Introduction: Manufacturing Advanced Chemistry Cell Battery in India

To fight against global warming, tiny advanced chemistry cells, which are used in lithium-ion battery, will play a big role in cutting short the world’s dependence on fossil fuels.

Advanced chemistry cells are the new generation technologies that can store electric energy either as electrochemical or as chemical energy and convert it back to electric energy as and when required. Globally manufacturers are investing in these new generation technologies at a commercial scale to fill the expected boom in battery demand over the next decade.

Products manufactured

Consumer electronics, electric vehicles, advanced electricity grids, solar rooftops etc., which are major battery consuming sectors, are expected to achieve robust growth in the coming years.

Several companies have already started investing in battery packs, though the capacities of these facilities are too small when compared to global averages.

The world is racing to tame this technology and make these batteries efficient and safe. India, which imports these batteries, is also taking baby steps in that direction. The government last year launched the National Programme on Advanced Chemistry Cell (ACC) Battery Storage to reduce import dependence.

With existing NDC targets reinforced by the recent announcement of a net-zero target by 2070, India is aiming to accelerate decarbonization efforts in line with global momentum on climate action. India has committed to meet 50% of its energy requirement from renewable energy by 2030, which includes a target of 500 GW of non-fossil fuel energy capacity by 2030. Advancement in battery technologies will be central to achieving these goals.

According to RMI’s research and Bloomberg New Energy Finance’s (BNEF’s) analysis, the global demand for lithium-ion batteries is expected to reach more than 2.8 TWh annually by 2030, with a vast majority of that demand serving electric transportation. Similar momentum is emerging in ESS applications. Investment in stationary energy storage globally reached US$6.3 billion in 2020. It is expected to continue at a rapid pace reaching US$22 billion by 2025 and more than US$30 billion by 2030.

In response to this momentum and massive demand growth expectations, many countries are already moving quickly to establish manufacturing pre-eminence in the battery storage space. Gigafactories—factories with battery manufacturing capacities over 5 GWh/ year—have begun developing worldwide. China has been the fastest mover, and currently is responsible for 78% of global battery manufacturing capacity. The United States and Europe account for 8% and 7% of current manufacturing capacity, respectively.

In 2015, the Department of Heavy Industry (DHI), Government of India, established its flagship scheme—the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India or FAME—that signaled the beginning of India’s EV transition. Phase I of FAME incentivized 2.8 lakh electric and hybrid vehicles from March 2015 to March 2019 through subsidies worth about Rs. 970 crore.

Near the end of the scheme, DHI announced FAME II—the Scheme for Faster Adoption and Manufacturing of Electric Vehicles in India Phase II—effective 1st April 2019. FAME II was provided a total outlay of Rs. 10,000 crore dedicated to demand incentives and charging infrastructure.

520 charging stations have been sanctioned under the Phase I of FAME scheme while under FAME II 2,877 chargers have been sanctioned in 68 cities with another 1,576 chargers being sanctioned across 9 expressways and 16 highways.

6,265 electric buses have been sanctioned in 64 cities/state government entities/STUs for intra-city and intercity operation under FAME India scheme phase II.

Approved a PLI scheme for the automobile and auto components industry with Rs. 26,000 crores in budget on September 2021, aimed at building a robust value chain for automobiles, including EVs.

NIC

As per the National Industrial Classification (NIC) 2008, under division 27 of manufacture of electrical equipment contain a group 271 which is dedicated to manufacturing of batteries.

States

Atomic Minerals Directorate for Exploration and Research (AMD), a constituent unit of the Department Atomic Energy (DAE), is carrying out exploration for Lithium in potential geological domains in parts of Mandya and Yadgir districts of Karnataka. Preliminary surveys on surface and limited subsurface exploration by AMD have shown presence of Lithium resources of 1,600 tonnes (inferred category) in Marlagalla area, Mandya district, Karnataka.

Further, the Geological Survey of India (GSI), an attached office of Ministry of Mines, takes up different stages of mineral exploration as per the approved annual Field Season Programme (FSP) every year viz. reconnaissance surveys (G4), preliminary exploration (G3) and general exploration (G2) following the guidelines of the United Nations Framework Classification (UNFC) and the Mineral Evidence and Mineral Content Rules (MEMC-2015). The FSP is undertaken for augmenting mineral resource for various mineral commodities including Lithium.

During FSP 2016-17 to FSP 2020-21, GSI carried out 14 projects on Lithium and associated elements in Bihar, Chhattisgarh, Himachal Pradesh, Jammu & Kashmir, Jharkhand, Madhya Pradesh, Meghalaya, Karnataka and Rajasthan. During the current FSP 2021-22, GSI has taken up 5 projects on Lithium and associated minerals in Arunachal Pradesh, Andhra Pradesh, Chhattisgarh, Jammu & Kashmir and Rajasthan.

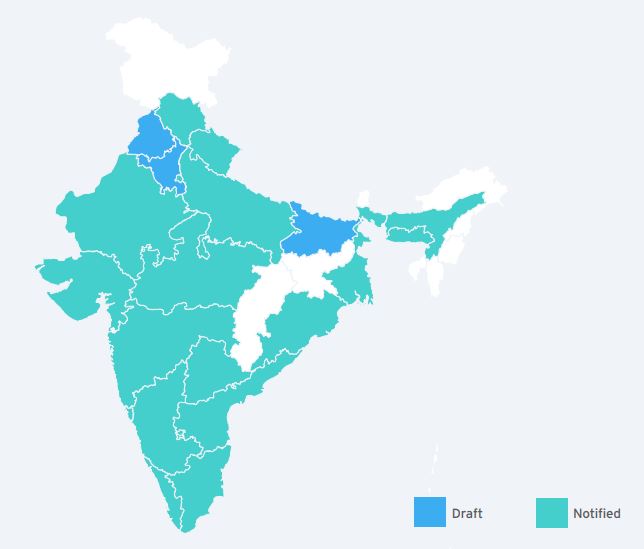

Many states have drafted and notified their electric vehicles policies with both fiscal and non-fiscal incentives. Depending on the states, support is being provided for both manufacturing as well as vehicle demand creation. Eighteen states have notified their EV policies.

Raw Materials required

The raw material ecosystem of Li-ion batteries in India as in the materials that go into these batteries are Lithium; Cobalt; Nickel; Manganese; Aluminum; Graphite.

The most important among them is lithium. Ions of lithium flow from one electrode to another during each charge-discharge cycle of the battery. Most of the other metals mentioned above including cobalt and nickel can be avoided in certain chemistries such as the fast-growing LFP chemistry or the proprietary BM-LMP chemistry.

In Li-ion batteries, metals such as cobalt, nickel, aluminum, and manganese are added to lithium to enhance the battery’s energy density and life (cycle life).

The rapidly growing EV industry, in particular, stands to benefit from this PLI scheme. One of the major factors contributing towards higher costs of EVs in India is the import of ACC batteries.

The usage and value of batteries in EVs are more direct. Batteries currently account for 25%–50% of the total cost of an EV depending on range and performance. While battery costs are declining rapidly, the battery will remain a critical component of the EV supply chain.

Another factor that has restricted the EV industry’s growth is lack of supporting infrastructure like charging stations, which is now becoming prioritized by the government. In fact, on March 22, 2022, the Ministry of Heavy Industries approved 2877 charging stations in 68 cities across 25 states/UTs under the Phase-II of the FAME India Scheme (or the Scheme for Faster Adoption and Manufacturing of Electric and Hybrid Vehicles in India). Further, MHI approved 1576 EV charging stations across 16 highways and nine expressways under this phase.

Infrastructure required

Stationary ESS can provide up to 17 different services to stakeholders at all levels of the electricity system, including utilities, grid operators, and end-use customers. However, while batteries are technically capable of providing these services to the various stakeholder groups identified in this report, a few challenges must be tackled for system operators to be properly compensated for those services.

The services described in the following sections are universal to electricity grids across the world. However, the nomenclature used here represents specific services defined in the US electricity market as a proxy for India because some of these grid services do not yet exist in the country. The following section of this report provides a summary of the storage applications that are possible when enabling regulatory and market frameworks are in place.

As costs come down and specific energy densities continue to increase, the performance and cost competitiveness of EVs will continue to improve and will soon become the more attractive choice considering upfront costs, in addition to the already lower operational costs, compared to diesel, petrol, and compressed natural gas (CNG) vehicles.

EVs are attractive technologies due to their lower maintenance and fuel costs than petrol, diesel, or CNG vehicles; the numbers of moving parts in the drivetrain for a typical EV are just 20, compared to nearly 2,000 for internal combustion engine (ICE) vehicles, making them more reliable.

Vehicles with lower operational cost are attractive to fleet operators and commercial drivers due to the relatively large component of their business costs associated with vehicle fuel and maintenance. EVs represent a large cost-saving opportunity for commercial drivers, fleet operators, and owners of personal vehicles.

Vaibhavi Pingale

Ms. Vaibhavi Pingale is a Visiting Faculty of Economics at Gokhale Institute of Politics and Economics, Pune & at Savitribai Phule Pune University. She is pursuing her PhD. She has been actively writing media articles other than academic research.