Credit/Loan Schemes for Cooperative Sector

Out of 30 lakh cooperative societies in the world, 8.55 lakh are in India and about 13 crore people are directly associated with them. There are 91% villages in India which have some form of cooperatives working in them. Among the 300 largest cooperative societies of the world, three societies of India namely Amul, IFFCO and KRIBHCO are also included.

The world’s two leading cooperatives (based on ratio of turnover over Gross Domestic Product per capita) are the Indian Farmers Fertiliser Cooperative Ltd (IFFCO) and the Gujarat Cooperative Milk Marketing Federation (GCMMF).

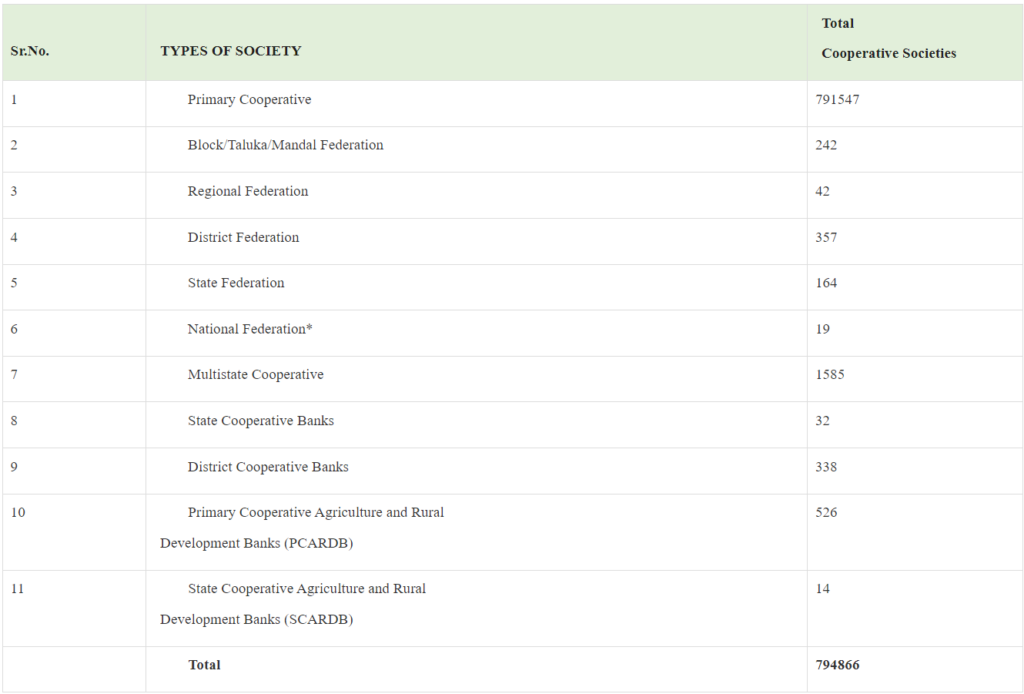

Public national statistics on cooperatives in India have been taken from the Statistical Profile by National Cooperative Union of India (NCUI) published for the year 2018. In 2018, there were 854,355 cooperatives with 290.06 million members. The cooperatives generated 13.3% direct employment and 10.91% self-employment for persons.

Institutional Arrangement

Cooperatives in India are broadly present in credit and non-credit sectors. There are seven types of cooperatives under the credit sector including state cooperative agriculture and rural development banks, state cooperative banks, district cooperative central banks, employee thrift and other credit societies, urban cooperative banks, primary cooperative agriculture rural and development banks, and primary agricultural credit societies (PACS).

The non-credit types of cooperatives include all others- tribal/SC-ST, service sector, women, multi-state, multipurpose, consumer, housing, industrial cooperatives, etc. Overall, the housing and dairy sectors have the highest number of cooperatives.

State wise list of Non-Credit and Credit Cooperative Societies as per Statistical Profile of National Cooperative Union of India (NCUI) 2018 is given below. District wise list is not maintained centrally.

Sectoral Distribution among Cooperatives

The sectors used below correspond to the categories used in the ISIC rev. 4. to classify the economic activities carried out by the organisations concerned.

Issues Faced by Cooperatives

Financial Constraints leading to Limited growth of Cooperatives throughout India: Institutions such as Vaikunt Mehta Institute of Cooperative Management have conducted various studies that highlight the progress of the cooperative structure in some states including Maharashtra, Gujarat and Karnataka. In addition, these cooperative institutions receive capital from the central government in the form of equity or working capital, which is provided under guarantee by the state government.

However, with the advanced maturity of cooperatives in the aforementioned states, they have been able to corner most funds, leading to insufficient funds for development of cooperatives in other states.

For the cooperative movement to propagate in other states too, the necessary framework of regulatory support and financial backing needs to be provided to cooperatives in all regions of India.

Some of the problems and challenges that cooperatives face today according to Report of the High-Powered Committee on Cooperatives (May 2009) are:

- Inability to ensure active membership, speedy exit of non-user members, lack of member communication and awareness building measures

- Serious inadequacies in governance including that related to Boards’ roles and responsibilities

- A general lack of recognition of cooperatives as economic institutions both amongst the policy makers and public at large

- Inability to attract and retain competent professionals Lack of efforts for capital formation particularly that concerning enhancing member equity and thus member stake

- Lack of cost competitiveness arising out of issues such as overstaffing a general top-down approach in forming cooperatives including the tiered structure Politicization and excessive role of the government chiefly arising out of the loopholes and restrictive provisions in the Cooperative Acts

The priority before the new Ministry, therefore, is to revamp the nation-wide cooperative strategy to ensure access to cost-effective institutional sources of credit, capital equipment, and state-of-the-art technology for producers

Loan Schemes of the Government:

- Pradhan Mantri Mudra Yojana:

Pradhan Mantri MUDRA Yojana (PMMY) provides loans up to Rs.10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’ (up to Rs 50,000), ‘Kishore’ (Rs 5 lakh) and ‘Tarun’ (Rs 10 lakh) to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.

- Kisan Credit Card Scheme:

Kisan Credit Card (KCC) scheme meets the financial requirements of farmers at various stages of farming. The scheme aims at providing adequate and timely credit support from the banking system. The scheme also provides the facility of ATM enabled RuPay Card, one-time documentation, built-in cost escalation in the limit and any number of drawals within the limit. Loan amount/Limit is fixed on an annual basis depending upon the cropping pattern, Scale of Finance for the crop and the extent of cultivation. The farmers eligible under the scheme include small farmers, marginal farmers, sharecroppers, oral lessee and tenant farmers. The Self Help Groups (SHGs) or Joint Liability Groups (JLGs) are also eligible for availing benefits under the scheme.

Credit/Loan Schemes under National Cooperative Development Corporation (NCDC) Schemes:

- Ayushman Sahakar:

The scheme provides financial assistance to cooperatives on holistic healthcare infrastructure, education and services. The objective of the scheme is to assist in provisioning of affordable and holistic healthcare through hospitals / healthcare / education facilities by cooperative societies. Three main activities are covered under the scheme:

- Infrastructure – For creation, modernization, expansion, repairs, renovation of hospital, healthcare and education infrastructure covering all types of infrastructure for healthcare services, Telemedicine and remote assisted medical procedures, Logistics health, healthcare and education, Information and Communication Technology related to digital health, Health insurance accredited by Insurance Regulatory and Development Authority (IRDA).

- Margin money for raising working capital required for day-to-day operations in respect of those mentioned above.

- Working capital for day-to-day operations.

Period of loan will be for 8 years, including 1-2 years moratorium on repayment of principal, depending on the type of project and its ability to generate revenue. As an incentive, NCDC will provide 1% less than applicable rate of interest on term loan for the project activities in case of a borrower cooperative society where women members are in majority for the entire tenure of the loan only if timely repayments are made.

- Scheme for extending Short Term Loan to Agricultural Credit Cooperatives towards Working Capital:

A scheme to provide loans to Agricultural Credit Cooperatives towards working capital for disbursement of agricultural loans/advances for activities/commodities/services under the purview of NCDC. The loan will be given as per requirement, not exceeding 80% of the total working capital required by the Cooperative taking into account the other sources of finance such as NABARD, State Government, Own funds, Deposits, other financing institutions etc.

- Yuva Sahakar – Cooperative Enterprise Support and Innovation Scheme 2019:

The scheme aims at encouraging newly formed cooperative societies with new and/or innovative ideas. It will be linked to Rs 1000 crore ‘Cooperative Start-up and Innovation Fund (CSIF)’ created by the NCDC. It would have more incentives for cooperatives of North Eastern region, Aspirational Districts and cooperatives with women or SC or ST or PwD members. The funding for the project will be up to 80% of the project cost for these special categories as against 70% for others. The scheme envisages 2% less than the applicable rate of interest on term loan for the project cost up to Rs 3 crore including 2 years moratorium on payment of principal. All types of cooperatives in operation for at least one year are eligible.

- Agriculture Infrastructure Fund:

The role of infrastructure is crucial for agriculture development and for taking the production dynamics to the next level. In this view, the Agriculture Infrastructure Fund for farm-gate infrastructure for farmers was launched in 2020. Financing facility of Rs. 1 lakh crore will be provided for funding Agriculture Infrastructure Projects at farm-gate & aggregation points (PACS, FPOs, Agri-entrepreneurs, Start-ups, etc.). The objective of the scheme is to mobilize a medium-long term debt finance facility for investment in viable projects for post-harvest management infrastructure and community farming assets through incentives and financial support in order to improve agriculture infrastructure in the country. The Scheme will be operational from 2020-21 to 2029-30. Disbursement to be done in four years starting with sanction of Rs. 10,000 crore in the first year and Rs. 30,000 crore each in next three financial years. Moratorium for repayment under this financing facility may vary subject to minimum of 6 months and maximum of 2 years. All loans under this financing facility will have interest subvention of 3% per annum up to a limit of Rs. 2 crore. This subvention will be available for a maximum period of 7 years. In case of loans beyond Rs.2 crore, then interest subvention will be limited up to 2 crore.

- Credit Guarantee Fund Scheme:

The Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement Credit Guarantee Fund Scheme for Micro and Small Enterprises. The fund offers collateral-free loans up to a limit of Rs.50 lakh – for individual MSEs. The credit facilities which are eligible to be covered under the scheme are both term loans and working capital facility up to Rs.100 lakh per borrowing unit, extended without any collateral security or third party guarantee, to a new or existing micro and small enterprise.

- North East Entrepreneurs Development (NEED):

The scheme has been formulated to help first generation entrepreneurs who are short of equity. New projects in Micro and Small Enterprises, expansion, modernisation of existing units. Technical qualification of the promoter in the relevant field is a prerequisite. Term loan up to a maximum of 75% of the project cost including one cycle of working capital in deserving cases. Promoter’s contribution minimum 25% of project cost.

- Swarojgar Credit Card:

Swarojgar Credit Card Scheme was introduced to provide adequate and timely credit that includes working capital/block capital or both to small artisans, handloom weavers, service sector, fishers, self-employed individuals, rickshaw owners, other micro-entrepreneurs, SHGs etc. in a flexible, hassle-free and cost-effective manner. The scheme envisages provisions of credit as a composite loan including term loan/ revolving cash credit. Rs. 25,000 is granted per borrower as a composite loan. The working capital/ recurring expenditure limit may be in the form of a revolving cash credit and fixed as a percentage of the turnover divided by the number of operating cycles per annum. SCC is normally valid for 5 years subject to satisfactory operation of the account.

- PSB Loans in 59 minutes (by SIDBI):

Under this scheme, Small businesses and MSMEs can get loans up to Rs 10 crore, under refinance schemes wherein 5 Nationalized (PSU) Banks are authorized to provide the loans. The interest rate on this special loan for MSMEs depends on the nature of the business, the current credit rating of the owner, and the tenure for which the loan has been approved. An MSME can get digital approvals for loans ranging from ₹10 lac to ₹5 crores having flexible tenures with affordable interest rates ranging from 6.8 % to 21%. Two types of loans can be availed under this scheme – Term Loan and Working Capital Loan

- Stand-Up India

The objective of the Stand-Up India (SUI) scheme is to facilitate bank loans between Rs. 10 lakh and Rs. 1 Crore to SC/ST borrowers for setting up a greenfield enterprise. This enterprise may be in manufacturing, services, agri-allied activities or the trading sector. The loan offered is a composite loan (one that is inclusive of term loan and working capital). The composite loan covers 85% of the project cost (in most cases). The rate of interest would be the lowest applicable rate of the bank for that category. The loan is repayable in 7 years with a maximum moratorium period of 18 months. The scheme also envisages 15% margin money which can be provided in convergence with eligible central/state schemes.

Knowledge-sharing platform is aimed at providing analytical insights into Economy, Public Policy and Foreign Policy.