Financial Aspect: Automobile Industry in India

The automobile industry in India is the fourth largest in the world, valued at $ 32.70 billion in 2021. According to IBEF, It is expected to grow at a CAGR of 9% between 2022 and 2027, reaching a valuation of $54.84 billion in five years.

Electric Vehicles: Sunrise

According to India Energy Storage Alliance, the electric vehicle market in India is expected to grow at a CAGR of 36% till 2026. To fuel this growth, one of the most crucial factors is investments.

One of the fastest growing segments in the automobile industry is electric vehicles. Electric vehicles are generally more expensive to manufacture than combustion engine powered vehicles, one of the biggest additional costs being the lithium ion batteries. However, the costs are reducing over time as battery prices reduce.

According to a study by CEEW Centre for Energy Finance, there is a US$ 206 billion opportunity for electric vehicles in India by 2030, which will require a $180 billion dollar investment in vehicle manufacturing and charging infrastructure.

Raw Materials

Finished automobiles have a significant cost of production. The biggest driver of cost is usually the raw material, followed usually by direct labour. However, it varies by the country of production, the manufacturer, and the specific product. The major factors are the type of the vehicle produced, the materials and components used, efficiency of the process of manufacturing, and the level of automation in manufacturing. There are also other factors, which are not constant in price and vary according to the market, such as the cost of raw materials which can also depend on the cost of other commodities. Geopolitical and global supply chain disruptions can also affect the overall cost of production,

One recent example of this is the semiconductor supply shortage which led to increased production costs. During the COVID pandemic, raw material prices surged significantly. Another factor that varies is the level of competition in the market, and availability of skilled labour. Compared to some other economies, the cost of labour may be lesser in India in the automobile industry. Additionally, domestic production of vehicles is very high in the industry in India. However, exact figures are not publicly available since most of this data is company-owned proprietary data. Specific estimates of the cost of production are therefore not available currently.

Foreign Investment

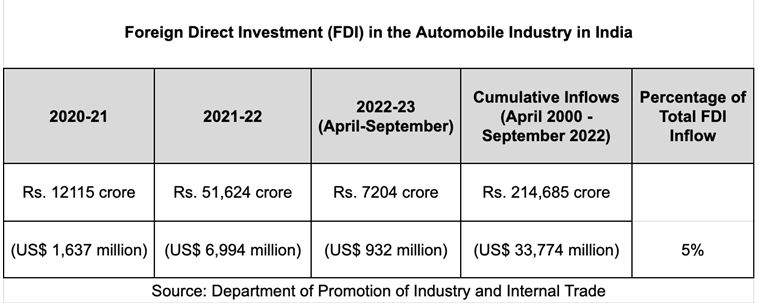

To meet the growing demand in the automobile industry, manufacturers are investing heavily in various segments. Between 2000 and 2002, the total Foreign Direct Investment equity inflow (FDI) attracted by the industry was worth US$ 33.53 billion. The government has encouraged FDI in the automobile sector, and has allowed 100% FDI under the automatic route, which means that foreign investors do not require approval from the government of India or the RBI for their investments, subject to all the applicable regulations and laws.

According to the Ministry of Commerce and Industry, in FY22 India recorded its highest ever annual FDI inflow, of USD 83.57 billion. In the first four months, the automobile industry had the highest share, with 23%.

Various government schemes and programs have supported foreign investments in this industry. Some major examples are:

- Automotive Mission Plan (AMP) 2016-2026– The AMP aims to increase competitiveness in the automobile industry in India and make it a global leader in vehicle and auto component production. It aims to increase the contribution of the Indian automobile industry to India’s GDP to 12% from the current level of 7%. The AMP also aims to improve the business environment for foreign investors, such as infrastructural development, simplification of regulations and procedures, and promotion of a favourable policy framework.

- Make in India initiative– The make in India program was launched in 2014 to enhance and promote the manufacturing sector in India. It also aims to make it more attractive to foreign investors, by providing tax breaks and other incentives such as access to financing, infrastructural support, and favourable policies.

Some foreign companies that have made significant investments in the Indian automobile industry are Toyota, Ford, and Hyundai. They have all established manufacturing plants in India to produce vehicles and components for the domestic as well as international markets.

SBI has received a total of $2 billion in loans from the Japan Bank for International Cooperation, in the form of refinance against the funding provided to manufacturers, dealers, and suppliers of Japanese automobiles in India.

Domestic Investments

The industry has also received significant domestic investments in recent years, both from the government and private entities. Some government domestic investment programs that have been implemented are:

- Automotive Mission Plan (AMP) 2006-2016, and 2016-2026– This program was implemented to encourage the development of the automobile industry in India. It included measures such as tax incentives, grants, and subsidies.

- Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India)- This program was launched in 2015 to promote the adoption of electric and hybrid vehicles. It includes a range of incentives and subsidies for electric and hybrid vehicles, as well as support for research and development activities, and charging infrastructure. As of June 2021, a total of US$ 117 million has been spent under the FAME-II scheme. A total of 87,659 electric vehicles have been supported through incentives, and 6,265 electric buses have been sanctioned for various state/city transportation undertakings.

- National Electric Mobility Mission Plan (NEMMP) 2020– This program was launched in 2013 to accelerate adoption of electric vehicles. One of the goals which the program was aiming to support was ensuring a population of 6-7 million electric/hybrid vehicles by 2020. It had an estimated cumulative outlay of 14,000 crore, with many measures such as tax incentives and subsidies, support for R&D, and infrastructure development.

Private companies have also invested heavily domestically. Some examples are:

- In November 2022, Maruti Suzuki India announced plans to spend almost Rs. 7,000 crore (US$ 865.12 million) on multiple projects including the building of its new facility in Haryana and the introduction of new vehicle models.

- In April 2022, Tata Motors announced plans to invest Rs. 24,000 crore (US$ 3.08 billion) over the next five years in its passenger vehicle segment.

- In February 2020, Hero MotoCorp announced plans to invest Rs.10,000 crores over the next 5-7 years in new products, alternate mobility solutions, manufacturing facilities, network expansion and brand building, and its foray into the electric vehicle segment. In January 2022, they also announced a 420 crore (US$ 50.7 million) investment in Indian electric vehicle company Ather Energy.

- Mahindra and Mahindra announced in December 2022 that they would invest Rs. 10,000 crores ($1.2 billion) to set up an electric vehicle manufacturing plant in Pune after receiving approval from the Maharashtra government. The investment will be made over a period of 7-8 years.

Production Linked Incentive (PLI) Scheme

Under the PLI scheme, 20 automobile manufacturers (including Tata Motors, Mahindra and Mahindra, Hyundai and Kia India, Suzuki Motors Gujarat) have been chosen to receive production-linked incentives by the government in the plans to increase vehicle manufacturing and attract new investment. The 20 automobile companies have proposed a total investment of Rs. 45,000 crore. (US$ 5.95 billion). The PLI scheme for automobiles and auto parts is expected to bring a total investment of Rs. 42,500 by 2026, and will lead to the creation of 7.5 lakh jobs in India.

Dhruv Chaudhari

Dhruv Chaudhari is a Research Intern at Tatvita. Presently he is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.