Governance Structure: Manufacturing Medical Devices in India

The Medical Devices sector is deemed to be a sunrise sector in India. For the sector to grow and become a manufacturing hub in the global market, government interventions are required. In this article, we shall explore the government’s industrial policy related to the sector. Moreover, we shall also explore the Production-Linked Incentive Scheme in detail.

Government’s Industrial Policy

Several initiatives have been taken by the government to help boost manufacturing of medical devices in India. These initiatives are discussed below.

The National Biopharma Mission, 2017 was launched with the aim of making India a hub for design and development of biopharmaceutical products and solutions. The Mission aids in enhancing India’s innovation research and product development capabilities, especially by focusing on development of vaccines, biologics, and medical devices. Under this Mission, an outlay of Rs. 148.79 crore is meant for establishment of infrastructure and facilities for manufacturing and testing of medical devices.

The Scheme for “Promotion of Medical Device Parks” was launched in 2021 with the aim of creating state-of-the-art infrastructure facilities for increased competitiveness. Under the scheme, a Common Infrastructure Facilities will provide easy access to standard testing and infrastructure facilities. The Parks to be developed under the scheme will provide common infrastructure facilities, like component testing centre, radiation testing centre and warehousing, at one place thereby creating a robust ecosystem for the medical device manufacturing and reducing manufacturing costs significantly. The total financial outlay of the scheme is Rs. 400 crores. It was recently announced that the government has approved Rs. 100 crores under the scheme to construct medical device parks in the States of Uttar Pradesh, Tamil Nadu, Madhya Pradesh, and Himachal Pradesh.

In September 2022, the government set up the Medical Devices Exports Promotion Council, which will help bring in coordinated inter-ministerial policy measures for unleashing the huge export and investment potential of over Rs. 80,000 crores for manufacturing medical devices.

To facilitate growth and development of Pharmaceutical and Medical Device Sectors through study/survey reports, awareness programs, creation of database, and promotion on industry, the government has launched the Pharmaceutical & Medical Devices Promotion and Development Scheme (PMPDS) this year, a sub-scheme under the Scheme for “Strengthening of Pharmaceuticals Industry.”

Additionally, a National Medical Devices Policy is also in the works. The aim is to make medical devices one of the champion sectors and boost India’s share of the global medical devices industry.

Production-Linked Incentive (PLI) Scheme

The PLI Scheme was launched by the Government of India in 2020 to give a boost to the manufacturing sector in India. The PLI Scheme for Promotion of Manufacturing of Medical Devices was announced in March 2020.

The objective of the scheme is to provide financial incentives to boost domestic manufacturing and attract large investments in the sector.

The scheme also aims to develop capacities in the local supply chain, introduce new downstream operations, and incentivize investments into high-tech production. The tenure of the scheme is from FY 2020-21 to FY 2027-28.

The scheme is applicable to four key target segments, as mentioned below:

- Cancer care / Radiotherapy medical devices

- Radiology & Imaging medical devices and Nuclear imaging devices

- Anaesthetics & Cardio-Respiratory medical devices including catheters of cardiorespiratory category & renal care medical devices.

- All implants including implantable electronic devices.

As per the latest guidelines, there are two categories of applicants, Category A and Category B. There are minute differences in the products under the target segments for each category. Products under Category A can be found under Annexure 1, while products under Category B can be found in Annexure 1A of the guidelines.

Government Organisations Involved

For monitoring and implementation of the scheme, there exist two governmental organisations, namely the Department of Pharmaceuticals and Industrial Finance Corporation of India Limited.

The Department of Pharmaceuticals (DoP) was entrusted with the responsibility of overlooking the implementation of the PLI Scheme for Medical Devices. In general, the Department is responsible for policy, planning, development, and regulation of Pharmaceuticals Industries. Specific to medical devices, the Department deals with issues related to promotion, production, and manufacture of medical devices.

The Industrial Finance Corporation of India Limited (IFCI Ltd.) is the Nodal Agency. This nodal agency acts as a Project Management Agency for the scheme’s implementation. The IFCI Ltd. is a non-banking finance company in the public sector, which provides financial support for the diversified growth of industries across the spectrum such as telecom, power, real estate, manufacturing, services sector, and other allied industries.

There are regulatory bodies for medical devices. These are the Project Management Agency, Empowered Committee, and the Technical Committee. The scheme has been designed in such a manner for easy facilitation and implementation.

The Project Management Agency (PMA) is a financial institution or any other authority, appointed by the DoP to act on its behalf for receipt and appraisal of applications, verification of eligibility and examination of disbursement claims. It is responsible for implementation of the scheme. It is also responsible for providing secretarial, managerial and implementation support and carrying out other responsibilities as assigned by the DoP.

The Empowered Committee (EC) is responsible for timely consideration of applications and disbursement claims and conducts periodic reviews of the scheme.

The Technical Committee (TC) was constituted by the DoP to examine and give recommendations on any technical issues related to the scheme referred by the PMA or the EC.

Eligibility Criteria

According to the revised guidelines released by the DoP, under the scheme, for applicants to be eligible for selection and incentives, following criteria must be met:

- Eligibility for Selection:

- The project shall be a greenfield project. A greenfield project is a project wherein committed investment is proposed to be made by the applicant under this Scheme in a new production facility or in a new plant in the premises of an existing production facility.

- Only companies and Limited Liability Partnerships registered in India and having Net Worth (of applicants including that of Group of Companies) not less than 30% of the committed investment for Category A applicants and positive Net Worth for Category B applicants as on the date of application. The applicant not meeting the said Net Worth criteria shall not be eligible.

- The applicant should not have been declared as bankrupt or wilful defaulter or reported as fraud by any bank or financial institution or non-banking financial company.

- Eligibility for Incentives:

- Eligibility shall be subject to committed investment and incremental sales of manufactured goods over the Base Year (FY 2019-20).

- An applicant under Category A and Category B must meet the criteria of committed investment and minimum threshold sales for the year under consideration to be eligible for disbursement of incentive for that year.

- In case an applicant does not meet criteria of committed investment and minimum threshold sales for any given year, the applicant shall not be eligible for disbursement of incentive for that particular year. However, the applicant will not be restricted from claiming incentive for subsequent years during the tenure of the Scheme, provided eligibility criteria of committed investment and minimum threshold sales are met for such subsequent years.

- For determining eligibility of an applicant under the Scheme, to meet the criteria of Committed Investment for any year, the cumulative value of investment done till such year (including the year under consideration) over the Base Year shall be considered.

- Eligibility under the Scheme shall not affect eligibility under any other scheme and vice versa.

Receiving Benefits

To receive benefits under the scheme, three main steps are to be followed:

Step 1 – Application Process

- Applicants must visit the online portal dedicated for filing and submission of applications under the scheme. The PMA maintains the portal.

- The PMA will conduct a prima facie examination to verify the facts mentioned in the application.

- After the prima facie examination, a Letter of Acknowledgement will be issued within 15 working days.

- The Empowered Committee and PMA will finalise applications within 60 days from the date of closure of application window.

- Based on the decision of the Empowered Committee, the PMA will issue a Letter of Approval within 5 working days.

Step 2 – Acceptance of Approval

- Within two weeks of receiving approval, the applicant must provide a bank guarantee along with undertaking bank guarantee. These guarantees are to be made in the format prescribed in Annexure 9 of the Guidelines.

- Bank Guarantee amount is to be equivalent to 1% of the threshold of the investment for Year 1 and is to be provided in favour of the DoP.

- The Guarantee should be valid for 365 days and will be rolled over till the investment for the first year is made.

Step 3 – Disbursement Process

- An applicant shall file a claim within 9 months from the end of the financial year to which the claim pertains.

- The PMA shall process claims for disbursement of incentive within 60 days from the date of submission of claim and make appropriate recommendations to the EC. The EC will consider and approve claims for disbursement of incentive.

- The PMA shall disburse funds after completion of all pre-disbursal formalities by the applicant and approval from the EC.

Incentives under the scheme

Incentives refer to the financial benefit to be provided to each selected applicant based on incremental sales of manufactured goods in the Base Year over the corresponding year.

Incremental sales are calculated as Sales of manufactured goods over a given period minus the Sales of manufactured goods in the Base Year over the corresponding period.

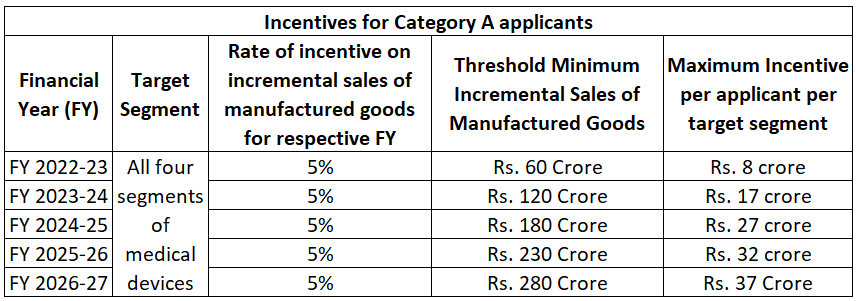

The following figures give an insight into incentive distribution under the scheme for each category of applicants.

The total maximum incentive for each beneficiary under Category A is Rs. 121 crores.

For Category B beneficiaries, from FY 2023-24 onwards, the threshold sales are computed at 10% growth over the minimum threshold incremental sale required in the previous financial year. Moreover, for this category, the total maximum incentive for each beneficiary is Rs. 40 crores.

The rate of incentive for both categories is 5%. It is interesting to note the minimum incremental sales required for each category. Perhaps the differentiation exists due to the nature of products manufactured under each segment in the two categories.

With the government interventions mentioned above, along with the PLI Scheme for medical devices, the sector can truly scale itself to become competitive in the global market.

Purvi Patil

Ms. Purvi Patil is a Research Assistant at Tatvita. She has pursued her graduation from the Liberal Arts Department of Savitribai Phule Pune University. Her areas of interest include International Relations, Data Protection and Privacy, and Sustainability.