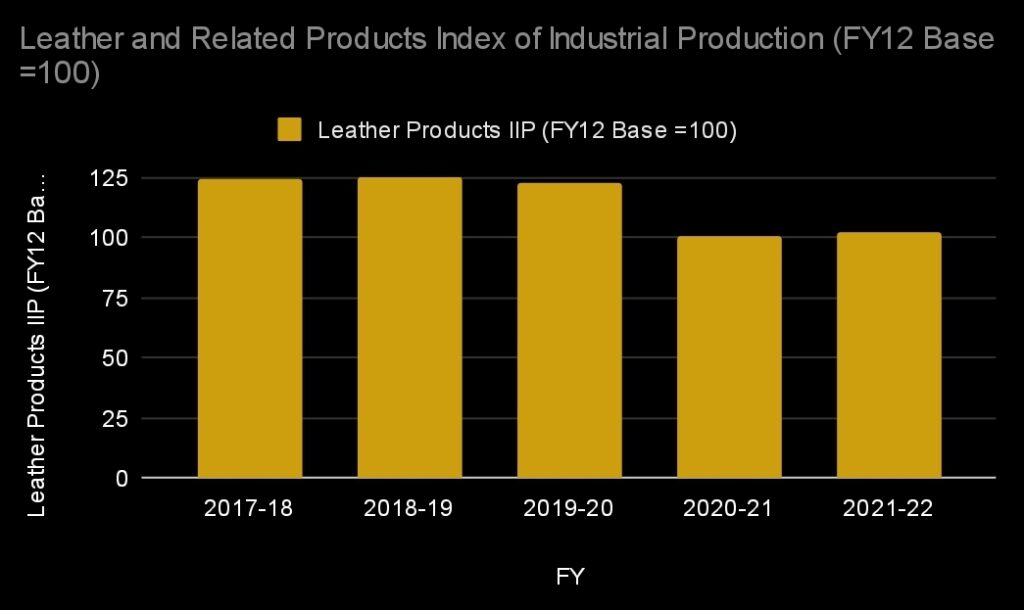

Another image that stands before us is of the total production output of the leather industry as a whole. Initial intentions to use data pertaining to the total annual volume produced were unfortunately unfruitful. As a result, data published in the RBI ‘Handbook of Statistics on the Indian Economy’ regarding the Index for Industrial Production (IIP) has been used. This index is calculated with figures from a base year, in this case FY 2011-12, as the base figures.

The index takes numbers of production volume and therefore is a direct indicator of output. This again, paints a grim picture of the leather industry where exports and production both seem to be on a decline, naturally signaling a fall in employment as well.

An academic paper by Muthusamy and Ganesh from Allahabad University reports that FDI inflow in leather industry has reached from USD 51.58 Million to USD 193.7 Million between 2005 and 2019. However, the impact of this on production and exports has so far been inevident, as they both remain declining or stagnant.

The major government initiatives in this regard as less publicly prominent compared to textiles, however the noteworthy ones are the Indian Footwear and Leather Development Programme which has announced an outlay of INR 1700 Crore mainly targeted at improving the infrastructure and setting up modern technological equipment in factories and more so in Design colleges and educational institutions. The budget allocation for schemes is almost entirely towards leather footwear, it being the largest among all leather industries, and secondarily towards education. This further highlights the need for a scheme to spur exports and production as a whole to improve labour intakes.

- Tea Cultivation

This industry, although not manufacturing based like the prior two, is largely labour intensive and employs between 2-3.35 million people in India. Being the second largest producer of tea in the world, India also stands among the top 5 tea exporting countries.

The practice of tea cultivation has historically been largely unorganized, where employment is unstable, seasonal and impermanent. This by nature has led to a lot of structural problems in the industry with low unsustainable wages, poor working conditions and an inconsistent supply chain for the retail markets. The first noteworthy aspect here, is to understand that being the largest producer of a commodity does not necessarily indicate prosperity for the employees in the industry.

The tea industry here shows commendable resilience where it has seemingly retained its exports compared to trends we observed in textiles and leather products. It is necessary to keep in mind here that India being one among the largest producers and exporters of tea, export growth in this sector has to be retained at mean levels on priority. Considering this, tea exports have found agreeable success in maintaining their levels despite setbacks during COVID-19.

Similar remarks can be made about the total production of tea, where figures have remained stable. The below graph illustrates the same.

What actually calls for attention in the sector, are the deep set structural problems that persist in its production processes. Although a drop in output of 770 lakh tonnes between 2019 and 2021 is recoverable owing to the industry’s resilience, the larger problems of low wages, lack of proper regulation and efficient institutions to provide social security to its employees still continue to slack the susceptible industry. This calls for further investments and government regulation to induce stability in the industry’s labour market. At present, the sector finds itself in a conundrum where increasing labour wages will increase cost of production serving to be counterproductive against the already low tea prices in the market. According to the Tea Board of India, this is in part due to the rise in cheaper imports in the country.

Overall, the immediate priority of the sector is to stabilize its internal structures and processes before boosting output over the long term.

Concluding Remarks

On the current demographic distribution of India’s 1.4 billion population, it can perhaps be said that the scope of India’s development in the next 30 or so years. To hail 21st century as the ‘India’s Century’ it has to work upon 18–35 aged population.

To summarize our examination across all the three industries, each possess a challenge unique to their sector. The manufacturing sector calls for better incentives for export promotion which go beyond mere infrastructural growth. The reversal of declining exports must be taken up as a priority in the textile and leather products markets, failing which the higher positions of prestige that India enjoys at the moment in global markets will be under threat.

The tea cultivation industry has far deeper problems which require policy change in specific aspects like price stability, labour wages and social security. Yet, tea cultivation in India has fared better than the manufacturing sector in terms of its output and exports.

The epicenter of the problem in India’s manufacturing is its capital intensive techniques of production which do not help in improving the job outlook in the country. The same concern is highlighted by eminent economists such as Dr. Nouriel Roubini and Dr. Santosh Mehrotra in various interviews. A report by Statista shows a positive trend in FDI in the textile sector, the effects of which however do not corroborate with an increase in exports.

Although the government has been making several investments in these industries, concentrated schemes aimed at incentivising exports are necessary.

Aarya Gandre

Aarya Gandre is a Research Intern at Tatvita Analysts. He is pursuing his Bachelors in Economics.