Contribution to Economy: Manufacturing Active Pharmaceutical Ingredients in India

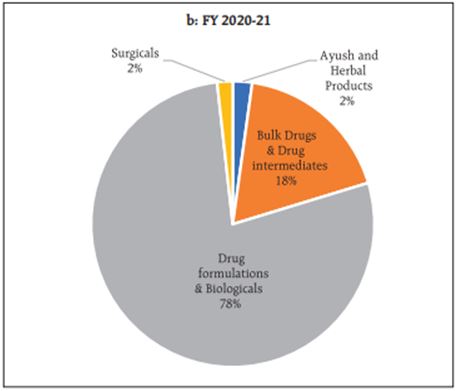

Pharmaceuticals exports from India stood at US$ 20.7 billion in FY20 and reached US$ 24.4 billion in FY21. The Compound annual growth rate (CAGR) of the exports was around 9 per cent from 2008-09 to 2020-21.

With an objective to attain self-reliance and reduce import dependence in these critical Bulk Drugs – Key Starting Materials (KSMs)/ Drug Intermediates and Active Pharmaceutical Ingredients (APIs).

It focuses on domestic manufacturing by setting up greenfield plants with minimum domestic value addition in four different Target Segments for 41 products with a total outlay of Rs. 6,940 cr. for the period 2020-21 to 2029-30.

- Target Segment I – Key Fermentation Based KSMs/Drug Intermediates

- Target Segment II – Fermentation Based Niche KSMs/Drug Intermediates/APIs

- Target Segment III – Key Chemical Synthesis Based KSMs/Drug Intermediates

- Target Segment IV – Other Chemical Synthesis Based KSMs/Drug Intermediates/APIs

Gross Domestic Product (GDP)

- India ranks third worldwide for pharmaceutical production by volume and fourteenth by value. The Indian pharmaceutical sector contributes about 2% to India’s GDP and around 8 per cent to the country’s total merchandise exports.

- Besides, the sudden outbreak and spread of COVID-19 pandemic across the globe, with India being severely hit by the pandemic crisis, also opened opportunities for the growth of India active pharmaceutical ingredients market. Due to the pandemic spread major countries boycotted China for trade as it was where the virus originated, similarly India also banned all kinds of imports and exports with China.

- This led to development of manufacturing facilities in the country and improved the status of domestic players. Also, India being a major pharmaceutical hub witnessed demand from various countries across the globe for getting the medical supplies and drugs.

- This in turn positively influenced the growth of active pharmaceutical ingredients market in the country. Also, supportive government policies such as Atmanirbhar Bharat, Pharma Vision 2020, Production Linked Incentive Scheme, among others is further expected to create lucrative opportunities for the growth of overall pharmaceutical industry and the Indian Active Pharmaceutical Ingredients Market.

- The Indian Active Pharmaceutical Ingredients Market is segmented based on method of synthesis, source, therapeutic application, drug type, company, and region. Based on method of synthesis, the market is further segmented into synthetic and biological. The synthetic method of synthesis dominated the market with a share of 56.29% in FY2021 on account of the easy availability of raw materials and easier process for development of active pharmaceutical ingredients.

Trade

- According to the Government data Drugs and Pharmaceuticals were the top 5th Exporter with 6.14% of the total Export in the year 2021

- The Indian pharmaceutical industry generated a trade surplus of US$ 15.81 billion in FY22

- India is the 12th largest exporter of medical goods in the world. Indian drugs are exported to more than 200 countries in the world, with US being the key market.

- Generic drugs account for 20% of the global export in terms of volume, making the country the largest provider of generic medicines globally.

- For the period 2021-22, export of drugs and pharma products stood at $24.6 billion compared to $24.44 billion as of 2020-21. The Indian pharma industry witnessed exponential growth of 103% during 2014-22 from $11.6 billion to $24.6 billion.

Employment

With the aim to further encourage the pharmaceutical industry to enhance its manufacturing capabilities, diversify the product mix to complex generics, patented drugs, going up the value chain, bringing investment and creating global champions out of India.

In total, 215 applications were received for the 36 products spread across the 4 Target Segments. Out of which, total 42 applications were approved by the Government with a total Committed Investment of Rs. 4,347.26 Crore and expected Employment Generation of around 8,792 persons.

Market demand and supply (Industry Scenario)

- The pharmaceutical industry in India is expected to reach $65 billion by 2024 and to $120 billion by 2030.

- The pharmaceutical industry in India is currently valued at $50 billion.

- India is a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports. India supplies over 50% of Africa’s requirement for generics, ~40% of generic demand in the US and ~25% of all medicine in the UK .

- India also accounts for ~60% of global vaccine demand , and is a leading supplier of DPT, BCG and Measles vaccines. 70% of WHO’s vaccines (as per the essential Immunization schedule) are sourced from India.

- Exports of Drugs & Pharmaceuticals values at $ 2052.78 mn in Septembert 2022 and shares 6.29% of the total exports of the month. The Average Index of Industrial Production of Manufacturing of pharmaceuticals, medicinal chemicals and botanical products in the FY 2021-22 is 221.6 and has grown by 1.3%.

- India and Russia have set the bilateral trade target at US$ 30 billion by 2025. Trade is expected to increase by an additional US$ 5 billion per annum, with opportunities in pharmaceuticals & medical devices, minerals, steel, and chemicals.

- For the period 2021-22, export of drugs and pharma products stood at $24.6 billion compared to $24.44 billion as of 2020-21. The Indian pharma industry witnessed exponential growth of 103% during 2014-22 from $11.6 billion to $24.6 billion.

Kaushal Sharma

Kaushal Sharma is a Research Intern at Tatvita-Analysts. He is pursuing Masters in Economics from Symbiosis College.