Contribution to Economy: Manufacturing Medical Devices in India

The Indian Medical Device market is the fourth largest market in Asia after Japan, China and South Korea and is in the top 20 markets globally. The current market size of the medical devices sector in India is estimated to be approximately $12 billion and its share in the global medical device market is estimated to be around 1.5%. The sector has been witnessing fast growth with a Compound Annual Growth Rate (CAGR) of 12% -15%, which is 2.5 times the global growth rate. In this article, we shall explore the medical device sector’s contribution to the Indian economy using publicly available data on Gross Value Added, Trade, Employment and Market demand and supply.

Medical Devices and Gross Value Added

In simple terms, Gross Value Added (GVA) gives the rupee value of goods and services produced in the economy after deducting the cost of inputs and raw materials used.

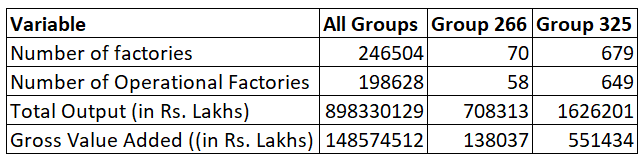

With data compiled from Annual Survey of Industries for 2019-20, the following analysis gives insights into the medical device sector in India. The Survey presents data on different sectors on the basis of their National Industrial Classification (NIC) code. There are primarily two groups that classify medical devices under the NIC. These are Group 266 (Manufacture of Irradiation, electro medical and electrotherapeutic equipment) and Group 325 (Manufacture of medical and dental instruments and supplies).

The following sections give insights into the sector’s contribution to the economy in terms of GVA. The variables used are number of factories, factories in operation, total output and GVA.

- All-India Data

In 2019-20, the total number of factories under all 3-digit NIC groups were 2,46,504. Out of these, only 1,98,628 were operational. The total output produced by these factories was valued at Rs. 8.98 lakh crores. The GVA stood at Rs. 1.48 lakh crores.

Combining the two groups mentioned above, the number of factories stood at 749, which represents about 0.30% of the total number of factories under all the NIC groups. Of these, 707 were operational, which represent 0.36% of the total number of operational factories. The total output produced under these groups was valued at Rs. 2.3 thousand crores. Of this, 30.34% was contributed by products manufactured under Group 266, while 69.66% was contributed by products manufactured under Group 325.

Group 325 deals with the manufacturing of medical devices that are at the lower end of the technology value chain, while Group 266 consists of products that are technology intensive.

As it can be observed from the table, the share of Group 325 in the medical device sector is much larger than Group 266 in all aspects. Group 325 has 81% more factories as compared to Group 266. In terms of total output, Group 325 contributes 39% more than Group 266. Similar is the case for GVA. Group 325 contributes about 60% more than Group 266. This implies that Indian manufacturers mostly engage in production of devices that are not technology-intensive and low in value. Screws and bone plates are some examples of devices included in this group. This highlights the issue of infrastructure necessary, among others, for the manufacture of medical devices in India.

Trade of Medical Devices

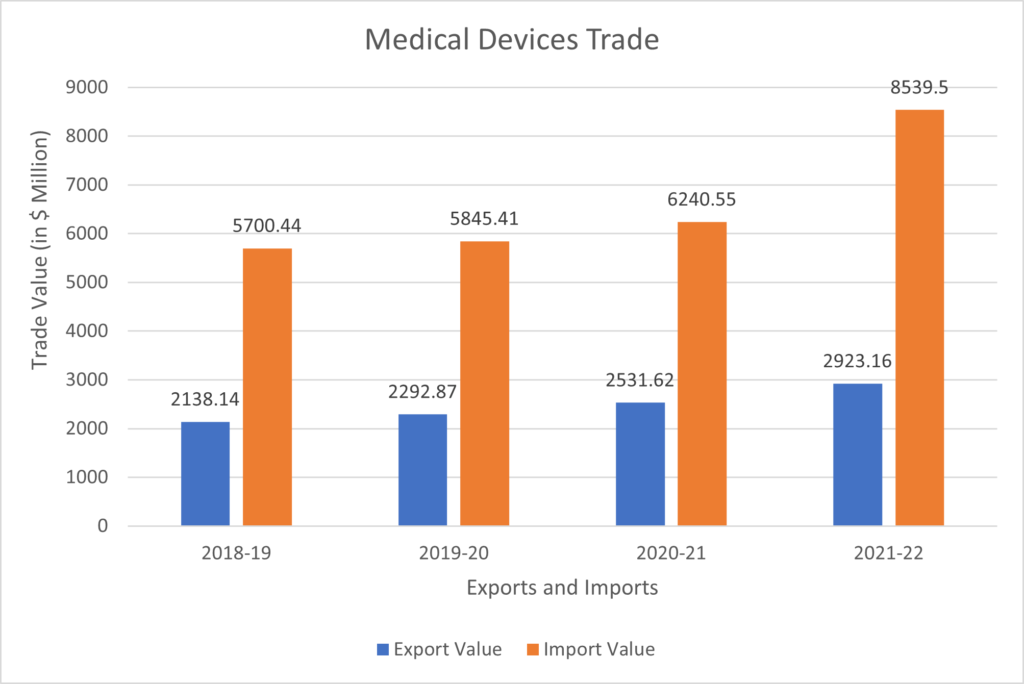

It has been observed that approximately 80% of medical devices are imported in India. In this section, we will explore some trade data related to medical devices. The data has been compiled from various Annual Reports of the Department of Pharmaceuticals and from a Parliamentary Standing Committee on Health and Family Welfare Report. The following figure shows export and import values of medical devices from the year 2018-19 to 2021-22.

It can be observed from the above figure that imports have been consistently higher than exports. On an average, imports have grown at a rate of 15.38%, while exports have grown at the rate of 11.04%. This, to an extent, backs up the argument that around 80% of medical devices are imported in India. Despite the implementation of several schemes that aid in boosting the manufacturing sector, it is alarming to notice that imports in 2021-22 are 36.84% higher than 2020-21 levels.

The following figures show the composition of medical device segments in exports and imports in the year 2021-22.

The figures show that electronic equipment constitute a major chunk of imports (64%), whereas only 40% of exports are electronic equipment. On the contrary, only 19% of imports are consumables and disposables like needles and syringes, while this segment accounts for 47% of exports. Furthermore, the export and import of devices under Implants and Surgical Instrument are the same, 5% and 2% respectively. IVD reagents make up about 10% of imports, while they constitute about 6% of exports.

It can again be observed here that India imports devices that rank high on the technology value-chain, whereas exports consist of devices that are on the low end of the technology value-chain.

Employment in the Medical Device Sector

Employment in the sector is crucial in understanding the sector. The data for this section was compiled from the Annual Survey of Industries for the year 2019-20. The variables selected are the number of persons engaged, wages and salaries including employers’ contribution and number of workers. Number of workers includes the number of workers directly employed.

Like GVA, this section also uses the NIC Groups mentioned previously.

A total of 82,063 persons were engaged in both groups. Of these, 7,766 were engaged under Group 266, while 74,297 were engaged under Group 325. The total number of workers stood at 58,838. Of these, 5,560 were employed under Group 266, whereas, 53,278 were employed under Group 325. A total of 39,001 were directly employed. Of these, 3,094 were under Group 266, while 35,907 were under Group 325. On an average, Group 325 has 82.10% employees more as compared to Group 266.

Wages and salaries for the sector stood at Rs. 310.5 crores. Of this, Rs. 58.2 crores were under Group 266, whereas, under Group 325, the same stood at Rs. 252.2 crores.

The trend continues here as well. Employment was significantly higher under Group 325 as compared to Group 266. The question that arises here is, what are the reasons for high production under Group 325, as compared to Group 266? The answer to this lies in the demand and supply dynamics of the medical device sector.

Demand for and Supply of Medical Devices

There exists robust demand for the medical device sector in India on account of factors like:

- Rising prevalence of chronic diseases

- Ageing population

- Increasing income and affordability

- Increasing insurance coverage

The presence of these factors give rise to higher demand for healthcare services, including medical devices. It has been observed that non-communicable diseases are expected to comprise more than 75% of India’s disease burden by 2025, compared to 45% in 2010. With an ageing population and rise in prevalence of chronic diseases, there is a higher need for good quality healthcare. This can be provided with high quality medical devices that are on the higher-end of the technology value-chain. Additionally, people’s incomes have been consistently increasing in India. It is expected that the size of the population earning more than $5000 per annum is likely to increase to around 450 million by 2025. Thus, with increasing incomes, health insurance coverage is also likely to increase.

From the supply side of things, the medical device sector faces a lack of a level playing field vis-a-vis competing economies. The sector suffers from a disability of around 12% to 15%, on account of issues like lack of adequate infrastructure, domestic supply chain and logistics, high cost of finance, inadequate availability of power, limited design capabilities and low focus on research and development (R&D) and skill development. Moreover, there is no mechanism to address this disability. Additionally, there are several regulatory hurdles as well. The present regulatory framework related to medical devices is deemed to be ambiguous, complex and lacks transparency, thereby posing as obstacles for manufacturers.

From the above analysis, it is clear that for India to compete in the global economy, there is a need to improve the manufacturing capabilities under Group 266 of the NIC, the more technology-intensive group. This would require massive investments. These investments must be adequately distributed across the supply chain, from investing in infrastructure to investing in R&D for technology upgradation. While it will take time, this will kick-start the process of manufacturing of high-end medical devices, which is much needed to reduce India’s import dependence.

Purvi Patil

Ms. Purvi Patil is a Research Assistant at Tatvita. She has pursued her graduation from the Liberal Arts Department of Savitribai Phule Pune University. Her areas of interest include International Relations, Data Protection and Privacy, and Sustainability.