Indian Entertainment Experience of Over-the-top Platforms

Prime Minister Narendra Modi announced the first national lockdowns on 24th March, 2020 which spelled doom for most businesses and services that relied on the physical aspect of trade (basically in-person purchases and dealings).

On the contrary, one sector that faced the exact opposite scenario was the online world, especially those companies that provided content to be consumed over the net and on-demand saw a massive boost in their operations.

One such sub-part of the online content marketspace are OTT (Over-the-top) platforms, named so because they go ‘over’ the regular cable TV subscription to provide on-demand content online.

OTTs have been around for a very long time, the first of which were in existence since 2007 with the emergence of Netflix (surprise, surprise) which started off operations in Scotts Valley, California in 1997 with renting DVDs but eventually became one of the first OTT platforms in the world and is now the most well-known of the entire bunch.

Since then, there has been a boom in the number of globally available OTT platforms and there are currently over 200 OTT platforms available worldwide. Even India had a few early players such as BIGFlix which was founded in 2008 to be an on-demand service for movies.

Before we proceed into the depths of how OTT became such a global phenomenon (and also how it managed to penetrate so deeply into the cable and DTH (Direct-to-home) heavy Indian market), let’s take a look at a few different ways of monetization and subscription methods that helped them become so easily accessible and customisable for the average consumer-

- Pricing strategies–

There are many pricing strategies that OTT platforms have used to make the consumer become pretty much dependent on them for their daily entertainment fix, some of which are quit widely used in other sections of the economy as well (such as premium pricing, bundle pricing, penetration pricing etc.) but there are a few very innovative ones that are exclusive to them.

- Cross platform packaging and bundling– As the number of OTT platforms increase over time, people have begun demanding access to the same account that is linked with an OTT platform on many different devices, and hence companies have begun to offer multi-device bundles to consumer which make them pay more to have access on more devices than just the original one.

This marginal profit that they earn per unit increase in number of users (increase in number of devices will indirectly correspond to the increase in number of users as well) is also a big part of the revenue that they earn.

- Pay-as-you-go charges– This pricing strategy is a major reason as to why people in countries like India, who may not have the resources to afford full subscriptions are still able to avail certain parts of the content that they want regardless of whether they have a subscription to that platform.

For example, FanCode is an on-demand streaming service that mainly focuses on livestreaming of certain sports events who offer ‘match passes’ or ‘tournament passes’ which are exclusively only available for select matches/tournaments that one may be interested in instead of subscribing for a whole month/year.

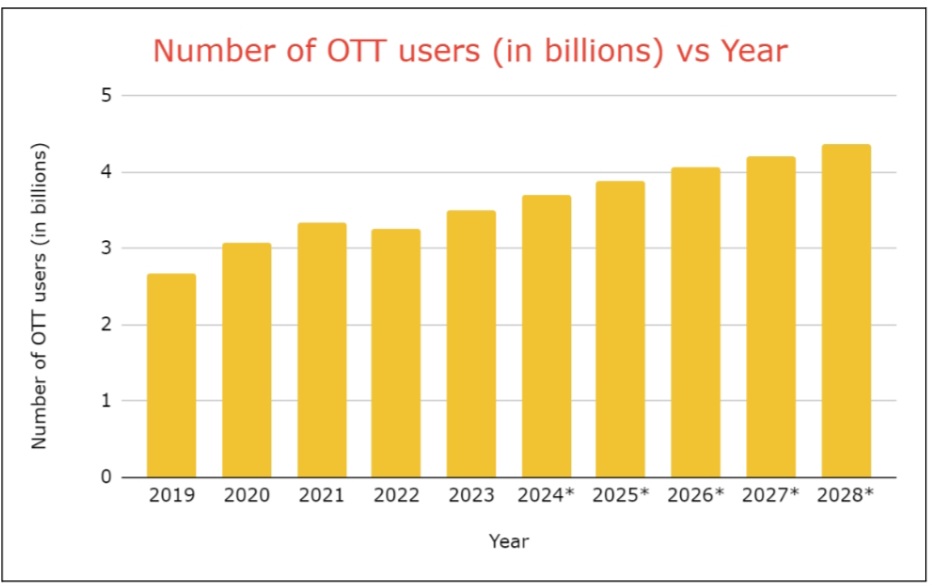

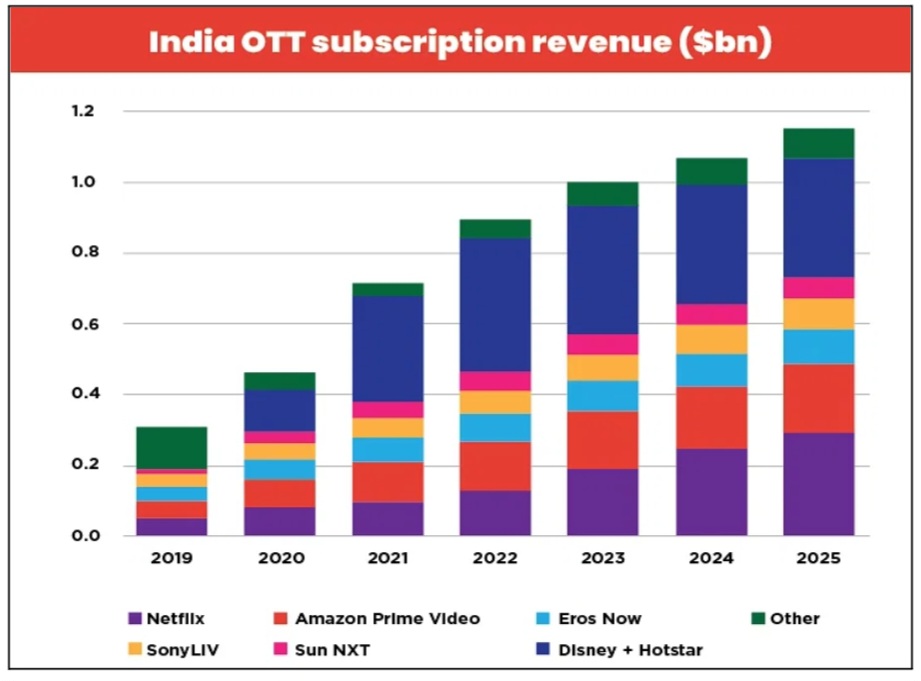

Let’s take a look at the numbers behind the game. As we can see from the above graph.

Disney+Hotstar has the lions’ share when it comes to revenue from the number of subscriptions and is expected to be the largest player in the future as well. It is followed by PrimeVideo, Netflix, Eros Now, SonyLIV and so on. And based on SvOD revenues, we can see that it is a three-way race between Netflix, YouTube (not an OTT platform but still occupies a large amount of digital content space) and PrimeVideo (from the graph below).

However, between 2022 and 2023, there is a meagre growth of just 10% (from the graph before this one) for all competitors without any apparent disproportional change in any of the already established competitors.

This was brought about because of a new player in the scene called JioCinema, whose parent company Viacom18 got the digital media rights to stream IPL (Indian Premier League) across the entire country from 2023-27 for a whopping 23,758 crores (2.86 billion dollars as of 26th December 2023) and decided to stream it for free (with ads, more about this later) which completely cancelled out the need for people to pay for a Disney+Hotstar subscription and led to the company losing 10% of their market share (from more than 40% in 2022 down to 30%).

- Flexible subscription models–

There are three main subscription models that different on-demand platforms use

- SvOD (Subscription video on-demand)- This is perhaps the most well-known, if not most widely used model that people are familiar with (at least consciously). Here, the consumers pay a recurring fee to gain access to the wide library of content that the service has to offer, regardless of whether most of the content is of interest to someone or not. This enables you to access pretty much anything, anytime and anywhere, but it ends up costing you extra unnecessarily because of the ‘extra’ (deadweight) content that you are getting. Some examples of companies using this model are- Amazon Prime, Netflix etc.

- AvOD (Advertising video on-demand)– This is a subscription strategy which is used by most on-demand platforms especially on their lower-tier packages. The basic idea is that advertisers get to advertise to their target audience and the said target audience ends up getting the services for a noticeably cheaper/sometimes even at no cost.

This also ensures that OTT platforms are not missing out on either their subscriber base because of high pricing nor are they missing out on their share of revenue (because of lowered pricing) as they end up charging companies to advertise on their platform which ends up reimbursing their potential losses. Some examples include- SlingTV, Crackle, lower tiers of Amazon Prime etc. (even YouTube uses this strategy but it is not an OTT platform per-se)

- TvOD (Transactional video on-demand) – This model is perhaps the most lucrative one for consumers in countries where most of the population belongs to the low-middle to middle income category, as you can choose to pay for any particular piece of content that you want to consume, and hence you don’t have to pay for the extra deadweight content that comes along with subscriptions.

This is perhaps the closest alternative to the traditional methods of renting/buying films on a per-unit basis. Examples are- FanCode, Renting movies on Amazon/YouTube etc.

Since we have taken a look at all these market penetration and establishment strategies that have been employed by OTT companies, we should also give some credit to short-video format apps (including YouTube and Instagram) for ‘conquering’ not just our shortening attention spans but also the online content space in a relatively short amount of time.

The following chart shows a noticeable expected jump of a bit more than 25% in just one month (from March 2020 to April 2020) after the announcement of the lockdown for short-format video content consumption.

On the topic of performance during the nationwide lockdown(s), we can see that OTT platforms flourished and grew at a very accelerated rate than what they were projected to, boosted especially because of a population that was stuck at home with nothing to do to while away the time.

This was soon caught on by movie and series producers, with more than a 100 movies being pitched to Netflix and around a 50 or so being pitched to PrimeVideo within the first few weeks of the lockdown. Some films are even OTT exclusive/are directly launched on OTTs instead of being launched in the movie theatres, such as Gulabo Sitabo which became the first movie to be launched exclusively on OTT. .

Another major reason as to why OTT platforms were able to ring a bell with the audience is because they were able to provide a wide-range of content to the masses in their language of choice, with many OTT platforms providing content (either dubbed or originals) in many languages including Telugu, Tamil, Marathi and Bengali (apart from Hindi) being the ones in focus.

This has had such an impact that the share of regional language consumption on OTT platforms will cross 50% of total time spent by 2025, just passing Hindi at 45%. Even Disney+Hotstar has 50,000+ hours of content in 8 languages (as of July 2021), while Hoichoi has brought in 25 crore Bengali viewers into the fray since its inception in 2017, and even has 80 original show with 27 of them being launched in the first year of the pandemic itself. Aha was another platform that debuted with 52 original shows right off the bat.

OTT platforms are not only something to be enjoyed by the urban residents, it has and is also being consumed on a large scale by the rural population.

Moreover, around 65% of the OTT consumption during the lockdown being reported from rural regions of India, with Tier 2, 3, 4, cities even clocking-in 1.5 times more new users registered than Tier-1 cities in India.

With this overviewing article of differentiating pricing and subscription strategies, introduction of regional programs, and quick and easy access to entertainment, it can be said that OTT platforms are creating new competitive markets in India. This market has a huge potential to grow not just in economic or revenue terms but also from art, creativity and expression perspective.

Nishad Govekar

Nishad Govekar is pursuing his graduation in Economics from Gokhale Institute of Politics and Economics. He has keen interest in share market.