Listed Clothing Companies in India & Their Performance

Our country is well known to be an agrarian economy and rightly so with around 44% of people employed by it as of 2021 according to the World Bank collection of development indicators, which makes you think whether there are any other sectors that are just as influential, if not more as agriculture.

And the answer to that is the textile industry, which is the second largest employer with around 45 million people employed directly and a 100 million more employed through allied industries, which bring in 44-billion-dollar annually just from exports.

India is also the second-largest producer of PPE (Personal Protection Equipment) gears, which in 2019 was a 52.7-billion-dollar industry globally, but is expected to be a 92.5 billion dollar one by 2025. There are also many other indicators of positive growth for the textile industry, but now let’s shift our focus towards the top players that function in the market.

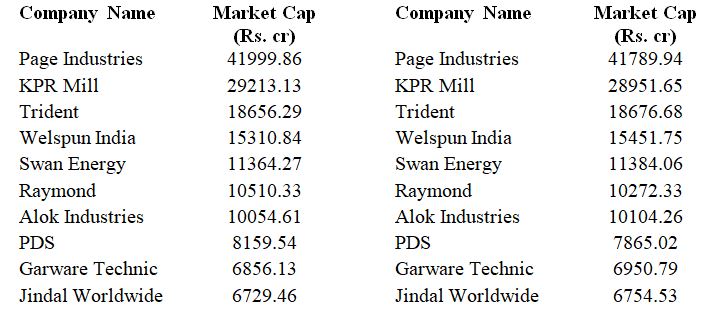

There are around 302 listed clothing and apparel companies on both the NSE and the BSE, and out of those, the top-10 players along with market capitalization are as follows-

Market cap. of leading textile and garments companies (BSE and NSE respectively)

There are many famous players such as Arvind, Bombay Dyeing, Siyaram and many others that miss out on the top-10 place but still deserve an honourable mention nevertheless.

This article will focus on the manufacturing side of the textile industry, because honestly, a lot of the times this is overshadowed by the much more glamourous fashion industry and hence I feel that textiles and garments need to be appreciated from the bottom-up instead of from top-down.

In India, there are many famous textile brands that produce some of the best quality garments on this planet, and hence we will take a look at a few of the famous textile and garment houses in India, and we’ll also look at their quarterly gains/losses in revenue for FY2022-23 to see if there is any significant difference over the festive season or not-

- Page Industries:-

There will be many people who would have not heard the name of Page industries, but might have already used at least one of their products, and many people do so on a regular basis as well.

Page industries are the authorised licensee of JOCKEY goods, whether it be innerwear, athleisure, sportswear etc. The main purpose of setting up of Page Industries by to introduce Indians to quality innerwear and thus break the notions we had about innerwear earlier on.

Page Industries are also the official licensee of Speedo in India, an Australian brand of swimwear that aspires to be the leader when it comes to swimwear in India.

Comparative chart of Page industries with other innerwear brands

Page Industries have displayed a sharp decline in the quarterly revenue reports of -8.45% from Q1 to Q2, and the negative trend continues during the festive season as well although perhaps festive fervour has led people to buy more and so the drop in revenue is only -0.49%, so maybe people are actually splurging on not just flashy new clothes but comfortable innerwear as well, but not enough for them to show a noticeable positive change in revenue.

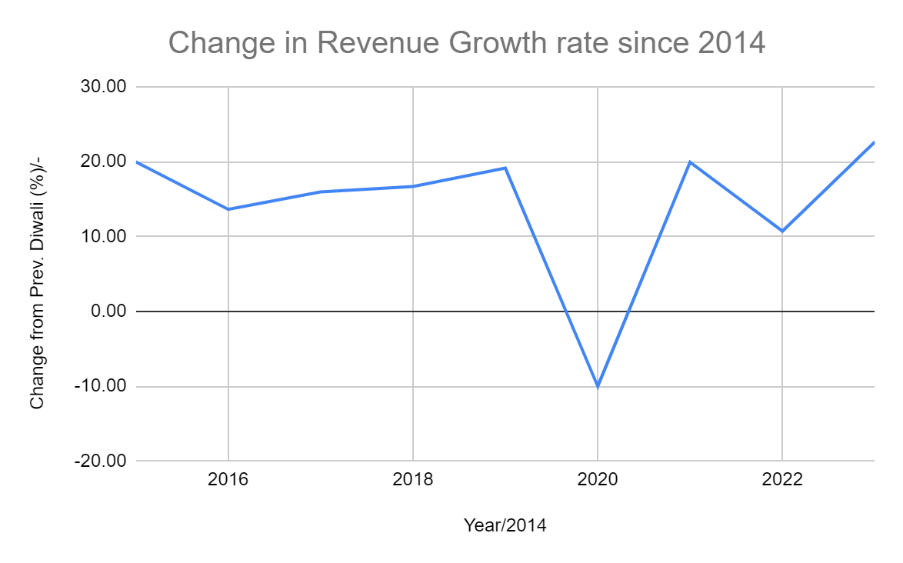

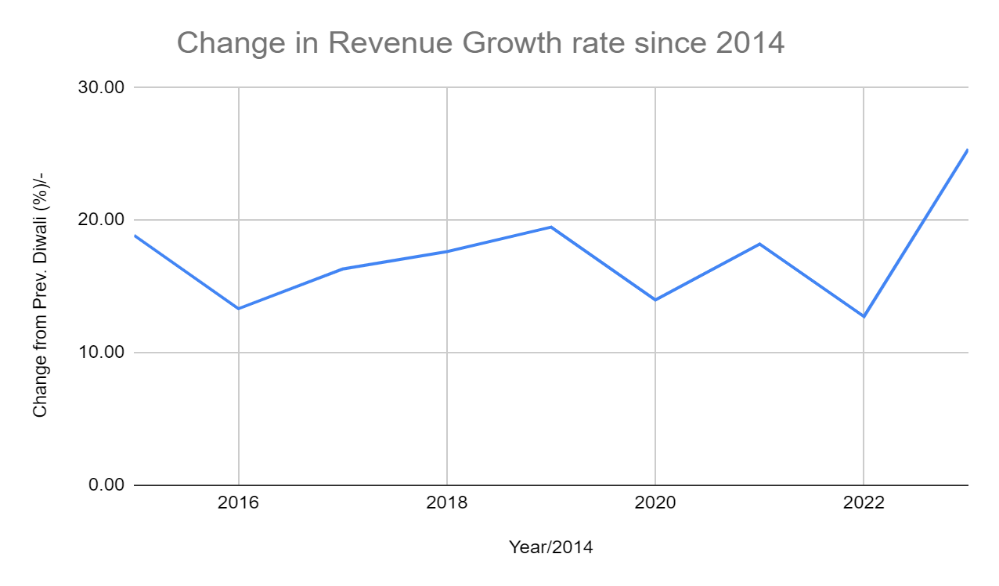

From 2014 to 2019, Page Industries saw their revenue growth rate increasing at values ranging from 10% to 20%. Come 2020, the company saw their revenue growth rate dipping- a decrease of 10% from the previous year.

The trend, however, made a V-pattern recovery, with a recorded increase of revenue growth rate by about 20% in 2021. While the change fell to close to 10% in 2022, the chart shows that Page Industries can expect a change in revenue growth greater than 20% post 2022.

- KPR Mill:-

Another company is KPR mill, one of the largest garment exporters as well as being one of the largest integrated apparel companies in the country, who specialise in manufacturing and marketing readymade knitted garments, knitted fabrics and cotton yarn. They are also actively involved in the production of white crystal sugar, which they use in the synthesis of Ethanol. They also have an innerwear brand called FASO.

KPR Mill has also set aside 400 Cr. for modernising and expanding their already well-updated company, out of which a 150 Cr. will be used for increasing Ethanol capacity, which goes to show that they are very versatile when it comes to their business portfolio as well.

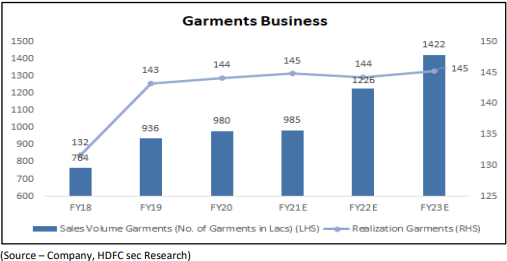

Sales volume of Garments

KPR Mill saw a whopping -22.71% decrease in revenue from Q1 to Q2, which is very alarming to say the least. However, they were able to bounce-back a little bit and had a 16.46% increase in revenue, which wasn’t enough for them to bounce back to their earlier levels. However, seeing the positive change in revenue can be an indicator of either robust exports or sales boosted by an increase in demand for Diwali clothing.

- Welspun Living:-

Welspun living is one of the better-known companies in the list till now, and they have made this reputation for themselves by being a leader in household textiles such as towels, bed linens, pillow covers etc. as well as flooring solutions that makes them, quite literally, a household name.

Welspun was founded by Mr. Balkrishna Goenka in 1985, and since then has proceeded to expand far and beyond, acquiring companies in the UK and USA as well, which ensured that Welspun was able to keep a diversified range of products across the seas as well.

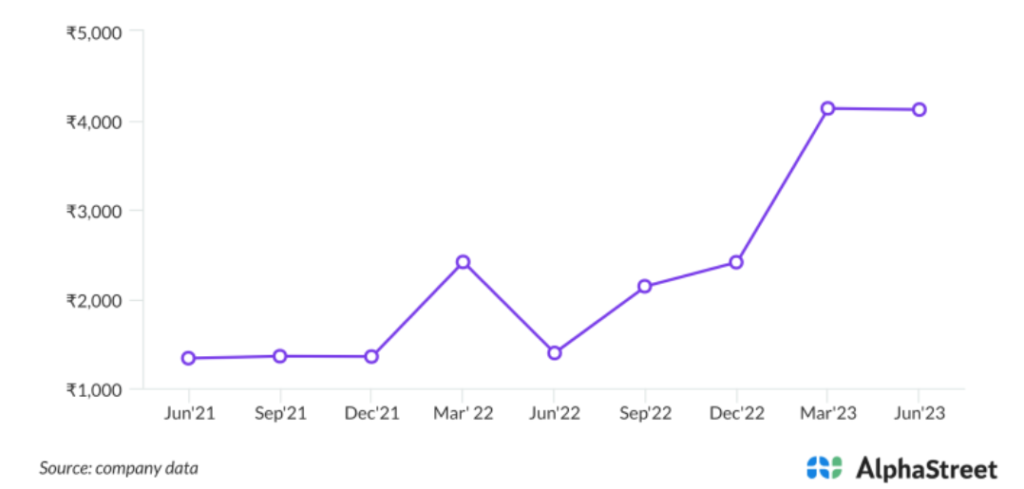

Total Revenue (in Cr) since June 2021

Welspun showed a decent increase of 8% between the 1st and 2nd quarters of FY22-23, which can be due to an increase in demand in domestic as well as foreign household consumption at the start of the financial year. However, the revenue plummeted in Q3 with a -10.89% decrease, which was due to rising input costs such as raw material cotton and polyester yarn, which makes it harder for them to push the costs forward to consumers, hence reducing their profit margins. Moreover, the falling value of the Rupee against the Dollar let to a shrinking of their profit margins by around 37 Cr. as well.

Welspun showed a decent increase of 8% between the 1st and 2nd quarters of FY22-23, which can be due to an increase in demand in domestic as well as foreign household consumption at the start of the financial year. However, the revenue plummeted in Q3 with a -10.89% decrease, which was due to rising input costs such as raw material cotton and polyester yarn, which makes it harder for them to push the costs forward to consumers, hence reducing their profit margins. Moreover, the falling value of the Rupee against the Dollar let to a shrinking of their profit margins by around 37 Cr. as well.

Welspun’s revenue growth rate has been increasing inconsistently since 2014. While the magnitude of increase experienced relative highs in 2019 and 2021 and relative lows 2016, 2020, and 2022. However, trends indicate that Welspun is seeing a massive increase in its revenue growth rate post 2022, with it being higher than any since 2014, at levels above 20%.

- Raymond Limited:-

One of the most well-known shirting cloth manufacturers in India, Raymond was first incorporated in 1925 as Raymond Woollen Mill by Abraham Jacob Raymond and Albert Raymond, which was later taken over by Lala Kailashpat Singhania in 1944. Since then, the company has been under the control of the Singhania family, and the latest ‘heir’, Gautam Singhania was recently embroiled in a divorce that saw his wife demand 75% of his 1.4 billion-dollar net worth (which led to quite a bit of turmoil in the company).

Raymond is well-known to be one of the leaders when it comes to making shirting materials, but that’s not all that they make. They also make ready-to-wear clothes and they also make woollen and worsted material clothing. They have a large chunk of real-estate land to their name and hence are a dominant power in that field as well.

Raymond shows a very interesting trend in quarterly revenue change, increasing at a very strong 25.12% between Q1 and Q2, but later only increasing by 0.13%. This can be attributed to the fact that a lot of companies/schools buy clothes from Raymond which usually happens at the star of the financial year, which could be a reason as to why they have a very high growth in revenue in the 1st quarter compared to the Diwali period.

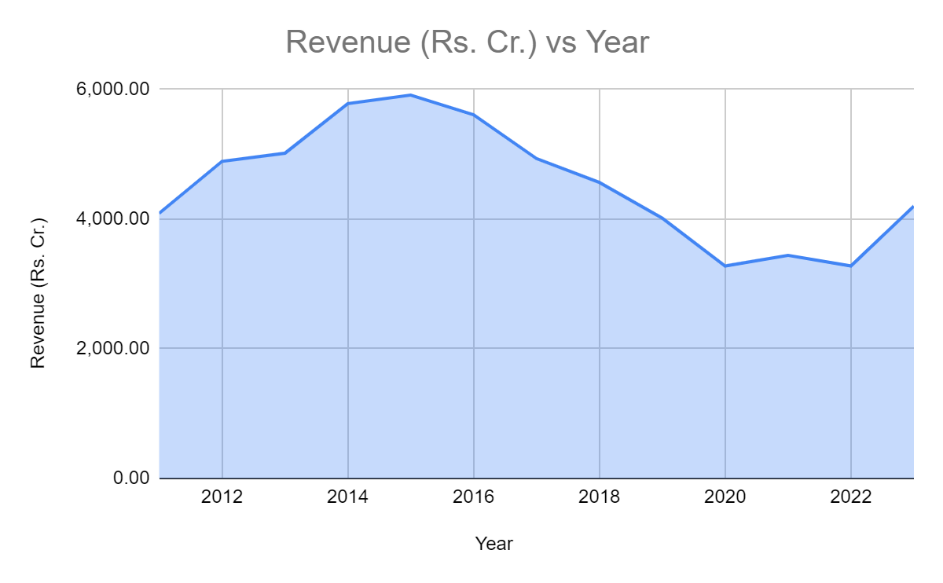

Total Revenue (in Cr.) vs. Year

From the chart, it is evident that Raymond’s revenue growth rate has been increasing at a relatively stable rate since 2018. While Diwali of 2016 saw a near 30% increase in revenue growth rate from the previous year, the following years could not replicate the same effect.

From the chart, it is evident that Raymond’s revenue growth rate has been increasing at a relatively stable rate since 2018. While Diwali of 2016 saw a near 30% increase in revenue growth rate from the previous year, the following years could not replicate the same effect.

Although the change in rate has since not reached 2016 levels, post 2018, the trend indicates that Raymond will see an increased revenue growth rate in upcoming years.

To conclude, we have taken a look at a very diverse range of textiles and garment manufacturers and distributors in this article, and we can safely say that not all follow the same pattern of growth as the others.

Some, like Raymond perform better during the start of the financial year, while others flourish during festivals when the need for traditional clothing increases a lot.

Irrespective of the case, the textile industry is going to play a very pivotal role in defining the overall growth of our nation over many years to come, and it is in our best interest to utilize it to the fullest to benefit everyone in society.

Nishad Govekar

Nishad Govekar is pursuing his graduation in Economics from Gokhale Institute of Politics and Economics. He has keen interest in share market.

Nice comparative study of India’s top textile top textile company. The solution to the agrarian problem is hidden in the provided solution as this sector can provide much needed employment to masses.

Analysis of top 10 textile companies are given in details with factual data and these companies are very much growth potentials.