6 years of Goods & Services Tax (GST) in India

The nation-wide single indirect tax, Goods and Services Tax (GST) completed its 6 years run on 1st July 2023. It was implemented on July 1st 2017 in India. Its Council is holding meeting on 11th July 2023. Each one of us in one way or other has been a part of this tax regime. Therefore, to commemorate the 6 years journey of GST, we delve deep into the intricacies, process and the latest updates of GST numbers through this piece.

Table of Content

- Basics of GST

- Features of GST

- GST Council

- Company Registration Process and Certificate

- e-Invoicing

- e-Way Bills

- GST Returns

- Goods and Service Tax Network (GSTN)

- GST Calculation

- Goods exempted from GST

Basics of GST

To begin with to understand the tax base first look at the latest amount received from GST collection.

The gross GST revenue collected in the month of May, 2023 is Rs.1,57,090 crore of which Central GST (CGST) is Rs. 28,411 crore, State GST (SGST) is Rs. 35,828 crore, Integrated GST (IGST) is Rs. 81,363 crore (including Rs. 41,772 crore collected on import of goods) and cess is Rs. 11,489 crore (including Rs. 1,057 crore collected on import of goods).

France was the first country to implement GST to reduce tax evasion. Since then, over 160 countries have implemented GST or VAT (on both goods and services), with some countries having a dual-GST model for example, Brazil, Canada and India.

GST is an indirect tax which has replaced many indirect taxes in India such as the value added tax, service tax, purchase tax, excise duty, etc. GST is imposed on the supply of specific products and services.

GST is a multi-stage tax system which is comprehensive in nature and applied on the sale of goods and services. The main aim of this taxation system is to curb the cascading effect of other Indirect taxes and it is applicable throughout India.

The GST Council has assigned GST rates of 5% GST, 12% GST, 18% GST, and 28% to different goods and services. GST rates for goods and services have been changed few times since its implementation. The updated GST rates can be found here.

Indirect tax will be levied by Central and State Government called Central GST (CGST) and State GST (SGST), respectively. For example, 5% of levied GST is distributed as 2.5% for CGST and 2.5% for SGST. In the case of intra-state transactions, the seller will collect CGST and SGST from the buyer which will be paid to the Central and State Government, respectively.

The tax is largely destination-based. For example, goods are manufactured in Maharashtra and sold to the final consumer in Karnataka then the entire tax revenue will go to Karnataka and not in Maharashtra as GST is levied at the point of consumption.

In terms of revenue distribution, the GST Council plays a crucial role. It is a joint forum consisting of the Union Finance Minister and representatives from all States and Union Territories. The Council makes decisions on various aspects of GST, including tax rates, exemptions, and revenue sharing between the Central and State Governments. Except for one decision, all decisions of the Council were taken by consensus.

To ensure a smooth transition to the GST regime and address any revenue losses incurred by the States, a compensation mechanism was established. The Central Government was committed to providing compensation to the States for any revenue shortfall during the initial years of GST implementation. This compensation was meant to bridge the gap between the expected revenue growth and the actual revenue collected by the States.

The government has settled Rs. 35,369 crore to CGST and Rs. 29,769 crore to SGST from IGST. The total revenue of Centre and the States in the month of May 2023 after regular settlement is Rs. 63,780 crore for CGST and Rs. 65,597 crore for the SGST.

Features of GST

- One Nation, One Tax: GST replaced multiple indirect taxes levied by the Central and State Governments, such as excise duty, service tax, value-added tax (VAT), and others. It brought uniformity in the tax structure across India, eliminating the cascading effect of taxes.

- Dual Structure: GST operates under a dual structure, comprising the Central GST (CGST) levied by the Central Government and the State GST (SGST) levied by the State Governments. In the case of Inter-state transactions, Integrated GST (IGST) is applicable, which is collected by the Central Government and apportioned to the respective State. Import of goods or services would be treated as inter-state supplies and would be subject to IGST in addition to the applicable customs duties.

- Destination-based Tax: GST is a destination-based tax, levied at each stage of the supply chain, from the manufacturer to the consumer. It is applied to the value addition at each stage, allowing for the seamless flow of credits and reducing the tax burden on the end consumer.

- Input Tax Credit (ITC): GST allows for the utilization of input tax credit, wherein businesses can claim credit for the tax paid on inputs used in the production or provision of goods and services. This helps avoid double taxation and reduces the overall tax liability.

- GST would apply on all goods and services except Alcohol for human consumption. GST on five specified petroleum products (Crude, Petrol, Diesel, ATF & Natural Gas) would by applicable from a date to be recommended by the GSTC. Tobacco and tobacco products would be subject to GST. In addition, the Centre would have the power to levy Central Excise duty on these products. Exports are zero-rated supplies. Thus, goods or services that are exported would not suffer input taxes or taxes on finished products.

- Threshold Exemption: Small businesses with a turnover below a specified threshold (currently, the threshold is ₹ 20 lakhs for supplier of services/both goods & services and ₹ 40 lakhs for supplier of goods (Intra–Sate) in India) are exempt from GST. For some special category states, the threshold varies between ₹ 10-20 lakhs for suppliers of goods and/or services except for Jammu & Kashmir, Himachal Pradesh and Assam where the threshold is ₹ 20 lakhs for supplier of services/both goods & services and ₹ 40 lakhs for supplier of goods (Intra–Sate). This threshold helps in reducing the compliance burden on small-scale businesses.

- Composition Scheme: The composition scheme is available for small taxpayers with a turnover below a prescribed limit (currently ₹ 1.5 crores and ₹ 75 lakhs for special category state). Under this scheme, businesses are required to pay a fixed percentage of their turnover as GST and have simplified compliance requirements.

- Online Compliance: GST introduced an online portal, the Goods and Services Tax Network (GSTN), for registration, filing of returns, payment of taxes, and other compliance-related activities. It streamlined the process and made it easier for taxpayers to fulfill their obligations.

- Anti-Profiteering Measures: To ensure that the benefits of GST are passed on to the consumers, the government established the National Anti-Profiteering Authority (NAA). The NAA monitored and ensured that businesses do not engage in unfair pricing practices and profiteering due to the implementation of GST. All GST anti-profiteering complaints are now dealt by the Competition Commission of India (CCI) from 1st December, 2022.

- Increased Compliance and Transparency: GST aims to enhance tax compliance by bringing more businesses into the formal economy. The transparent nature of the tax system, with the digitization of processes and electronic records, helps in curbing tax evasion and increasing transparency.

- Sector-specific Exemptions: Certain sectors, such as healthcare, education, and basic necessities like food grains, are given either exempted from GST or have reduced tax rates to ensure affordability and accessibility.

- Accounts would be settled periodically between the Centre and the States to ensure that the credit of SGST used for payment of IGST is transferred by the Exporting State to the Centre. Similarly, IGST used for payment of SGST would be transferred by the Centre to the Importing State. Further, the SGST portion of IGST collected on B2C supplies would also be transferred by the Centre to the destination State. The transfer of funds would be carried out on the basis of information contained in the returns filed by the taxpayers.

GST Council

Any recommendations that are made to the State and Union Government regarding any issues that are related to GST are undertaken by the GST Council. The chairman of GST Council is Union Finance Minister of India. The other members of the GST Council are the Union State Minister of Revenue or Finance of all the states.

Company Registration Process and Certificate

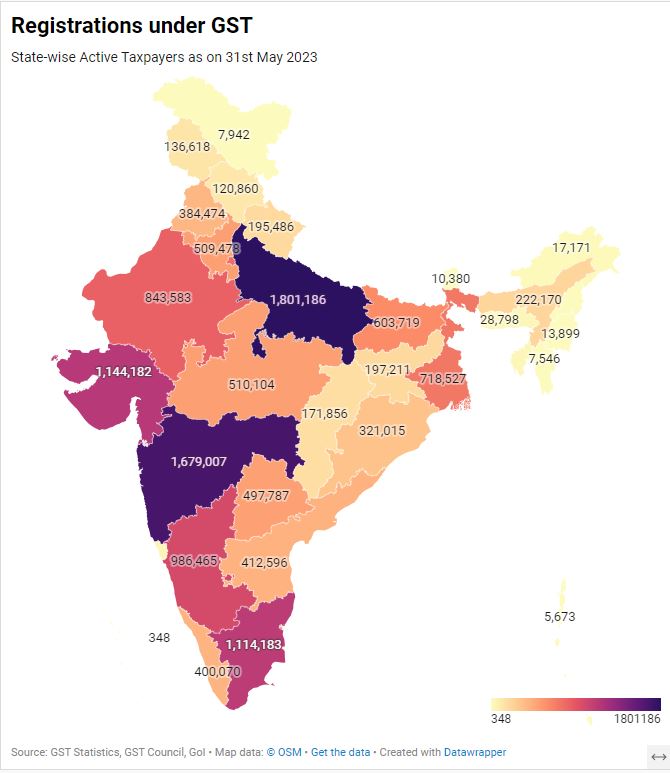

It is mandatory for all Service providers, buyers, and sellers to register. A business that makes a total income of Rs. 20 lakhs and more in a financial year must be required to do GST registration. It takes 2-6 working days to process.

Under the GST regime, manufacturers and dealers can benefit from input tax credit.

Any company that is eligible under GST must register itself in the GST portal created by the Government of India. The registered entities will get a unique registration number called GSTIN. A 15-digit distinctive code that is provided to every taxpayer is the GSTIN. The GSTIN will be provided based on the state you live at and the PAN.

A GST Certificate is a legal document that the relevant authorities issue to a company that has registered for the GST system. The certificate is not physically handed out. It is only accessible digitally. GSTIN, Legal Name, Trade Name, Business Constitution, Address, Date of Liability, Validity Period, Types of Registration, Particulars of Approving Authority, Signature, Specifications of the Approving GST Officer, and Date are all included on the GST Certificate.

e-Invoicing

The e-invoicing system was made applicable from 1st October 2020 for businesses with an annual aggregate turnover of more than Rs.500 crore in any preceding financial years (from 2017-18). Further, from 1st January 2021, this system was extended to those with an annual aggregate turnover of more than Rs.100 crore.

These businesses must obtain a unique invoice reference number for every business-to-business invoice by uploading on the GSTN’s invoice registration portal. The portal verifies the correctness and genuineness of the invoice. Thereafter, it authorises using the digital signature along with a QR code.

e-Invoicing allows interoperability of invoices and helps reduce data entry errors. It is designed to pass the invoice information directly from the IRP to the GST portal and the e-way bill portal. It will, therefore, eliminate the requirement for manual data entry.

e-Way Bill

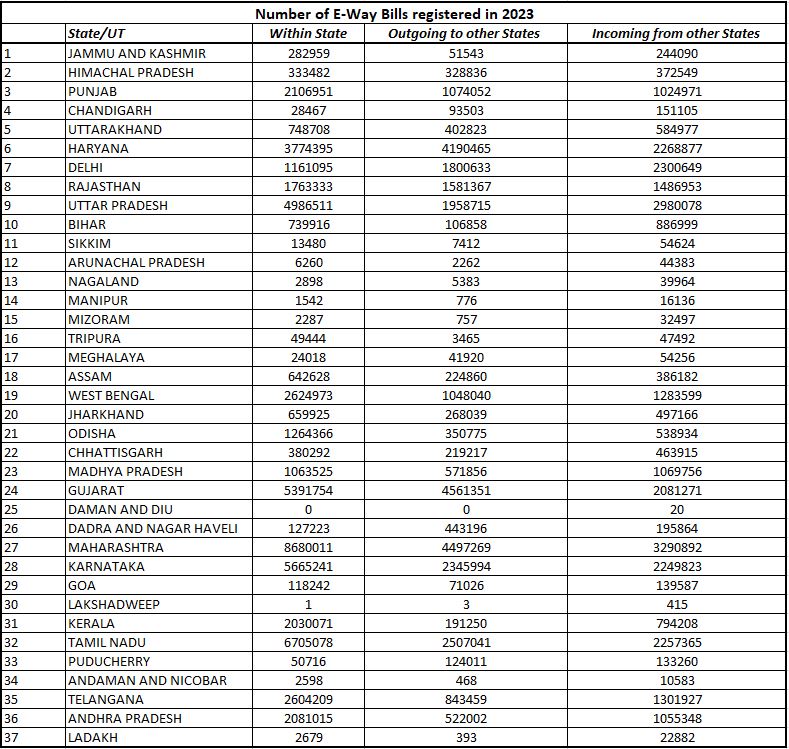

GST introduced a centralised system of waybills by the introduction of “E-way bills”. This system was launched on 1st April 2018 for inter-state movement of goods and on 15th April 2018 for intra-state movement of goods in a staggered manner.

Under the e-way bill system, manufacturers, traders and transporters can generate e-way bills for the goods transported from the place of its origin to its destination on a common portal with ease. Tax authorities are also benefited as this system has reduced time at check -posts and helps reduce tax evasion.

GST Returns

Currently, the GST must be paid every month GST payments can be made both online and offline. Once the payment has made, a challan must be generated.

Goods and Service Tax Network– GSTN

The GSTN is the Goods and Services Tax Network which is responsible for managing the IT system concerning the GST Portal. It is a non-profit, non-government organization and is the database for the official GST Portal.

Features of GSTN

- Keeping the information of all the taxpayers safe and secure.

- Maintaining confidentiality of the taxpayers’ information.

- It is a trusted National Information Utility (NIU).

Functions of GSTN

- It is responsible for handling the invoices

- It is responsible for handling the registrations

- It is responsible for handling the payments and refunds (if any)

- It is responsible for handling different types of returns.

GST Calculation

- Step 1: Determine the GST rate applicable for the goods or services you are selling or purchasing.

- Step 2: Determine the transaction value of the goods or services on which GST is to be calculated.

- Step 3: Calculate the GST amount by multiplying the transaction value with the applicable GST rate. The formula is GST Amount = (Original Cost x GST%)/100Net Price

- Step 4: Determine the gross amount payable by adding the GST amount to the transaction value. In case a product is sold for Rs.5,000 and the GST rate applicable to it is 12%. Then, the net price of the product will be Rs.5,000 + 12% of Rs.5,000 = Rs.5,000 + Rs.600 = Rs.5,600.

Goods Exempted from GST

- Tools or instruments– Tools for differently abled individuals, agricultural tools, etc.

- Raw materials– Handloom fabrics, unprocessed wool, cotton for khadi yarn, raw jute fiber, raw silk, etc.

- Food item– Vegetables and fruits, meat, fish, cereals, etc.

- Miscellaneous– Books, newspaper, journals, vaccines, map, non-judicial stamps, etc.

Knowledge-sharing platform is aimed at providing analytical insights into Economy, Public Policy and Foreign Policy.