Financial Aspect: Manufacturing Drone & its Components in India

Drone Industry is expected to grow to over Rs. 900 crore in FY 2023-24. The Drone Manufacturing Industry is expected to generate over 10,000 direct jobs. Here are some of the key features related to the finances of drone and drone components.

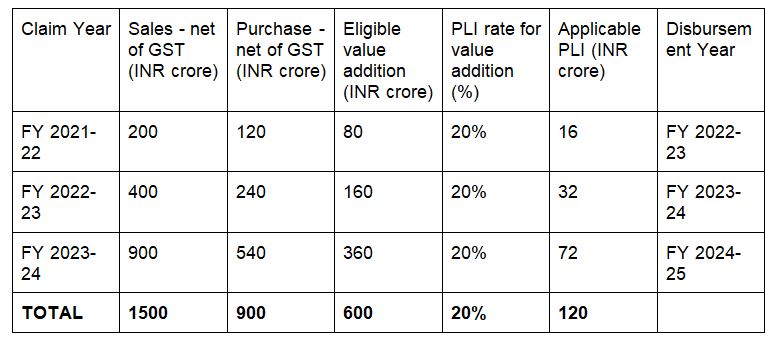

There are multiple features of the schemes such as incentives of Rs. 120 crore are to be given in the next three years under the PLI scheme for drone and drone components: Civil Aviation Minister Shri Jyotiraditya M. Scindia; the incentive for a manufacturer of drones and drone components shall be as high as 20 % of the value addition made by the firm; the value addition shall be calculated as the annual sales revenue from drones and drone components (net of GST) minus the purchase cost (net of GST) of drone and drone components; the government has agreed to keep the PLI rate constant at 20 % for all three years, an exceptional treatment given only to the drone industry.

In PLI Schemes for other sectors, the PLI rate reduces every year; the proposed tenure of the PLI Scheme is three years, starting in FY 2021-22; the government has agreed to fix the minimum value addition norm at 40 % of net sales for drones and drone components instead of 50 %, another exceptional treatment given to the drone industry; PLI for manufacturers must not exceed 25% of total annual expenditures. The number of recipients can be increased as a result.

- The PLI scheme covers a wide variety of drone components:

- Airframe, propulsion systems(engine and electric), power systems, batteries and associated components, launch and recovery systems;

- Inertial Measurement Unit, Inertial Navigation System, flight control module, ground control station and associated components;

- Communications systems (radio frequency, transponders, satellite-based etc.)

- Cameras, sensors, spraying systems and related payload etc.;

- ‘Detect and Avoid’ system, emergency recovery system, trackers etc. and other components critical for safety and security.

Incentives

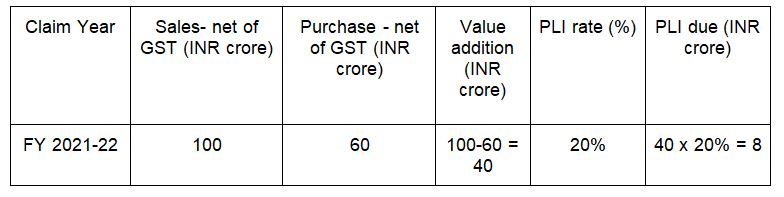

A drone and drone component maker will only receive one-fifth of the value addition as an incentive. The PLI calculation for a manufacturer was presented using the example below:

A manufacturer’s PLI will be limited to 25% of the total annual expenditure. Manufacturers who fall short of the required amount of qualified value addition for a given fiscal year may still be eligible to receive the lost incentive if they make up the difference in the next year.

Domestic investments

The government has maintained the minimum sales thresholds for Indian MSMEs and start-ups at INR 20 million (for drones) and INR 5 million, respectively (for drone components). The number of recipients is widened and made more flexible as a result.

Industry outlook and challenges

The annual sales turnover of the drone manufacturing industry is expected to grow multifold from INR 600 million in 2020-21 to over INR 9 billion in FY 2023-24. During this period, the drone manufacturing industry is expected to generate over 10,000 direct jobs. The PLI Scheme will have an effect on the size of the drone services sector as well (operations, logistics, data processing, traffic management, etc.). In total, it is anticipated that the drone services sector will increase to over INR 300 billion over the next three years and create over 500,000 jobs. “The government estimates that the drones and drone components manufacturing industry will attract investments over INR 50 billion over the next three years.” In addition to the flexible criteria used to select target beneficiaries, the government has said that the PLI Scheme may be expanded or revised after being evaluated and discussed with the sector.

Even while the sales turnover has increased and there are more start-ups now than ever before, the drone sector still lags behind advanced economies. The number of drone start-ups in India has increased slightly from 157 in August 2021 to 211 in March 2022 (statistics from Tracxn), but it still falls far short of the 970 in the US. Averaging US$5.6 million per start-up in 2022, funding for drone startups has only slightly increased from US$5.1 million in 2021.

In order to resolve barriers preventing the sector’s expansion, the Federation of Indian Chambers of Commerce and Industry (FICCI) is now requesting the federal government to form an inter-ministerial committee on drones. According to Money Control, “Issues include gaining licence for operating drone flights, exporting and demonstrating drones abroad, indigenous component manufacturing, and so on.”

A recent move by the government in this regard is the ban on the import of drones. The Directorate General of Foreign Trade (DGFT) issued an order on 9th February to prohibit the import of drones in Completely-Built-Up (CBU), Semi-Knocked-down (SKD) and Completely-Knocked-down (CKD) forms with immediate effect. The only exceptions of drones that will be authorised to be imported would include those imported by government entities, educational institutions recognised by the federal or state governments, government-recognized R&D firms, and drone manufacturers for research and development as well as defence and security objectives. While the import of finished drones has been banned, the import of drone components has been made free. This essentially means that domestic or local manufacturers would not need an approval from the DGFT to import parts like chips, ion batteries etc.

This landmark step has come days after the Union Budget 2022-23, which highlighted “Drone Shakti” and “Drone-As-A-Service” as major commitments of the government’s efforts towards “Make in India” and “Atmanirbhar Bharat”. Further, with the government’s increased emphasis on the use of “Kisan Drones” for crop inspection, digitisation of land records, spraying of insecticides, etc. the demand for drones will witness a sharp increase.

Ananya Khar

Ananya Khar is a Research Intern at Tatvita. Presently she is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.