Fiscal Analysis of recently formed Union Territory: LEH & LADAKH

Ladakh, has arguably one of the most difficult situations to describe politically and economically. It is a region which has its history stretching from the Neolithic period right up through several rulers, indigenous administrators, and now, after being split from Jammu and Kashmir, as an independent Union Territory of India since 2019.

The novelty of this region is spread manifold, in which it might just be the region in India with the most interesting superlatives. It has the highest located agricultural fields in the world in the Korzok region at 4600 meters above sea level. The highest built bridge in the world, the Bailey Bridge at 5602 meters above sea level, even the highest desert in the world at 2226 meters, the Katpana Desert; and highest battleground in the world, the Siachen Glacier, which is a stunning 6000 meters above sea level!

In terms of its economy, Ladakh has historically been a strong trading and merchant outpost for Chinese and mainly Tibetan businessmen traveling to Central Asia. This trend continued with several Ladakhis trading textiles, carpets and dyes until. Chinese authorities banned travel to the region in the 1970s. Although the merchant routes were shackled due to political disputes, the region currently has tourism as its largest industry, which accounts for close to 50% of its GNP. Besides this, the region has a magnanimous potential for hydropower and solar energy combined with plenty limestone reserves.

Like Jammu and Kashmir in the previous article, our primary intent will be limited to examining Ladakh’s economy and its fiscal administration. Due to its political circumstances, the data used has only been that published by the Ministry of Home Affairs, Government of India in its Ladakh budget allocation documents. All data for the years 2022-23 and 2023-24 is from under the revised budgeted and budgeted columns respectively.

An important point to note is that data for this article was more so unavailable in terms of the regular CAG and Accounts reports that other UTs or States release. This can be naturally discounted for due to the political challenges in the region and the administration under the Central Government which is relatively still new, as well as the presumably roadblocks of the Covid Pandemic.

Owing to these factors, this article will make use of the capex and revex of the UT of Ladakh, the investments in tourism and annual tourist footfall, and finally the investments in power generation and capacity. This has been done bearing the thought in mind that the best yardstick to analyse the region’s performance would be its own strengths.

- Capital Expenditure

Coming to our first metric for this analysis, the capital expenditure, or capex, is the expenditure of the government which leads to the direct creation of assets. This has two benefits. Primarily, it creates infrastructure that encourages investment in the economy which has far reaching long term effects in sustaining the resilience of the economy. Secondly, it creates a steady and reliable source of revenue for the government such that it does not rely overly on tax collection from the public.

However, comparing this metric with Ladakh’s figures would be largely mistaken owing to the fact that the UT got its own independent administration quite recently and that it has the least population density in all of India with an equally low population as a whole. In summary, less people, more land and less industrial output make the region one in urgent need of capital investments to boost their economy and increase their overall productivity.

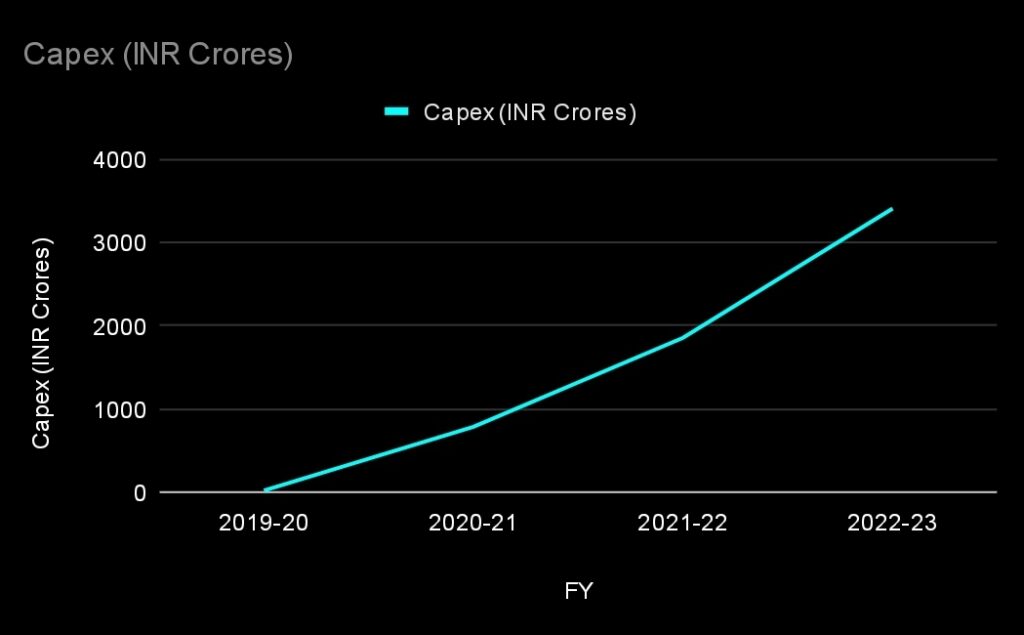

Being a centrally managed Union Territory, it is natural for the administration to rely heavily on Central loans and grants in aid, especially considering the short duration since its foundation. What’s necessary to observe is the growth in the capex figures since 2019. The below figure illustrates the same.

It is necessary to note that the first 2019-20 data point refers to the capex between 1st October 2019 to 30th March 2020, a visibly shorter time frame than the others which account for the whole year between April to March of their respective FYs. This results in the 2019-20 capex records showing only INR 24.59 Crore.

However, even in regards to the remaining three time frames, there is an exponential growth in the capex which is an optimistic sign. A glance through the Home Ministry’s releases shows that majority of the UT’s schemes funds, about 42.88% goes towards power generation. The remaining highest avenues are rural and tribal development, tourism and public works. This shows a positive inclination towards infrastructure growth that will attract investments in the long term.

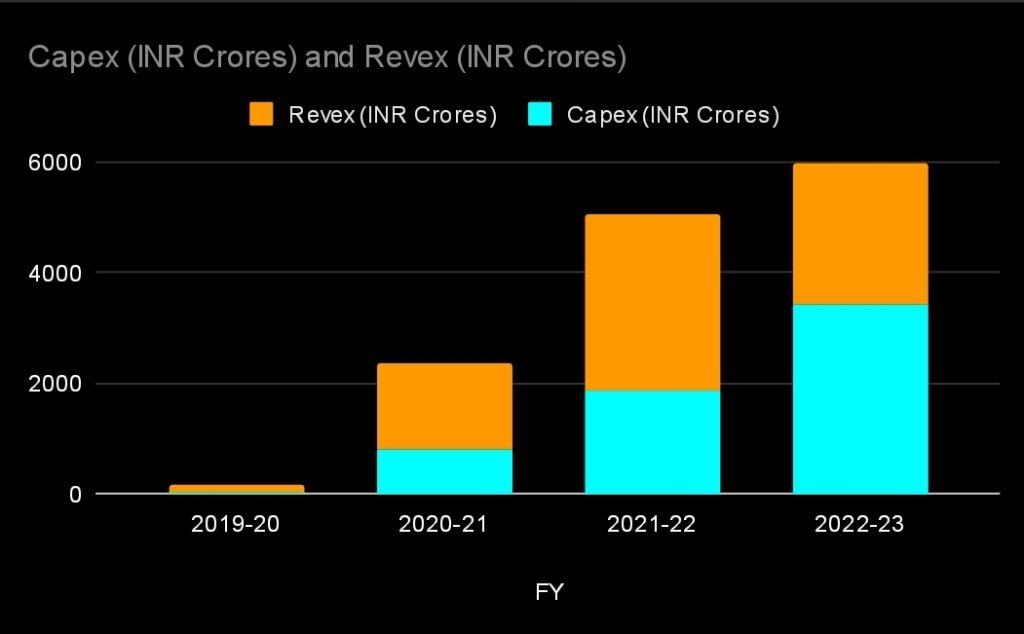

Furthermore, we shall examine the revenue expenditure (revex) and capex comparatively. While the capex gives us the expenditure towards direct assets, revex gives us the expenditure towards daily operations and running of the government. It is advisable to not have a substantial margin between the capex and the revex to ensure that the revex does not eat through most of the budget, and leave lesser opportunities for investments.

The data here is rather surprising, in which the government’s revised budget for 2022-23 indicates a higher capex than the revex, which is unusual for other state and UT budgets. The trend here is again largely positive where the government seems to be prioritizing capital expenditure over other expenses.

What is unique about Ladakh, compared to all other states is that the region needs an overall stimulus in all spheres for a holistic approach towards development. The Home Ministry records show the same where there is no consistency of expenditure towards one particular avenue across all three years. Power, rural development and tourism, all three alternate between the spot for the highest expenditure. The trend continues down through all other avenues as well.

Education and health are similarly represented down the priority chain, with education being allotted INR 2.99 Crores in the actuals of 2021-22 capex and health receiving INR 2.42 Crores in the same financial year. Among the two education clearly requires more attention, with even the higher secondary GER being as low as 49.4, a significantly less figure compared to other states with the only lower exceptions being Bihar, Haryana and Odisha. It is undoubtedly clear that more funds are required to be directed to this domain.

Compared to this, health has an entirely different picture, with the RBI Handbook of State Statistics showing the required number of doctors and specialists in the PHS domain being 28, but the sanctioned specialists stood at 94 and the active ones were at 32, 4 more than the required amount. Although the gynecologists and obstetricians are lesser in number than the required amount, if is only by a fraction and healthcare in Ladakh needs relatively lesser attention than education does.

- Investments in Tourism

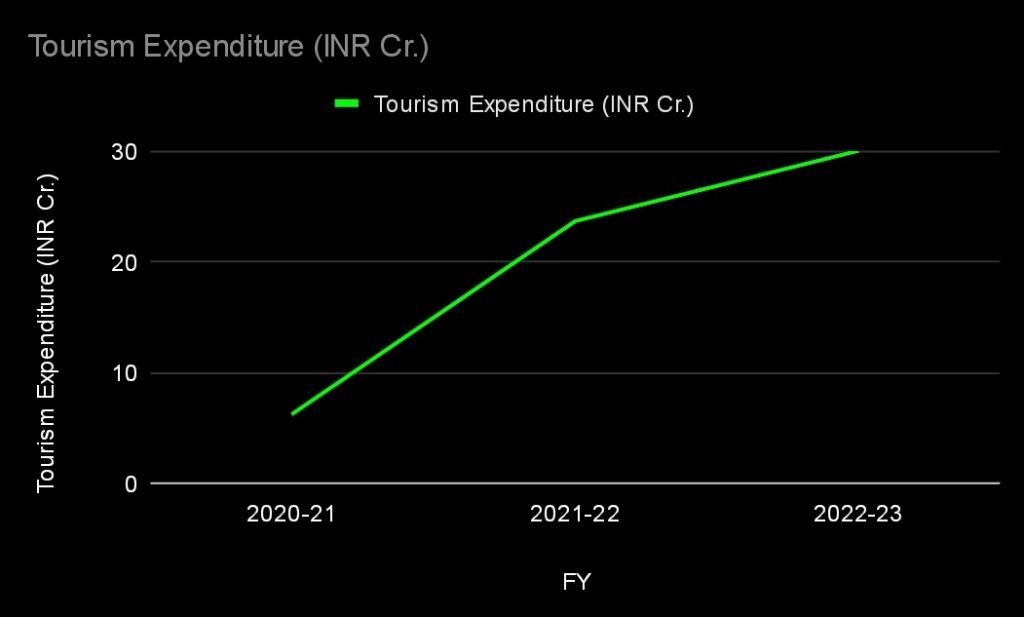

As aforementioned, the inclusion of this metric is to gauge the region’s economy by means of the growth of its largest sector. We aim to achieve this by analyzing this on two fronts, firstly the government capital investment in the sector across the years of 2020-21 to 2022-23; and secondly through the annual tourist footfall across 2018 (for pre-covid numbers), 2020, 2021 and 2022.

Capex in the sector has gone up from INR 6.25 Crores in 2020-21, to INR 23.65 Crores in 2021-22, and budgeted at INR 30 Crores in 2022-23. The investments have shown healthy growth in this regard and will likely continue to increase owing to the growing number of tourists in the region.

Last year, the Ladakh Tourist Trade Alliance, an association between prominent local and national political parties in the region and the local tourism industry community decided to indirectly ban any outside investments to prevent the debasement of the local community, resources and culture in the region. This was a positive step taken towards improving small scale cottage industry, the long term consequences of which are as of yet only speculative.

Although the environment discourages external investments in the region, Ladakh has not had a problem in the past attracting abundant tourists to visit its famed landscapes every year, even a a time it did not have its own independent budget.

The tourist footfall in 2018 was 327,366 out of which about 50,000 were foreigners. The covid pandemic has since slowed this boom especially for foreigners. Yet, the year 2021 recorded 304,077 which is a respectable recovery for a world still struggling within the 2nd wave during April, the summer season being of peak business for Ladakh tourism. 2022 recorded a healthy 450,000 again. A full compensatory growth crossing precovid figures. All in all, it can be said that the tourism sector is in a good shape.

- Investments in Power Generation and Capacity

The third parameter is one similar to tourism. One of the lesser talked about facts about this region is that Ladakh has more about 360 days of clear, open sunny skies every year giving it immense potential for solar energy generation, with many reports claiming the solar energy potential in Ladakh is upto 35 Gigawatts. It is of this accord that the government has already invested in a 20,000 acre, 10 GW solar energy plant in the Pang region of Changthang, which the Solar Energy Corporation of India have taken the charge of developing. It is planned to be the largest solar plant in the country.

The above graph illustrates the same. Even though capex in the power sector has stagnated in the last year, it can be attributed to local people’s concerns (over agriculture and livestock grazing) which have caused delays in project implementation. It can be hoped that these issues will soon be resolved to further these developments and bring already started projects to fruition. The government has also identified 5 hydro power projects with an estimated potential of 760 MW along the Nimo-Bazgo HEP.

Important strides are being taken in the sector with accurate budget allocation towards the same.

Concluding Remarks

As we summarize the entire analysis towards conclusion, there are three noteworthy points about which we should be mindful.

Firstly, that Ladakh is a recently independent UT territory with a complicated political environment that warrants a regular military vigil, making foreign and other investments unlikely in a lot of ways. Even if gaining an independent administration has been hugely beneficial for it in some aspects like independent budget allocation with relative freedom to allocate it as necessary (as would it be for any recently independent territory), these benefits somewhat fade away when restrictions from the Central Government (although necessary for national defense concerns) and local tensions act as challenges.

Secondly, a regular analysis of the fiscal management of the UT becomes largely irrelevant considering these uncommon circumstances. The new administration is bound to take large loans from the Central Government to undertake infrastructure development projects and boost its capex. The budgeted higher capex than revex are positive signs towards fulfilling this goal.

And thirdly, it is essential to keep in mind that data for this article was substantially difficult to come by compared to those of other states and even J&K. From a meta perspective, this is strongly indicative of the Ladakh administration’s nascent stage in formalizing its processes and making economic documents public regularly.

In consideration of all these points, it is noteworthy that further investments and efforts are required to improve education in the state and bring up its higher secondary education GER. Unless educational and training standards improve, the region will be stuck in doldrums over adapting to growing technology and business methods.

Despite this, the region is still in the process of growing. We can safely conclude that the amount of investments Ladakh is making in tourism and power are tremendously important and will hopefully continue across the years. These two sectors will be the pillars in establishing Ladakh as a successful independent economy, as it will see brighter days to come.

Aarya Gandre

Aarya Gandre is a Research Intern at Tatvita Analysts. He is pursuing his Bachelors in Economics.