Governance Structure: Textile Industry in India

Taking steps forward towards the vision of an ‘Aatmanirbhar Bharat’, the Government has approved the PLI Scheme for textiles for man-made fibers (MMF) and 10 segments of technical textiles with a budgetary outlay of Rs. 10,683 crore. Let us get a broad view on the necessities, incentives and other aspects of the PLI scheme for textiles.

The objective of the Production Linked Incentive (PLI) Scheme as per the scheme reports is:

The PLI Scheme is intended to promote production of MMF fabrics and technical textiles products in the country to enable the textile industry to achieve size and scale; to become globally competitive and a creator of employment opportunities for people. The scheme is to support creation of a viable enterprise and competitive textile industry.

Outline of the scheme

The PLI scheme for textiles is designed to be implemented in two parts –

- Scheme Part- 1:

- Any firm / company willing to invest a minimum ₹300 Crore in Plant, Machinery, Equipment and Civil Works (excluding land and administrative building cost) to produce products listed under PLI, shall be eligible to apply for participation in this part of the scheme.

- The applicant will form a separate company under Companies Act, 2013, before commencement of investment under this scheme and such a company under the scheme will be eligible to get incentive when they achieve a minimum of ₹600 Crore turnover by manufacturing and selling the products listed under this scheme.

- For getting incentive, both the conditions of minimum investment and minimum turnover should be met.

- Only such sales will be counted, which are transacted through normal banking channels.

- Scheme Part-2:

- Any firm / company willing to invest a minimum ₹100 Crore in Plant, Machinery, Equipment and Civil Works (excluding land and administrative building cost) to produce products listed under PLI lines, shall be eligible to apply for participation in this part of the scheme.

- The applicant will form a company registered under Companies Act, 2013, before commencement of investment and such a company under the scheme will be eligible to get incentive when they achieve a minimum of ₹ 200 Crore turnover by manufacturing and selling the products notified under this scheme.

- For getting incentives, both the conditions of minimum investment and minimum turnover should be met.

- Only such sales will be counted, which are transacted through normal banking channels.

Application procedures

- An Application shall be made through the on-line portal http://PLI.texmin.gov.in and in the format provided therein.

- The Applicant has to submit the Undertaking as prescribed.

- A non-refundable application processing fee Rs 50,000/- shall be paid electronically by the applicant.

- The Applicant and its group company should neither have been declared as bankrupt or defaulter or reported any fraud by any bank or financial institution or non-banking financial company or placed under black list/denied entity list by any state or central Government department/agencies.

Government Organizations involved

- Textile Ministry, Government of India

- Department for promotion of Industry and internal trade ( DPIIT )

- NITI Aayog

- Department of Commerce

- Department of Expenditure

- Department of Revenue

- Export Promotion Councils and Trade bodies

With the following Departments and Ministries involved to execute, and monitor the progress of the PLI, another body i.e. Empowered Group of Secretaries (EGoS) – Investment & Promotion, DPIIT will monitor the implementation of the scheme.The EGoS will monitor the progress of this PLI scheme; undertake periodic review of the outgo under the Scheme; ensure uniformity with other PLIs and take appropriate action to ensure that the expenditure is within the prescribed outlay.

The composition of the EGoS for monitoring of PLI for Textiles will be as under:

- Cabinet Secretary, Chairperson

- CEO, NITI Aayog, Member

- Secretary, Department for Promotion of Industry and Internal Trade, Member Convenor

- Secretary, Department of Commerce, Member

- Secretary, Department of Revenue, Member

- Secretary, Department of Economic Affairs, Member

- Secretary, Ministry of Textiles, Member

For examination of the application for selection, following grading system will be adopted by the Selection Committee:

- Financial Capacity of the Applicant – Based on Turnover and Reserves & Surplus in the balance sheet (50:50%)

- Relevant Experience & Technical Capacity of the Applicant – Based on Experience in MMF, Technical Textiles, Weaving/Processing/Garmenting etc and General Technical Capacity (50:50%)

- Location of the Manufacturing Activity. – Preference to Investment in Aspirational Districts and Category “C” cities, as Notified by Ministry of Housing & Urban Affairs

- Investment – As per specified in the Gazette Notification

- Additional Direct Employment in 1st Performance Year

Scheme Duration

The Scheme is in operation from 24.09.2021 (Date of Notification) to 31st March 2030 and the incentive under the Scheme will be payable for a period of 5 years only.

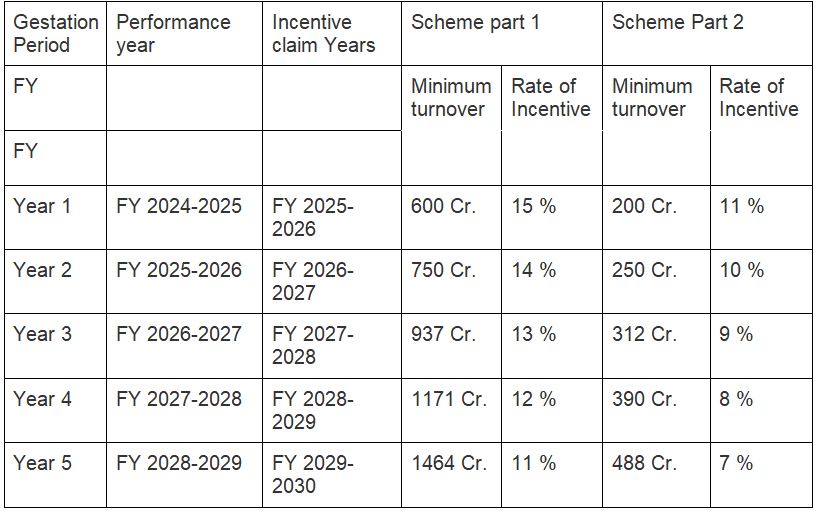

Framework of Implementation: The gestation period for both parts of the scheme will be of two (2) years i.e. FY: 2022-23 to FY: 2023-24. (Gestation Period: Means period allowed to the participating company for establishing the manufacturing and for commencement of production of listed Products by investing prescribed investment as declared in notification. Under current PLI scheme, FY 2022-23 to FY: 2023- 24 will be the gestation period for both parts).

Framework of the scheme

The Participant shall be eligible for the incentives on achieving threshold investment and threshold/incremental turnover.

The participating company shall be devoid of any incentive under this scheme if it fails to achieve the prescribed turnover or 25% increase in turnover over immediate preceding year’s turnover for that year. Such participants will get incentive only when they achieve both, i.e. the prescribed turnover target for the year and 25% increase in turnover over immediate preceding year’s turnover, in subsequent years for a reduced number of years.

Following table exhibits the prescribed turnover and rate of incentive required for receiving the incentive.

(Net Incremental Sales within cap of Notified Product(s) excluding taxes) * (Rate of Incentive in percentage for the Performance Year)

Formula for incentive calculation

Where, net incremental sales shall be turnover of the participant in the product(s) manufactured by the participant company minus the Turnover for products of the participant in the immediate preceding year during Scheme period.

The applicant shall submit a claim for disbursement of incentive on annual basis for the sales made in a performing financial year along with its audited financial statements.

General conditions

- The Applicant once selected shall form a new company under the Companies Act, 2013 before commencement of investment. This new company will be called “Participant” under the Scheme. The Applicant should have PAN/GST/DIN.

- There will be no restriction for making higher investment for enhancing manufacturing capabilities and achieving growth targets.

- Turnover achieved from trading and job work will not be accounted for incentives under the Scheme.

- Products manufactured by a company other than registered one, even of the same group, shall not be accounted for in the calculation of incremental turnover.

- The Participant, while dispatching products out of the factory, shall ensure to put “Made in India” tag on each product.

- All products manufactured by the participants shall be in conformity with applicable regulatory norms, quality standards and guidelines issued by the concerned authorities from time to time. The Ministry of Textiles may ask for quality reports from the internationally accredited laboratories and centers.

- A Risk Management System shall be put in place by the Ministry of textiles for inspection of participants as and when required. The teams will conduct inspections on a random basis.

Aayush Patil

Aayush Patil is a Research Intern at Tatvita. Presently he is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.