Indian Women in Business: And the Businesses They Run

India has historically responded progressively to the ideas of women in positions of power. Whether having a women Prime Minister way before the western world caught today’s intense drift of feminism; to having a serious wave of women business leaders in the past few decades.

These women leaders are present in almost all industries marking their presence, and helping the business reach new heights. In view of the upcoming Navratri festivities, this week’s market analysis article spans a particular theme, ‘Women-led Businesses’.

An ET study from 2009 notes that nine women-led listed companies at the time fared better than the top 30 companies listed on the BSE on a YoY growth basis in the previous 5 years. Interestingly, the 9 companies had an average Compounded Annual Growth Rate (CAGR) of 35%, the top 30 firms had a CAGR 21% on average.

Drawing away from larger businesses a bit, the Indian populace is saturated, with women leading home run small businesses and cottage industries.

A fantastic report by the IWWAGE initiative at KREA University notes that the 73rd NSSO round deduced that 80% of women led businesses are run from within the household premises and another 3% operated without a fixed location in FY 2015-16.

However, the noteworthy factor in these settings is the resilience that this home industry carries with it. Now, with the sales infrastructure that giant firms like Meesho offers, it has been gaining considerable momentum amongst the larger Indian diaspora.

Similarly, in a written reply to a question in March 2022, MSME Minister Shri Bhanu Pratap Singh Verma was quoted saying the while the Udyam Registration portal had 4.9 Lakh units of registered women-led MSME businesses in FY 2020-21, the platform recorded a 75% YoY growth in its figures with 8.59 Lakh new users making registrations in FY 2021-22.

With the above context of small scale women businesses in mind, we shall begin to take a look at some of the larger names in the corporate world and how they have fared in their recent history of operations.

The firms we will be considering are two of the most well-known giants in their respective industries and hold the distinction of not just being run by women leaders but also being founded by them. Biocon, founded and led since 1978 by Kiran Mazumdar-Shaw; and Nykaa, founded and led since 2012 by Falguni Nayyar.

The course of analysis that we’ll take will center mainly on the revenue growth, market positioning among key competitors and a unique case study that defines the impact value of the brand that both these companies have created.

Biocon Ltd.

Beginning with their ‘Papain’ product, a plant enzyme derived from papaya, Biocon has come a long way to specialize in their biosimilars market, where they are committed to bringing affordable drugs across the segments of diabetology, cardiology, and oncology among others.

The company that started with humble beginnings in a shed manufacturing only one product with three employees and under the leadership of Kiran Mazumdar-Shaw laid the cornerstone to their first, 20-acre Hosur Road campus in 1981 that they purchased for INR 6,00,000.

Today, Biocon is a leading global player with its major influence in the affordable biosimilar market; which are highly similar to established pharmaceutical drugs in the market but made with key product differentiations in place to enhance brand value and distinguish an identity.

Biocon’s biosimilars, in this case, control the market to the extent that 60% of their entire revenue came from that segment in FY22.

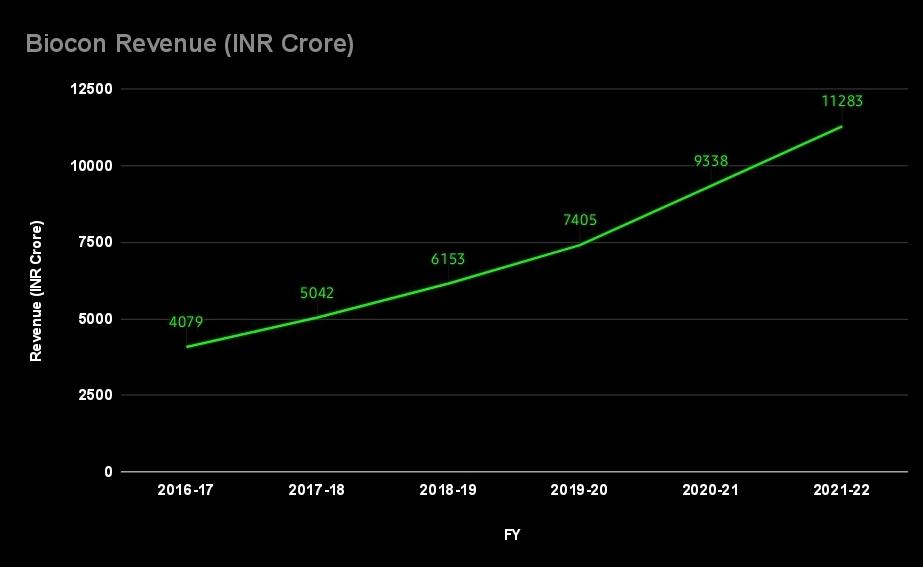

One of the most impressive highlights of Biocon’s success story is a consistently well managed balance sheet with a healthy trend in its revenue growth. The below given chart indicates the same.

Biocon holds true even in that regard where its current ratio, which is the ratio of its current assets to current liabilities and provides an insight into the company’s financial governance, has been greater than 3:1 every year in the last five years.

The strength and reach of the company can be seen once one compares the total net profit before tax between its competitors in the Indian market, where even the giant Sun Pharmaceuticals actually reported a loss of INR 200 Crore in the last financial year, Biocon reported a profit of INR 2848 Crore.

The most interesting story that follows Biocon’s success is its branding, which sits at the heart of its success roots. Larger respect that the Indian populace has for Kiran Mazumdar-Shaw adds upon to the reputation that firm gets in India. This has created an image of the brand that has sheltered it away from the “evil corporation” image that the industry as a whole shares in the country. This ‘Indian-ness’ that Biocon propagates has given it a distinct edge in terms of their brand image in the Indian population.

Looking at a case study from Biocon’s archives, one which defines their novel R&D and Indianized commitment to affordable biosimilars, was its entry into the market of ‘Trastuzumab’, a drug unique drug with therapeutic treatments in HER2 breast cancer.

It all started in 2006, when Biocon CEO Kiran Mazumdar-Shaw realized that the high cost of trastuzumab was making it inaccessible to many patients in developing countries. She decided that Biocon would develop its own biosimilar of trastuzumab, so that more patients could have access to this life-saving drug.

Biocon’s scientists faced a number of challenges in developing a trastuzumab biosimilar. Trastuzumab is a complex monoclonal antibody, and it was important to ensure that the biosimilar had the same safety and efficacy as the originator product. With heavy investments in research and development, and its scientists working tirelessly to develop a biosimilar of trastuzumab that met the highest standards, in 2013, Biocon became the first company in the world to receive regulatory approval for a trastuzumab biosimilar.

Ogivri was launched in India in 2014. Since then it has since been approved in over 60 countries. Ogivri is now the leading trastuzumab biosimilar in the world that has helped to make trastuzumab more affordable for patients in many countries. Biocon’s development of Ogivri is a testament to the company’s commitment to innovation and its vision of making healthcare more affordable and accessible for everyone.

NYKAA

The quest for beauty in every sense of the worl, is a passion for most people. Some people choose to pursue this passion via make-up and cosmetics. And a pioneer in this field that did not even exist till about a decade ago has something in it for all of us to learn from.

With the tagline ‘Your Beauty, Our Passion’, Nykaa cuts straight to the chase with what they have to offer to their ever-growing consumer base. The company’s quest for providing value-for-money products also ensures brand loyalty like no other cosmetics brand can.

Let’s take a look at how they managed to become a household name by looking at their backstory. Becoming one of the most successful e-commerce websites in India in just 4 years since sales started in 2015 (although the company has been around since 2012) is a very impressive task which Ms Falguni Nayar, the CEO of Nykaa was able to achieve by following and believing in her passion.

Ms. Nayar, who was the MD for Kotak Mahindra capital before she decided to pursue her passion for make-up and beauty products, led this company to become the first woman-led unicorn in India, and it continues to dominate the online retail marketspace in beauty and fashion.

Due to their unique marketing strategy of content driven promotion Nykaa has been leaving a different impression on its consumers. They push advertisements on YouTube to ensure that people not only buy the products that they have to offer but also be invested in the company by consuming their beauty-related content which is sponsored by them. They also collaborate with many social-media influencers which makes it possible for people to make a personal connection of sorts which is not really possible through a YouTube ad. They also utilize Search-engine optimization, through which it is able to target people who have searched about beauty-products and cosmetics and ensure that the hit-rate stays high.

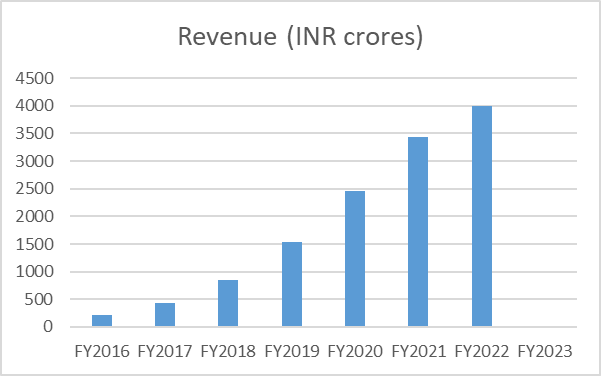

Moving on to their financial performances, Nykaa has a Compounded Annual Growth rate of 60% since 2016, which makes the national average of 21.5% (for the past 5 years) look like child’s play.

Nykaa’s revenue in 2016 was INR 215 crores, which has risen to INR 4000 crores as of FY 22, having a continuous growth path that did not waver even through the tough times of the COVID-19 pandemic.

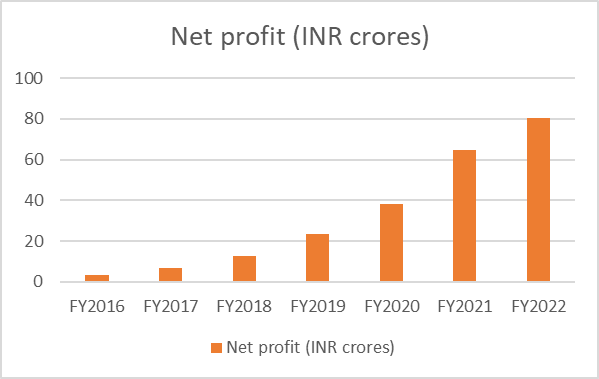

The story stays the same for the net profit which was just INR 3.3 crores for FY 2016 but was INR 80.3 crores for FY 2022, which showed an upward curve till then but is now a bit shaky seeing that they only registered INR 5.4 crores in the first quarter of FY 2023, which should still improve considering that the festival season is upon us in a few weeks.

Concluding Remarks

Women leadership in business has always been a lucrative topic to cover for all researchers, journalists and bloggers alike.

India is currently a boiling pot for all things entrepreneurial with the startup financing industry picking up its graces quicker than most of the other south Asian countries in the developing world.

Biocon individually, has been a gargantuan success story for the world to look up to and Kiran Mazumdar-Shaw its beacon representative. With an established an ever growing market in pharmaceuticals, its B2B consumer base is solid, and B2C market image well footed in India’s business iconography.

The future for Nykaa looks bright because they have an ever-growing consumer-base which is furthered by the fact that many youngsters want cost-efficient solutions to their beauty needs, which provides virtually an infinite stream of revenue for them. Another factor that needs to be enhanced a bit is their transition towards physical stores, which are as of now a total of 80 across the nation, which can surely be improved. As long as they are able to manage the valuation of their shares (which have slumped a bit and fallen by 11% but it’s nothing catastrophic so they should bounce back), the company should maintain it’s position as the leader for affordable beauty products for the foreseeable future.

Aarya Gandre

Aarya Gandre is a Research Intern at Tatvita Analysts. He is pursuing his Bachelors in Economics.