Financial Aspect: Textile Industry in India

The article aims to analyze and plot the trends of various category products of the textile industry including Cotton, jute, wool, silk and technical textiles w.r.t two variables i.e. its production and export value. Majorly the data used is from 2016-17 and ahead. The formula used for trend analysis is same as of the growth rate.

COTTON

Cotton is one of the most important commercial crops cultivated in India and accounts for around 25% of the total global cotton production. The fact that India stands at the First place in the world in cotton acreage with 120.69 Lakh Hectares area under cotton cultivation i.e. around 36% of world area says it all about the cotton production. Further to draw a trend line the data consisting of production of cotton for the last 10 years is used. The following graph demonstrates the cotton production in respective financial years for FY 2012-13.

Following the production let us have a glance at the export of cotton from India and trace the trend line of export of cotton. It is exported in the form of raw cotton, intermediate products such as yarn and fabrics to ultimate finished products. Due to its economic importance in India, it is also termed as “White-Gold”. Following is the Graph presenting the year-wise export of cotton.

With the available datasets a trend analysis graph has been attempted to get a clear idea of changes in production and growth or shortage of demand in export of the cotton section in the textile Industry. Following is the trend line graph combining both the data:

So we can clearly visualize that there was a negative export growth with rising exports from low cost suppliers, but India cotton still holds strong and has shown an upward surge in its exports.

JUTE

“Jute”, is another important component of the textile industry in India. As per an April 2018 study published by the Ministry of Textiles, India is the leading jute goods-producing country globally, accounting for about 70% of estimated world production.

An important aspect of jute is that it is a very economic crop for the producers. Though jute plant is known principally for its versatile fiber, every part of the plant has its use and this makes it economical. The tender leaves used for cooking, the stalk provides for cheap building material for houses. Roots enrich the soil and the plant has very high CO2 assimilation capacity, as in an acre, within just 120 days of growing period it absorbs 6 MT of CO2 and releases 4.4 MT of O2, several times higher than trees. These aspects of plants also are statistics and cannot be neglected.

With the qualities now let us glance at the statistics of the plant of economic importance. The following graph highlights the production of the Jute in the Metric tonnes.

Jute, also known as the golden fiber, meets all the standards for ‘safe’ packaging in view of being a natural, renewable, biodegradable and eco-friendly product. This makes it a demanding product and adds to exports of India. The following graph shows jute exports from India.

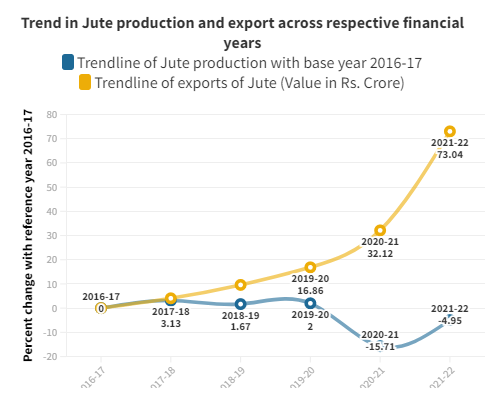

One can straightly witness the rising export of the crop. This signifies that Jute is seen as an option to the plastic packing. And with further increase in the awareness of sustainability, the demand for jute is bound to shoot up. Following the two data sets, a trend line graph has been plotted to get a bird’s eye view of the Sector.

Following graph says more clearly that a positive growth of ~ 70+ % within just 5 years is really a huge growth. Keeping the growth in mind, research, innovations and investments can further help to tap the full potential of the Jute sector.

WOOL

Wool as a fiber may have a small presence among all other natural fibers partially because of its seasonal usages; nonetheless, it is an essential fiber for winter clothing, suiting, floor coverings and certain industrial applications. Woolen textiles are an important link to the rural economy with the manufacturing industry, represented by small, medium and large scale units.

The following graph displays the production of wool in respective Financial years.

India is the 3rd largest sheep population country in the world and 9th largest wool producing country. Out of this about 85% is carpet grade wool, 5% apparel grade and remaining 10% coarser grade wool. India not only produces raw wool but also a small quantity of specialty fiber is obtained from Pashmina goats and 4000 families engaged in pashmina goat rearing in UT of Ladakh and this special kind of wool adds and contributes to the export of from India. The following graph gives an idea of exports of the wool.

Following and combining the data sets from the year 2016-17 and ahead, the following trend analysis graph is plotted.

One can understand that the exports definitely show a positive trend, but somewhere the policies at the home for motivating the production of wool are suffering which needs to be focused upon.

SILK

India is the second-largest producer of silk in the world. The major silk-producing states in the country are Andhra Pradesh, Assam, Bihar, Gujarat, Jammu & Kashmir, Karnataka, Chhattisgarh, Maharashtra, Tamil Nadu, Uttar Pradesh and West Bengal. With this now let’s have a glance at the production of silk within the nation in respective financial years.

India produces four types of natural silks; Mulberry, Eri, Tasar and Muga. The country produces silk garments, made-ups, fabrics, yarns, carpets, shawls, scarves, cushion covers and accessories through the raw material.

India exports raw silk, natural silk yarn, fabrics & made-ups, readymade garments, silk waste and handloom products of silk.

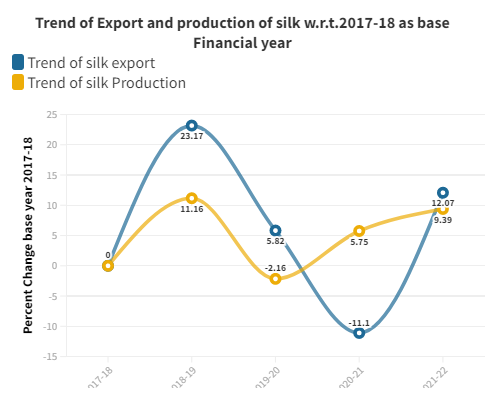

The following graphs gives clarity of trend in the demand and exports for the silk products and industry, which proves effective in further action plans.

To have a compare, contrast and projection oriented view of the silk production a combined graph emphasizing the trend with respect to production and export of silk is given below.

The trend line graph highlights that there are significant fluctuations in both production as well as export of the silk. Lack of consistency in variables, highlights two way failures or shortcomings of the Industry cycle. Various reasons could be accorded, pandemic being one. But a significant conclusion, that a firm policy and monitoring is direly needed.

TECHNICAL TEXTILES

Technical Textiles is a high technology sunrise sector which is steadily gaining ground in India. They are functional fabrics that have applications across various industries including automobiles, civil engineering and construction, agriculture, etc. Given the large scale at which emerging nations are industrializing, technical textiles are the need of the future in different parts of the world.

Also understanding the rising demand, the Indian Entrepreneurs have made gold out of the opportunity. With support of government incentives like Production linked incentives (PLI) Scheme, direct demand of technical textiles from huge industries like the automobile industry, healthcare, oil and petroleum industries there is an upsurge in the production.

Also with the government allowing 100% FDI under automatic route for technical textiles, leading global manufacturers are either through partnerships or individually are establishing technical textiles units in India. This not only satisfies the domestic demand, but significantly has a huge effect on the exports of technical textiles. The following graph demonstrates reality.

This above data (graph 13) talks merely about the exports in values. For accessing the trend of the exports, one needs to find the change in particular year with respect to the base year. To calculate and project the trend, FY 2016-17 is considered as base year and a trend analysis is plotted. The following graph depicts the same.

The positive rise in the trend with ~73% growth with respect to the rate of 2016-17 is really a huge growth rate. This growth rate makes this section of textiles worth considering and opening for the Production Linked Incentives scheme.

To talk about it further, the Government has launched Production Linked Incentive (PLI) Scheme for Textiles, with an approved outlay of Rs.10683 crore over a five year period, to promote production of Man Made Fibre (MMF) Apparel, MMF Fabrics and Products of Technical Textiles in the country to enable Textile sector to achieve size and scale and to become competitive. In order to extend the benefits of the PLI Scheme to Technical Textile products, the Department of Revenue, Ministry Finance have been requested for creation of new HSN Codes for 65 Technical Textiles products separately.

The PLI scheme has two parts;

- Part-1 envisages a minimum investment of Rs.300 crore & minimum turnover of Rs.600 crore per company

- Part-2 envisages a minimum investment of Rs.100 crore & minimum turnover of Rs.200 crore per company.

Finally, putting together all the data of export trends of all types of textiles excluding handlooms, the following graphical representation is obtained. So the textile Industry clearly in all sections demonstrates a rising trend in exports.

Aayush Patil

Aayush Patil is a Research Intern at Tatvita. Presently he is pursuing his bachelors in the Liberal Arts department at the Savitribai Phule Pune University.