Introduction: Manufacturing Electronics & IT Hardware in India

India is the 17th largest supplier of builder hardware products and is on its way to fulfil the government ambition to become a global manufacturing hub of builder hardware products. India‘s IT and business services market is projected to reach US$ 19.93 billion by 2025.

In a meeting with the Minister for Electronics and Information Technology (MeitY), Ashwini Vaishnaw, IT hardware industry body MAIT discussed the way forward to achieve the electronics hardware manufacturing target of $300-billion by 2026. On the MAIT proposal for Electronic Hardware Repair, Refurbishment and Calibration services, the next sunrise sector opportunity for India.

The IT hardware market includes all physical components integral to computing. The total market values include client computing hardware (desktop PCs, notebook PCs, fixed phones and adaptors, scanners and imaging devices standalone printers, thin-clients and workstations), networking hardware (Ethernet hubs and switches, Ethernet routers, WAN CPE and termination equipment, WAN multi-service switches, WLAN access points, WLAN cards and WLAN switches and appliances), security hardware (content-filtering and anti-spam appliances, encryption/SSL accelerators, firewall and VPN gateways, smart card readers and smart cards), servers hardware (high-end servers, low-end servers and mid-range servers) and storage hardware (hard-disk drives, NAS filers and arrays, NAS gateways, SAN adaptors and connectors and SAN disk arrays).

NCO

National classification of occupation – Division 3 Technicians and Associate Professionals, specific code for Electronics Engineering Technician (3114).

Proactive States in Production in India

- India’s IT clusters are located in the states of Andhra Pradesh, Karnataka, Maharashtra, New Delhi, Tamil Nadu, and Telangana.

- India’s share in global electronics manufacturing and Hub state of Reputed IT/IT Products/Electricals is Noida (Uttar Pradesh)

- India’s IT industries and companies are majorly located in the southern regions such as Bangalore, Hyderabad, Chennai, Visakhapatnam, Trivandrum, Mysore, Mangalore, Kochi, etc. The country’s major information technology hubs are Mumbai, Pune, Delhi, etc.

- Noida facility ranked first among all Samsung subsidiaries in delivering the highest productivity for mobile phones, refrigerators, and LED televisions

Raw materials required

The Electronic/ Technical devices used by millions of people daily are made of many tiny electronic components and those components are made from a variety of raw materials. These raw materials have special characteristics, ranging from superior conductivity to unmatched insulating properties, that make them perfect for use in electronic components.

Metals – Copper is often used for its excellent conductivity and malleability (the ability to be shaped and mashed). Nckel, chromium, aluminum, lead, silver and tin are also used. These metals go into components such as resistors, capacitors and transducers.

Plastics and Other Petroleum-Based Materials – Plastics and other petroleum-based materials are used in electronic components mostly for their insulating and heat-resistant properties. Polystyrene, polyethylene terephthalate (PET) and polyvinylchlorate (PVC) are widely used in components such as capacitors and thermistors.

Minerals and Non-Metallic Materials – Silicon is considered a metalloid, or semimetal and is used in microchips and semiconductors. Other nonmetal or semimetal materials are antimony, bismuth, cobalt, fluorite, garnet, magnesium and talc.

Other Raw Materials includeElectronic components and Circuit board (PCB), Ceramics are used as insulators in a variety of electronic components, certain clays, glasses, calcium (in various forms), gold and carbon (in various forms are also often used.

Infrastructure required

- A traditional IT infrastructure is made up of the usual hardware and software components: facilities, data centers, servers, networking hardware desktop computers and enterprise application software solutions.

- A variety of metals, plastics, raw materials and chemicals are used by the electronics industry. Some of the more common metals include copper, lithium, tin, silver, gold, nickel, and aluminum.

- Manufacturers are particularly reliant on infrastructure to receive their raw materials and ship out their goods to clients in a timely manner. Deficiencies in transportation and energy infrastructure reduce productivity and create delays, driving up costs for manufacturers

- Chip shortage: The biggest hurdle for the electronic sector would be semiconductor supply shortage aggravated by Covid-19 and Russia’s invasion of Ukraine. India imports 100% of its semiconductors and achieving the targets proposed under PLI scheme could be a tedious task considering the worldwide chip shortage.

Challenges

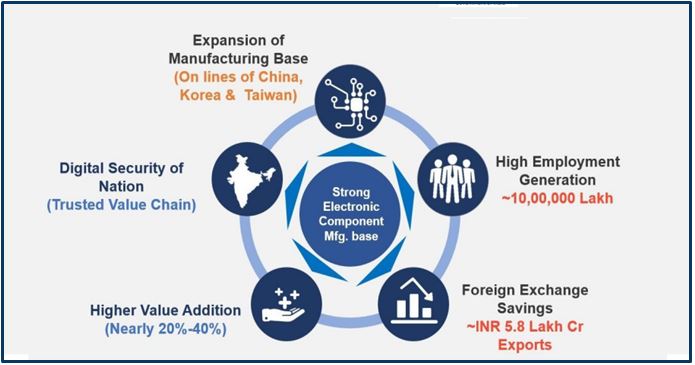

The IT Hardware manufacturing sector faces the lack of a level playing field vis-à-vis competing nations. As per industry estimates (Source: ICEA and ELCINA), electronics manufacturing sector suffers from a disability of around 8.5% to 11% on account of lack of adequate infrastructure, domestic supply chain and logistics; high cost of finance; inadequate availability of quality power; limited design capabilities and focus on R&D by the industry; and inadequacies in skill development. There is need for a mechanism to compensate for the manufacturing disabilities vis-à-vis other major manufacturing economies.

Government industrial policy

Implementation of the Schemes/ Programmes under the aegis of the National Policy on Electronics 2012 (NPE 2012) has successfully consolidated the foundations for a competitive Indian Electronics System Design & Manufacturing (ESDM) value chain. It is now proposed to build on that foundation to propel the growth of ESDM industry in the country. Besides the economic imperative, focus on electronics hardware manufacturing up to the integrated circuit or chip level is required due to the growing security concerns. However, the sector continues to face many challenges.

The Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) provide financial incentive of 25% on capital expenditure for the identified list of electronic goods that comprise downstream value chain of electronic products, i.e., electronic components, semiconductor/ display fabrication units, ATMP units, specialized sub-assemblies and capital goods for manufacture of aforesaid goods, all of which involve high value added manufacturing.

The National Policy on Electronics 2019 (NPE 2019), prepared after extensive stakeholder consultation, envisages to position India as a global hub for ESDM with thrust on exports by encouraging and driving capabilities in the country for developing core components, including chipsets, and creating an enabling environment for the industry to compete globally.

Governmental organization involved

- Software Technology Parks of India was set up in 1991 as an autonomous society under the Ministry of Electronics and Information Technology (MeitY). STPI’s main objective has been the promotion of software exports from the country. STPI acts as ‘single-window in providing services to the software exporters.

- Electronics & Computer Software Export Promotion Council (ESC) is India’s apex trade promotion organization mandated to promote India’s electronics, telecom, and IT export to global markets. With a wide array of memberships, the Council has been laying emphasis on facilitating the interaction of Indian SMEs with potential buyers in the global market. Starting in 1989, with an export performance of US$ 200 million, ESC has successfully steered India’s Electronics and Software Exports to US$ 126 billion during 2017-18. ESC has a membership of over 2000 Electronics and Software exporters. ESC Acts as a link between the Government and its members and provides a platform for interaction on policy issues.

- The National Association of Software and Service Companies (NASSCOM) is an Indian non-governmental trade association and advocacy group, focused mainly on the technology industry of India. Established in 1988, NASSCOM is a non-profit organitation. The NASSCOM Centre of Excellence for Data Science & Artificial Intelligence is an initiative with the Government of Karnataka to catalyze innovation and accelerate the AI and Data Sciences ecosystem in the country with focus on enablement and use case adoption. INDIAai is the National AI Portal of India. Over the years, NASSCOM has enabled several changes in key policies in India to support the growth of the industry. NASSCOM has built a symbiotic relationship with the Government of India on key issues relating to this sector, and we strive to be a Industry trusted partner in policy framing and review.

Production Linked Incentive (PLI) Scheme

The Production-Linked Incentive (PLI) Scheme for IT Hardware aims to boost India’s manufacturing capacity for laptops, tablets, all-in-one PCs, and servers, as well as attract greater foreign investment. Foreign investors with a registered company in India are eligible to participate under this scheme. The Target Segment under PLI for IT Hardware includes Laptops, Tablets, All-in-One PCs, and Servers.

- The total budget outlay approved by the union cabinet for PLI scheme for IT Hardware scheme is INR 7350 Crore.

- Includes Electronic/Technology Products and Large Scale Electronics Manufacturing for Product Linked Incentive (PLI) Schemes.

- The Scheme shall extend an incentive of 4% to 2% / 1% on net incremental sales (over base year) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four (4) years.

- PLI scheme has been a huge success in terms of the applications received from global as well as domestic manufacturing companies.

- Incentives are applicable under the Scheme from 01.04.2021 and 14 companies have been approved under the PLI Scheme for IT Hardware.

- 14 companies, including Dell, Lava, Dixon, Wistron and Foxconn etc and under the category of domestic companies, proposals from 10 firms have been approved.

- The scheme proposes production linked incentives to boost domestic manufacturing and attract large investments in the value chain of these IT Hardware ,Electronics and software products

Scheme Outcomes

Kaushal Sharma

Kaushal Sharma is a Research Intern at Tatvita-Analysts. He is pursuing Masters in Economics from Symbiosis College.