Financial Aspect: Large-Scale Electronics Manufacturing in India

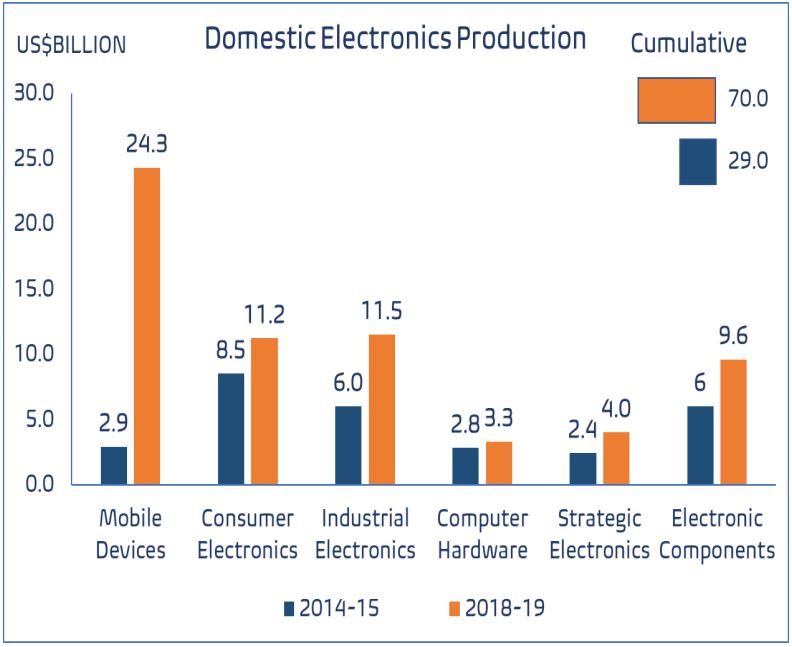

India’s share in global electronics manufacturing has grown from 1.3% in 2012 to 3.0% in 2018. The domestic production of electronics hardware has increased substantially from Rs. 1,90,366 crore (USD 29 billion) in 2014-15 to Rs. 4,58,006 Crore (USD 70 billion) in 2018-19.

With the domestic demand for electronics hardware expected to rise rapidly to approximately Rs. 26, 00,000 crore (USD 400 billion) by 2025, India cannot afford to bear the rapidly increasing foreign exchange outgo on account of import of electronics.

Given the limited relief expected for the electronics manufacturing sector under other schemes, there is need for a mechanism to compensate for the manufacturing disabilities vis-à-vis other major manufacturing economies.

Cost of production

The electronics hardware manufacturing sector faces the lack of a level playing field vis-à-vis competing nations. As per industry estimate (ICEA and ELCINA), electronics manufacturing sector suffers from a disability of around 8.5% to 11% on account of lack of adequate infrastructure, domestic supply chain and logistics; high cost of finance; inadequate availability of quality power; limited design capabilities and focus on R&D by the industry; and inadequacies in skill development.

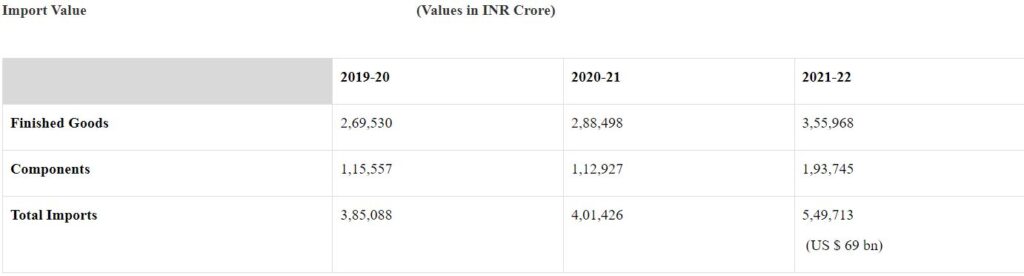

As per data received from industry associations, India’s production of electronics is Rs 6,40,810 crore in 2021-22 (US $ 80bn). Over the last three years, the import of electronic raw materials, finished electronic goods and electronic components is as under:

Increasing labour costs in China, the geopolitical trade and security environment, and the Covid-19 outbreak are compelling many global electronics majors to look at alternative manufacturing destinations and diversifying their supply chains. India is one of the leading contenders for alternate solutions for global electronics companies.

The electronics sector has the potential to become one of the top exports of India in the next 3-5 years. Electronics exports may account for significant contributions to the Indian economy in terms of foreign exchange earnings and employment generation.

Government has taken several measures for the expansion of electronics manufacturing in the country. As a result, percentage share of imported finished electronics goods with respect to total imports of electronic goods has decreased from 69% in 2019-20 to 64% in 2021-22, whereas, the percentage share of imported electronic components with respect to total imports of electronic goods has increased from 30% in 2019-20 to 35% in 2021-22, indicating a favorable shift in domestic electronics manufacturing.

Production Linked Incentive (PLI) Scheme

One such effort is the PLI scheme on Large-Scale Electronic Manufacturing which includes manufacturing of mobile phones and manufacturing of specified electronic components, was approved in March 2020, with a total outlay of Rs 38,645 crores. The scheme is expected to bring in additional production to the tune of Rs 10,69,432 crore and generate employment for 7,00,000 people.

Electronics manufacturing has to nearly quadruple from present US$67 billion to US$300 billion by 2025-26, it is imperative that specific product segments with high potential for scale are shortlisted and catered to by way of incentives and policy measures.

Such products segments cover mainly mobile phones, Information Technology hardware (‘IT hardware’), consumer electronics, wearables and hearables, LED lighting, electronic components in electric vehicles etc. and have been elaborated in the ensuing sections of this document.

These product segments hold significant potential from demand perspective as well as their feasibility to make in India for the world through adequate policy initiatives. These shall assist India to achieve its target of US$ 300 billion manufacturing of electronics.

Domestic Investment

An empowered committee headed by NITI Aayog CEO approved 32 beneficiaries under the production-linked incentive (PLI) scheme for large-scale electronics manufacturing, including 10 for mobile. This is the first-ever disbursement under any PLI scheme. The committee headed by Parameswaran Iyer approved the first incentive for mobile manufacturing under the PLI scheme for large-scale electronics manufacturing.

M/s Padget Electronics Pvt Ltd, a domestic company, is the first beneficiary approved by the Empowered Committee to receive incentive under mobile manufacturing based on its incremental investment and sales figures for FY 2021–22. Padget Electronics Pvt. Ltd is a 100% subsidiary of Dixon Technologies Pvt. Ltd and has manufacturing facilities in Noida, Uttar Pradesh.

Thirty-two beneficiaries had been approved under the PLI scheme for Large-Scale Electronics Manufacturing, of which 10 (5 global and 5 domestic companies) were approved for mobile manufacturing.

For the quarter ending June 2022, the applicants under this PLI scheme had undertaken sales of Rs 1,67,770 crore, including export of Rs 65,240 crore. This PLI scheme has also generated employment of 28,636. Over the last 3 years, exports have grown by 139%. The applications for incentives by the other beneficiaries will also be considered for approval soon.

Foreign Investments

The PLI scheme for Large-Scale Electronics Manufacturing, under MeitY is advancing towards making India a competitive destination for electronics manufacturing and providing a boost to Atmanirbhar Bharat while creating more global champions in this sector.

As of September 2022, the PLI scheme for LSEM has attracted investment of Rs 4,784 crore, and led to total production of Rs 2,03,952 crore, including exports of Rs 80,769 Crore. The scheme has also generated employment of 40,916. Electronics manufacturing is expected to rise to USD 300 billion by 2025-26.

M/s Foxconn Hon Hai Technology India Mega Development Pvt. Ltd is the first global company that has been approved under the target segment ‘Mobile Phones’ (Category: Invoice Value Rs 15,000 and Above) to receive incentive under mobile manufacturing for the period 1 August 2021–31 March 2022 based on its incremental investments and sales figures. The incentive amount approved is Rs. 357.17 crore.

Foxconn Hon Hai Technology India Mega Development Private Limited (or Foxconn India), owned by Hon Hai/Foxconn Technology Group is part of the Foxconn Group, which is the world’s No. 1 manufacturer/assembler of mobile phones. Foxconn India is a Taiwanese multinational electronics contract manufacturer with its headquarters in Tucheng, New Taipei City.

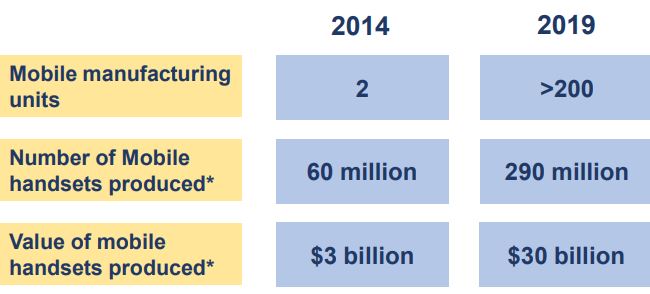

As a result of government initiatives and industry’s efforts, India has made rapid advances in the past five years in the field of electronics manufacturing. The production of mobile phones has risen from about 6 crore in 2014-15 to approximately 31 crore in 2021-22.

The export of mobile phones has also seen a sharp increase. India exported Rs 45,000 crore worth of mobile phones in FY 2021-22 and during the current year up to November 2022, mobile phone exports have already crossed Rs 40,000 crore, which is more than double the exports made during the same period last year.

The PLI for Large-Scale Electronics Manufacturing sector has attracted leading global players, including Foxconn, Samsung, Pegatron, Rising Star and Wistron while leading domestic companies, including Lava, Micromax, Optiemus, United Telelinks Neolyncs and Padget Electronics, have also participated in this scheme.

Vaibhavi Pingale

Ms. Vaibhavi Pingale is a Visiting Faculty of Economics at Gokhale Institute of Politics and Economics, Pune & at Savitribai Phule Pune University. She is pursuing her PhD. She has been actively writing media articles other than academic research.