81% or 100% of Debt-GDP ratio: What is the case of IMF Report on Indian Debts?

“IMF says India will face 100% Debt-GDP ratio and in 2023 it has reached to 81%!”

The Ministry of Finance, Government of India issued a clarification on IMF’s projection by calling it “misconstrued”. In a statement, the finance ministry said that several other countries are expected to perform worse than India on debt front.

What’s the matter? What are these percentages representing? Let’s explore and clarify the matter of great complexity in this article.

Although both 100% and 81% represent Debt-GDP ratio however, the context in which both projected by the IMF report are different.

Recently, International Monetary Fund (IMF) in its review claimed that with traditional financing sources, India’s public debt is expected to reach over 100% of GDP, especially if solely government investment participates upon investment on climate change adaptation.

Origin

Towards the eighteenth century, the borrowing needs of Indian Princely States were largely met by Indigenous bankers and financiers. The concept of borrowing from the public in India was pioneered by the East India Company to finance its campaigns in South India (the Anglo French wars) in the eighteenth century. The debt owed by the Government to the public, over time, came to be known as public debt.

The endeavours of the Company to establish government banks towards the end of the 18th Century owed in no small measure to the need to raise term and short term financial accommodation from banks on more satisfactory terms than they were able to garner on their own. The incentive to set up Government or Central banks, had a lot to do with debt management.

What is Government Debt-GDP Ratio?

The debt-to-GDP ratio indicates how likely the country can pay off its debt. Investors often look at the debt-to-GDP metric to assess the government’s ability to finance its debt. Higher debt-to-GDP ratios have fuelled economic crises worldwide.

For the same reason, it is often important to see the nature of government’s deficit. If the government is borrowing more for creating capital assets or on subsidies and other expenditure which doesn’t result in the creation of any asset. Capital spending by the government especially during a slowdown helps in crowding in private investment.

The debt taken by the present-day government is transferred to next generations increasing the inter-generational financial burden. Hence, as per the macroeconomic indicator Debt-GDP ratio should be balanced and maintained as per the economy’s strength and weaknesses.

What forms Government/Public Debt in India?

Public Debt denotes liabilities payable by the Central Government, which are contracted against the Consolidated Fund of India, as provided under Article 292 of the Constitution of India.

The Central Government Debt includes all liabilities of Central Government contracted against the Consolidated Fund of India (defined as Public Debt), other liabilities in the Public Account, (called Other Liabilities) and liabilities of Extra Budgetary Resources (EBR) raised by issuing GoI Fully Serviced Bonds.

Public debt is further classified into internal and external debt. Internal debt consists of marketable debt and non-marketable debt.

Marketable debt comprises of Government dated securities and Treasury Bills, issued through auctions. Non-marketable debt comprises of Intermediate Treasury Bills (14 days ITBs) issued to State Governments/UTs of Jammu & Kashmir and Puducherry as well as select Central Banks, special securities issued against small savings, special securities issued to public sector banks/EXIM Bank, securities issued to international financial institutions, and compensation and other bonds. Other liabilities include liabilities on account of State Provident Funds, Reserve Funds and Deposits, Other Accounts, etc.

Non-marketable securities include intermediate treasury bills issued to state government’s, special securities issued to national Small Savings Fund among others.

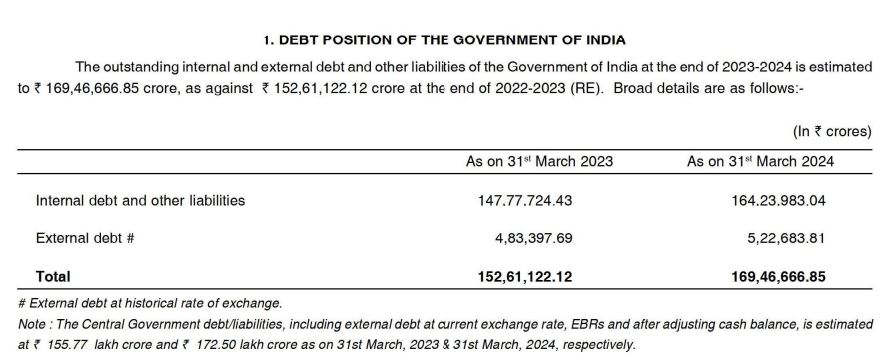

The central government’s debt stood at Rs 155.6 lakh crore or 57.1% of the GDP at the end of March 2023. As per the Budget 2023-24 documents, the internal and external debt of Government of India has predicted to increase this year.

The NK Singh Committee on Fiscal Responsibility and Budget Management (FRBM) had envisaged a debt-to-GDP ratio of 40% for the central government and 20% for states aiming for a total of 60% general government debt-to-GDP.

IMF Report says…

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

India’s economy showed robust growth over the past year. Headline inflation has, on average, moderated although it remains volatile. Employment has surpassed the pre pandemic level and, while the informal sector continues to dominate, formalization has progressed.

Growth is expected to remain strong, supported by macroeconomic and financial stability. Real GDP is projected to grow at 6.3% in FY 2023-24 and FY 2024-25. Headline inflation is expected to gradually decline to the target although it remains volatile due to food price shocks. The current account deficit is expected to improve to 1.8 percent of GDP in FY 2023-24 as a result of resilient services exports and, to a lesser extent, lower oil import costs. Going forward, the country’s foundational digital public infrastructure and a strong government infrastructure program will continue to sustain growth.

The current account deficit in FY 2022-23 widened as the post-pandemic recovery of domestic demand and transitory external shocks outweighed the impact of robust services exports and proactive diversification of critical oil imports. While the budget deficit has eased, public debt remains elevated and fiscal buffers need to be rebuilt.

While focusing upon climate change adaptation and climate change mitigation, given the size of India, huge amount of investment will be required than traditional government-supported investments.

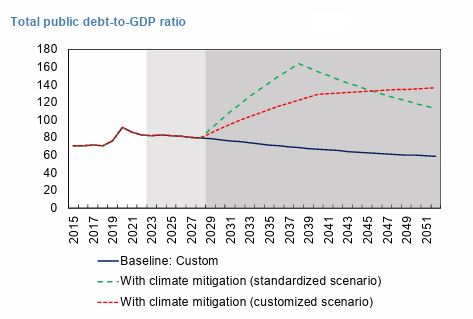

India’s investment needs to meet its climate change mitigation targets are sizeable, estimated at between 4%-8% of GDP per year. If these investments were funded using the same instruments that are used to finance the general government deficit, then debt could reach as high as 136% of GDP. This suggests that concessional sources of financing, greater private sector involvement and carbon pricing or equivalent mechanism are needed.

Further, the report projections suggest a steep increase in general Debt-GDP ratio of India.

The estimation of rise up to 82.3% in 2024 and 100% by 2028 has created a lot of confusion. However, they are two separate aspects in the report.

Government of India’s Stance

Among the various favourable and unfavourable scenarios given by the IMF, under one extreme possibility, like once-in-a-century COVID-19, it has been stated that the General Government’s debt could be “100% of debt to GDP ratio” under adverse shocks by FY 2028.

Similar IMF Reports for other countries show much higher extreme scenarios for them. The corresponding figures of ‘worst-case’ scenarios for the USA, UK and China are about 160%, 140%, and 200% respectively, which is far worse compared to 100% for India.

It is also noteworthy that the same report indicates that under favourable circumstances, the General Government Debt to GDP ratio may decline to below 70% per cent in the same period.

The General Government debt (including both State and Centre) has steeply declined from about 88% in FY 2020-21 to about 81% in 2022-23, and the Centre is on track to achieve its stated fiscal consolidation target (to reduce fiscal deficit below 4.5% of GDP by FY 2025-26). The States have also individually enacted their Fiscal Responsibility Legislation, which is monitored by their respective State Legislatures. Therefore, it is expected that the General Government debt will decline substantially in the medium to long term.

Conclusion

100% Government debt-GDP ratio mentioned in the IMF report is dedicated to investments for Climate Change: Adaptation and Mitigation if solely by the Government of India without involving private sector to it. It will be burdensome given India’s size and needs.

General Debt-GDP ratio announced for 2023 is 81% and according to its projections it is likely to increase to 82.3% in 2024. Although both 100% and 81% represent Debt-GDP ratio however, the context in which both projected by the IMF report are different.

So far, in past almost 20 years the Government of India is working persistently on maintaining and reducing Debt-GDP ratio in global volatile situations. As the world comes to new normalcy post-pandemic, the government can reduce its expenditure and with Goods and Services Tax (GST) expand its revenue base to manage and balance the governmental finances. Simultaneously, encouraging private players in the matter of energy security will positively reduce the chances of having 100% Debt-GDP ratio. Lastly, the situation will improve when equal level of attempts to follow the Fiscal Responsibility and Budget Management (FRBM) will by both Central and State Governments.

Vaibhavi Pingale

Ms. Vaibhavi Pingale is a Visiting Faculty of Economics at Gokhale Institute of Politics and Economics, Pune & at Savitribai Phule Pune University. She is pursuing her PhD. She has been actively writing media articles other than academic research.