Financial Aspect: Renewable (Solar) Energy Sector in India

India’s energy demands are expected to become the world’s highest in the coming years, of which a large portion will be fulfilled by renewable energy sources. India’s installed renewable energy capacity in the last 8.5 years has increased 396%. Renewable energy generation has special infrastructural requirements depending on the source, and renewable energy generation facilities currently have a high cost of setting up.

Solar energy production will have the largest share of renewable energy generation by 2030, with around 60% of the total renewable energy output, up from the current figure of around 30%. In the previous years, solar cell and module manufacturing in India has been heavily dependent on imports, and prices and production costs have been affected by global supply chain issues and raw material prices. India has amped up its domestic solar production capacity, including raw material production, for which the PLI scheme has been hugely supportive.

To make this possible, and to drive production costs down and develop a robust domestic supply chain in this industry, significant financial resources will be needed. This is also a great opportunity for the country and domestic and foreign investors. India ranked 3rd in the EY Renewable Energy Country Attractive Index 2021. On the same index, India ranked 1st globally under Solar PV technology. To ensure that solar and other renewable energy has a significant share in the fulfilment of India’s massive energy demand in the coming years, the government and domestic as well as foreign investors have begun to make significant strides with their investments.

Cost of Production

The cost of production of solar PV modules depends on multiple factors. Cost and availability of raw material and hardware such as silicon, solar glass, etc. is one of the biggest cost drivers. Global supply chain issues may also affect this, especially since import dependency on countries including China is still high.

It also varies according to the type and size of the solar module. Other factors are the efficiency of the manufacturing process, level of competition in the market, and availability of skilled labour.

However, labour cost in the manufacturing process may have a very small share usually in this industry, since there is a high level of automation. It also depends on the country of production. Countries that have a robust domestic supply chain and domestic production of raw materials (eg. China), along with low labour costs, tend to have lower costs of production than other countries.

The cost of setting up solar power generation projects also includes installation costs, other infrastructural costs, transportation, labour, etc. Exact and accurate production cost data of solar cell and module manufacturing in India may not be available, since most of it is proprietary data owned by companies.

An analysis by Center for Study of Science, Technology and Policy (CSTEP) estimates the cost of production of solar modules to be Rs. 20.94/Wp (watt peak), of which Balance of Module components including the solar cell have the biggest share. The analysis estimates the solar cell manufacturing costs to be Rs. 14.96/Wp (watt peak), of which 80% is attributed to raw material costs including imported wafer. The estimates and detailed breakdown can be found in the CSTEP report.

Foreign Investment

The renewable energy sector in India has become attractive for investors due to the high expected demand and other favourable economic factors, as well as support from the Government of India. The government has allowed up to 100% FDI in the renewable energy industry under the automatic route, with no prior approval from the government or RBI required, subject to all applicable laws and regulations.

Up to 100% FDI is allowed under the automatic route also for renewable energy generation and distribution projects, subject to provisions under The Electricity Act, 2003. According to data by the Department for Promotion of Industry and Internal Trade (DPIIT), FDI inflow in the non-conventional energy sector in India between April 2000 and September 2022 was US$ 13.03 billion, which accounted for around 2.19% of the total FDI inflow in India during this time period.

Government schemes that have supported FDI in this industry include the Make in India initiative, and the Solar PV and Solar Water Heating Systems/Components Manufacturing Scheme (SPVSWHS) by the Solar Energy Corporation of India (SECI), providing financial support to manufacturers of solar energy components and systems that increase production capacity, as part of the National Solar Mission.

FDI activities by private companies in the renewable energy sector include:

- In August 2022, Norfund, (who manage the Norwegian Climate Investment Fund), and KLP (Norway’s biggest pension company), signed an agreement to buy a 49% stake in a 420 MW solar power plant in Rajasthan for Rs. 2.8 billion (US$ 35.05 million).

- In August 2021, Copenhagen Infrastructure Partners (CIP) signed an investment agreement with Amp Energy India Private Limited to facilitate joint equity investments of US$ 200 million across Indian renewable energy projects.

- Danish wind energy company Vestas has been in India since 1997 and has developed multiple wind energy projects in India, including a Rs.500 crore blade manufacturing facility.

The industry has also had significant domestic investment both by Indian manufacturers and companies and through government initiatives. Some domestic investment activities by Indian companies include:

- In June 2022, Ayana (Ayana Renewable Power Pvt Ltd.) announced plans to invest Rs. 12,000 crore (US$ 1.53 billion) for setting up renewable energy projects totaling 2 gigawatts (GWs) in Karnataka.

- In December 2021, Tata Power, which is India’s largest energy provider, was awarded a contract to set up a 300 MW wind-solar hybrid power plant, by the Maharashtra State Electricity Distribution Company Limited.

- In October 2021, Reliance New Energy Solar Ltd. announced two acquisitions – REC Solar Holdings AS (REC Group), a Norway-based firm, and Sterling & Wilson Solar, based in India – exceeding US$ 1 billion. Both are expected to contribute to Reliance’s target of achieving a 100 GW capacity of solar energy at Jamnagar by 2030.

- In October 2021, Adani Green Energy Ltd. acquired SB Energy India for US$ 3.5 billion.

The government has also invested in the development of the industry through public sector undertakings and other initiatives like schemes and programs. Some of these include:

- The allocation for the Solar Energy Corporation of India (SECI) in the Union Budget 2022-23 stood at Rs. 1,000 crores. The SECI was dedicated towards the solar sector, but its scope was widened and currently covers the development of the entire renewable energy sector in India.

- The Government of India has spent US$ 4.63 billion between 2018-21 on hydroelectric projects to provide electricity to villages in Jammu and Kashmir.

- In July 2022, the NTPC commissioned India’s largest floating solar power project at Ramagundam, Telangana, with a total installed capacity of 100 MW which is fully operational.

India also has the world’s largest solar power plant at Bhadla with a total installed capacity of 2,245 MW, and a total investment of around Rs.10,000 crore. It houses projects by various domestic companies, the NTPC, as well as foreign companies including Softbank Energy.

The Gujarat Hybrid Renewable Energy Park is under construction near Kutch, Gujarat. It is expected to generate 30GW of energy in the form of solar and wind energy, and will possibly be the largest renewable energy project in the world upon completion. It is expected to attract huge investment estimated figures include $19 billion) and create several thousands of jobs.

The industry has also received loan assistance. One example is: In February 2022, Husk Power Systems, which is working towards rural electrification, secured a US$ 4.2 million loan from the Indian Renewable Energy Development Agency (IREDA).

An elaborate list of investments and government investment support can be found on IBEF’s webpage on the renewable energy industry in India.

In the renewable energy industry, the solar energy sector has been one of the major sectors for investments. India was the second largest market in Asia for new solar PV capacity and third globally in 2021. The installed solar energy capacity has increased over 18 times in the last 8 years. The contribution of solar energy is expected to have the largest share in the total renewable energy generation in India towards the end of the decade. This will require huge investments, including for setting up a robust domestic supply chain and manufacturing capacity. The Production Linked Incentive scheme is a major step towards this.

The PLI scheme under the National programme on High Efficiency Solar PV Modules has a total outlay of Rs. 24,000 crore and aims to promote manufacturing of high efficiency solar PV modules and thus also reduce import dependencies. It aims to develop a domestic manufacturing ecosystem in this sector.

The incentives will be disbursed to manufacturers for a period of 5 years. It is estimated that 65 GW per annum manufacturing capacity of solar PV modules will be installed. The import substitution will be approximately Rs. 1.37 lakh crore. It will also give impetus to research and development activities in this sector, which may lead to more efficiency in the products and in manufacturing. It is estimated to generate direct employment of around 1.95 lakh people and indirect employment of around 7.8 lakh people. The scheme will bring direct investments of Rs. 96,000 crore.

India aims to be a net-zero carbon emission economy by 2070 and is targeting around 450 GW of installed renewable energy capacity by 2030. According to a World Economic Forum report, India’s transition to a net-zero economy will have an estimated economic impact of US$ 1 trillion by 2030 and of US$ 15 trillion by 2070 along with the creation of 50 million net new jobs. This makes it a huge investment opportunity.

In March 2022, the Parliamentary Standing Committee on Energy estimated that the Indian renewable energy sector would need an annual investment of US$ 19.72-26.29 billion until 2030 for achieving its targets. According to the committee, currently there is a gap between the investments required and actual investments which will need to be bridged, for which it recommended certain measures to the Ministry of Renewable Energy.

The PLI scheme will be a major step for India towards increasing the investment in this industry and towards achieving the renewable energy goals, for which the solar energy sector will play a major role.

Analysis of Renewable Energy Company Stock Prices with respect to Solar PLI Scheme Announcements

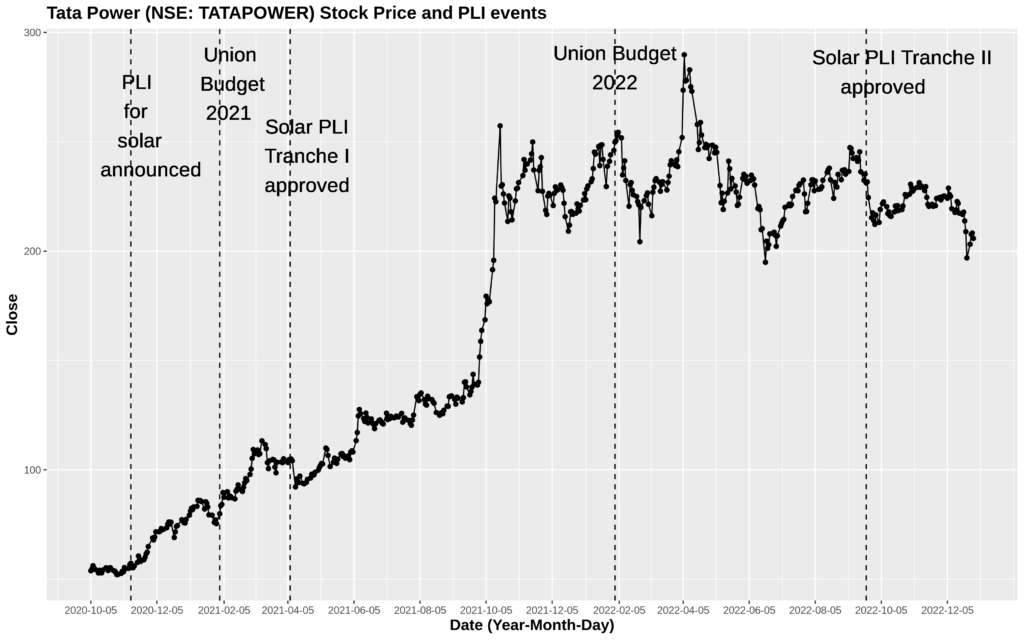

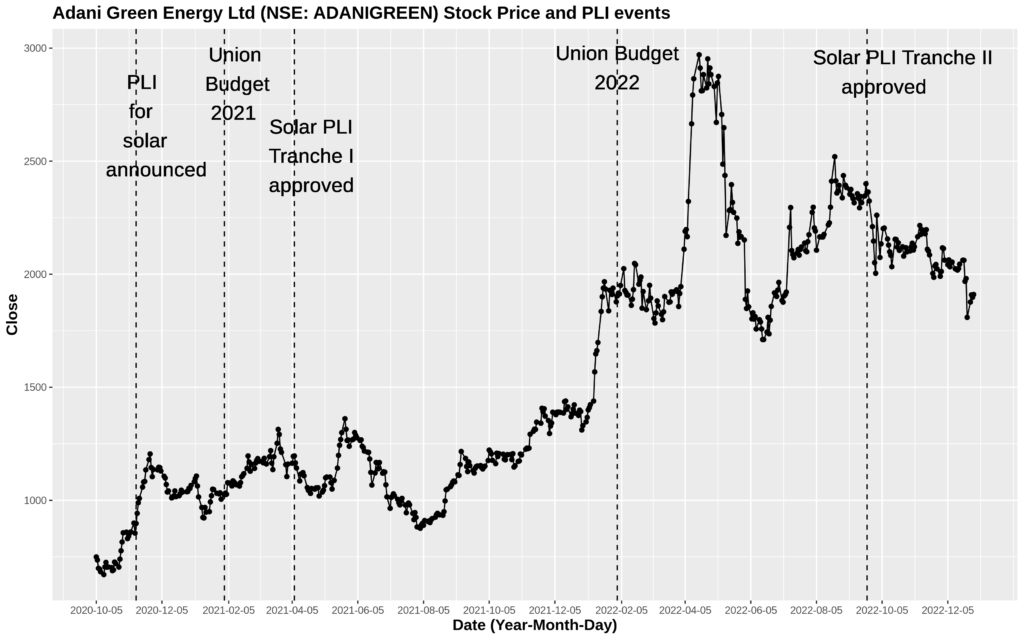

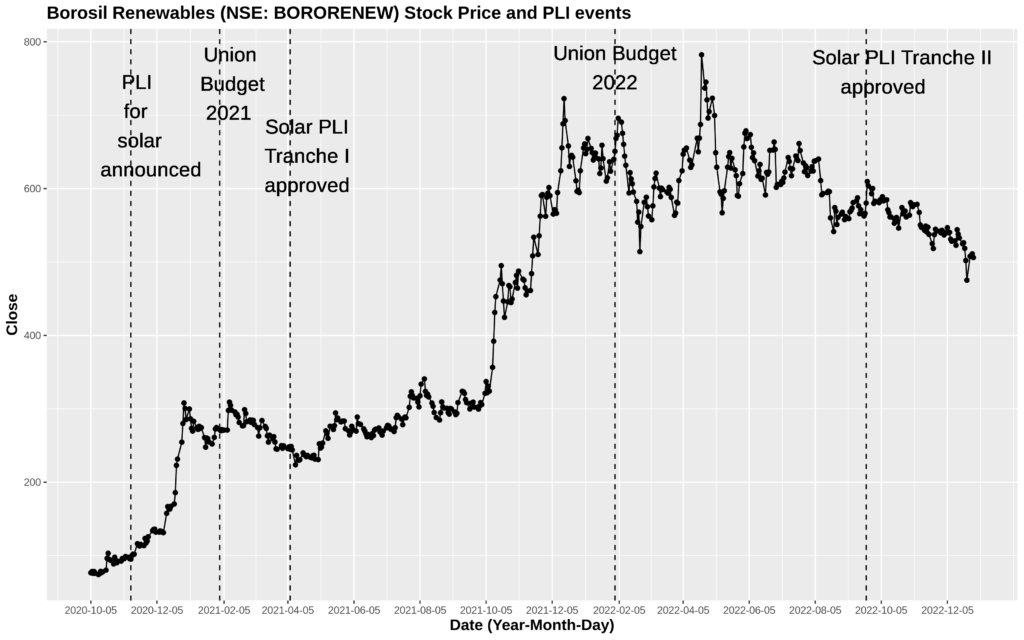

The stock market is an important part of the financial aspect of any industry, especially for most categories of investors as well as the companies themselves. The PLI schemes for the solar sector may have been an important factor in the stock price trends of various renewable energy companies in India. This analysis compares the average stock prices for a fixed period before and after the announcement of the PLI scheme, of three major enterprises involved in the renewable energy industry in India: Tata Power, Adani Green Energy Ltd, and Borosil Renewables. Announcements include the initial PLI scheme announcement for this sector, the Union Budgets in which the scheme outlay was allocated for both Tranches, and the approval dates for both Tranches.

The stock price trends depend on a large number of factors, and the aim of this analysis is not to identify the exact effect or association between the PLI scheme announcements and stock prices of companies. Hence, any percentage differences may not be attributed to PLI scheme announcements.

Tata Power

Tata Power Company Limited is an Indian electric utility company. Tata Power has a portfolio of 2,688 MW of solar power generation capacity. It has commissioned solar projects of 300MW and 160MW in Gujarat and Rajasthan respectively, and has planned a bulk capital expenditure of Rs. 75,000 crore for scaling up renewable’s overall portfolio. Tata Power’s solar energy arm was one of the bidders for Tranche I of the PLI scheme for this industry.

- The difference between the average share price of Tata Solar 90 days before the initial PLI announcement, compared to 90 days after the announcement was 61.84%. The 30-day difference for the same was 34.69%.

- For the Union Budget 2021 Announcement, the 30-day interval difference was 29.7%. In a 60-day interval before and after, the difference was 46.62%.

- For the PLI Tranche I approval, the 30-day interval average difference was -4.02%.

- For the Union Budget 2022 announcement, the 30-day interval difference was negligible, at 0.13%. In a 60-day interval before and after, the difference was 11.14%.

- For the Tranche II approval announcement, the 30-day before and after period had a price difference of -5.55%.

Adani Green Energy Ltd

Adani Green Energy is an Indian renewable energy company. It is one of the largest renewable energy companies in India with a total project portfolio of 20,434 MW. It operates one of the largest solar photovoltaic plants in the world, with a capacity of 648 MW, at Kamuthi in Tamil Nadu. Adani Green Energy is the renewable energy arm of the Adani Group. The group also has a solar PV manufacturing arm called Adani Solar. The company under Adani Group which applied for the Tranche I of this PLI scheme was Adani Infrastructure Private Limited. Both the previous companies are not publicly listed. Since the renewable energy arm of Adani group is involved in this industry, this stock may have most relevance with the PLI scheme among publicly listed companies of the Adani Group.

- The difference between the average share price of Adani Green Energy Ltd 90 days before the initial PLI announcement, compared to 90 days after the announcement was 44.91%. The 30-day difference for the same was 47.71%.

- For the Union Budget 2021 Announcement, the 30-day interval difference was 7.28%. In a 60-day interval before and after, the difference was 2.68%.

- For the PLI Tranche I approval, the 30-day interval average difference was -5.43%.

- For the Union Budget 2022 announcement, the 30-day interval difference was 42.75%. In a 60-day interval before and after, the difference was 41.08%.

- For the Tranche II approval announcement, the 30-day before and after period had a price difference of -12.75%.

Borosil Renewables

Borosil renewables limited is the first and currently the only solar glass manufacturer in India. Its current solar glass manufacturing capacity is equivalent to 2,8 GW of solar modules. Although solar glass is not a product eligible for manufacturing incentives under the PLI scheme for this sector, solar glass is an essential component of finished solar modules, and currently Borosil Renewables fulfils 40% of the total domestic demand. Since the government is emphasizing domestic manufacturing and reduction in imports in this sector, the PLI scheme may have indirect positive consequences for domestic solar glass manufacturers.

- The percentage change of Borosil Renewables stock on the NSE between the average share price 3 months before the initial PLI announcement, compared to 3 months after the announcement was 289.15%. For a 30-day period from the announcement, the percentage increase was 74.53%.

- For a 30-day period before and after the Union Budget 2021 announcement, the percentage change was negligible. For a 60-day period before and after this announcement, the percentage increase was 89.09%.

- For a 30-day before and after period from the Tranche I approval, the average share price slightly decreased, although it was a mild decrease of 3.6%.

- For a 30-day before and after period from the Union budget 2022, the percentage change was -12.95%. For a 60-day period for the same, the price increased by 8.07%

- For the Tranche II approval announcement, the 30-day before and after period had a price difference of -4.87%. However, the immediate average difference, between 3 days before and after this announcement, was mildly positive at 6.62%.

The stock prices for these companies during these time periods were also dependent and related with a large number of other factors. Hence these market movements or trends cannot accurately or necessarily be attributed to one single factor such as PLI scheme announcements in the scope of this analysis. However, the aim is to visualize and observe how the stock market prices of these companies tended to trend in the periods close to PLI scheme related events, which may be one of the several factors that affect the stock prices of these companies in the Indian stock market.

Dhruv Chaudhari

Dhruv Chaudhari is a Research Intern at Tatvita. Presently he is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.