Contribution to Economy: Speciality Steel Industry in India

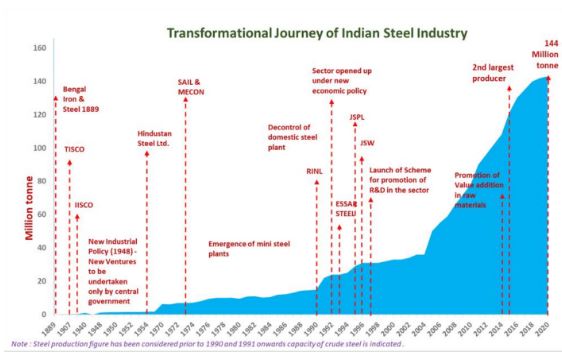

Since the Industrial Revolution in the 18th Century, steel has been an important ingredient for economic growth. Steel has uses in various sectors viz. infrastructure, automobile, manufacturing, construction, etc. and, thus, is an important factor driving India’s GDP growth. India’s journey in the production of Iron & Steel started way back in 1889 from Bengal Iron & Steel Company.

The growth in the Indian steel sector has been driven by domestic availability of raw materials such as iron ore and cost-effective labor. Consequently, the steel sector has been a major contributor to India’s manufacturing output.

In FY2020-21, India is the second largest producer and consumer of crude and finished steel. According to the World Steel Association, SAIL, Tata Steel and JSW Steel were in the top twenty-five steel producing companies in 2020. In 2021, India produced 96.9 million tonnes (MT) of crude steel, up 20.6% year-on-year.

Majority of the steel plants including integrated steel plants, are located in the Eastern or Purvanchal region of the country, states of Odisha, Chhattisgarh, Karnataka and Jharkhand and some parts of northern Andhra Pradesh. The plants on the western zone were mainly set up near the coastal area.

The steel industry has emerged as a major focus area given the dependence of a diverse range of sectors on its output. It nearly contributes 2% to the nation’s GDP.

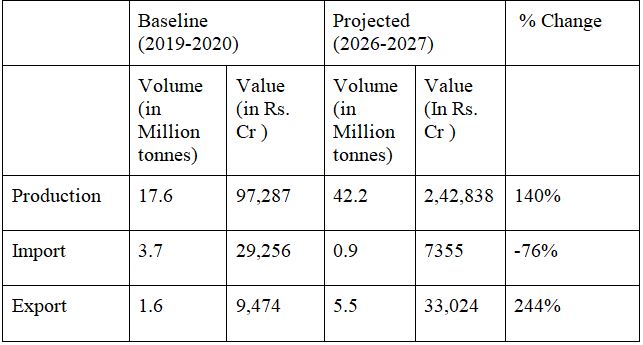

Under Production Incentive Linkage (PLI) scheme, production of Specialty Steel is being encouraged. Talking more about speciality steel, today, specialty steel accounts for about 18% of steel produced in India and can meet only 85% of domestic demand. The balance is met through imports. This Scheme aims to promote manufacturing of specialty steel in India through capital investment, employment generation and technology up gradation, thus, reducing dependence on imports in meeting the domestic demand. With the PLI being implemented the following projections and contributions are being estimated.

Projected production of the identified ‘specialty steel’ is expected to more than double by 2026-27, baseline production is 17 million tonnes, projected production is 42 million tonnes. Projected export (in volume) is expected to become more than three times the present volume, with reduction in imports (in volume) by four times.

Also, with the aforementioned projections of the steel industry, there is no short of the potential demand and growth and the steel market in India. A major internal driving force for domestic market expansion in steel demand is the country’s vast population, low per capita consumption of iron and steel and its GDP growth. India’s relatively young population and the trend of urbanization both tend to boost demand for housing, transportation, and public infrastructure, which translates into higher demand for steel.

- Indian Railways has proposed to spend INR 2 lakh crore a year till 2023-24 to upgrade infrastructure, providing opportunities for increased demand of rail steel. Further, Indian Railways’ plans of decongestion through multi-tracking, high speed projects and concentrated focus on 58 super critical projects which are expected to increase the steel demand at a massive scale. In addition, Dedicated Freight Corridor projects are expected to consume 17 MT of steel in the next 5 years (2020-25).This creates a huge demand for the Speciality steel which has been dealt in the PLI scheme. This incentivising and rise in production of speciality steel provides alternatives and acts as import substitution to control the outflow of forex.

- The opening of the mining sector and rapid investment in the infrastructure sector is expected to result in a growth in Capital Goods which consumes nearly 15 percent of the domestic steel produced.

- Under the Sagarmala Programme, mobilization of over US$58 Bn of infrastructure investment in ports and shipping is estimated to drive steel demand in the future.

- The Indian Army, Navy and Air Force along with DRDO and the Ordnance Factory have expressed the great potential for domestic fulfillment of special steel alloy requirements in the defense sector.

These projected super infrastructural projects by various ministries demand a huge amount of Special steel. Understanding the rising demand in the sector Speciality steel was incentivised to produce a gradual rise in the Speciality steel production by the domestic industries and become import independent.

Understanding the importance of the Steel Industry, the government has taken major steps to further enhance and empower the steel sector in India. A few of such steps are deregulation of the Steel Industry; removing it from the list of industries reserved for the public sector; exempting it from compulsory licensing; new Industrial policy 2017; and, allowing 100% FDI through automatic route.

The contribution of steel industry to the economic growth can be seen with an output multiplier effect. Investment in the steel industry leads to increase in Gross Domestic Product (GDP) by nearly 1.4x times and has the potential to generate employment by about 6.8x times. Steel sector has the potential of providing 20,00,000 jobs directly and indirectly in the country.

Aayush Patil

Aayush Patil is a Research Intern at Tatvita. Presently he is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.